This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

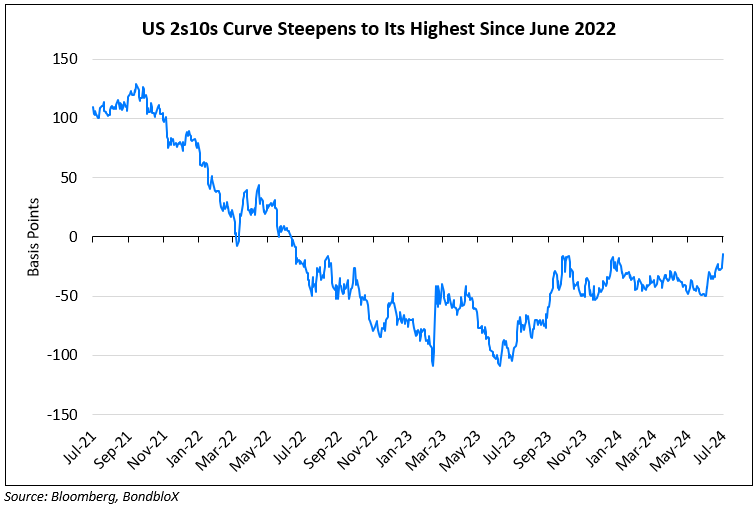

US 2s10s Treasury Curve Bull Steepens to 2-Year Highs

July 25, 2024

The US 2s10s Treasury curve bull steepened by over 6bp to its highest level since June 2022 when the curve inversion began to solidify. The demand on the front-end of the curve was also seen in the 2Y auction earlier this week that witnessed strong demand on all metrics. The 2s10s curve now stands at -14bp.

The US 5Y Treasury auction saw moderate demand yesterday, with a bid-to-cover ratio of 2.40x vs. 2.35x last month and an indirect take-up of 67.2% vs. the prior auction’s 68.9%. The notes tailed by about 1bp at a yield of 4.121%. The preliminary US S&P Manufacturing PMI came at 49.5, lower than the surveyed and prior 51.6 print. However the S&P Services PMI was better at 56.0 vs. the surveyed 54.9. US equities plummeted with the S&P and Nasdaq down 2.3% and 3.6% respectively. US IG and HY CDS spreads widened by 2bp and 9bp respectively.

European equity markets were also in the red. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 1.2bp and 5bp respectively. Asian equity indices have opened lower this morning. Asia ex-Japan CDS spreads were wider by over 2.8bp.

New Bond Issues

-

Dongxing Voyage $ 3Y at 5.8% area

-

BOCOM HK Branch $ 3Y at T+105bp area

Mirae Asset raised $400mn via a 3Y bond at a yield of 5.688%, 40bp inside initial guidance of T+185bp area. The senior unsecured bonds are rated Baa2/BBB (Moody’s/S&P). Proceeds will be used for general corporate purposes.

Rating Changes

- Fitch Upgrades Deutsche Post’s IDR to ‘A-‘; Outlook Stable

- Fitch Downgrades Ukraine to ‘C’

- Tesco PLC Outlook Revised To Positive On the Back Of Strong Performance; ‘BBB-/A-3’ Ratings Affirmed

Term of the Day

Panda Bonds

Panda bonds are renminbi denominated notes sold by a non-Chinese issuer in onshore China. The first of its kind was issued by the IFC and ADB in 2005. While these bonds attract Chinese investors, they have also gained traction among international investors. It also helps issuers diversify investor bases and reduce currency risk.

Bloomberg notes that Panda bond issuances have hit a record $17bn YTD thanks to cheaper borrowing costs in China.

Talking Heads

On BlackRock Expects BOJ to Hold Rates for Longer in Boon to Stocks

“We expect an accommodative environment to continue in Japan”… offers a corporate-friendly condition and boost to the stock market as real rates remain negative

On US Yield Curve Steepens as Bond Traders See Fed Cuts Looming

Zachary Griffiths, strategist at CreditSights

“The front end has been rallying on the idea the Fed will cut sooner and more than the market had previously been pricing”

George Catrambone, DWS Americas

Steeper yield curve reflected a “combination of 100% market probability of a September cut, equity selloff, and repositioning of election news”

On Credit Firm Värde Sees Opportunities In Commercial Property, Private Credit

Higher interest rates continue to “drive stress and distress in both large rate-sensitive credit markets”… Opportunities in India and Australia – demand for credit, and pricing remains disciplined

Top Gainers & Losers- 25-July-24*

Go back to Latest bond Market News

Related Posts: