This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US 10Y Real Yield Rises To 14-Year High Levels

August 15, 2023

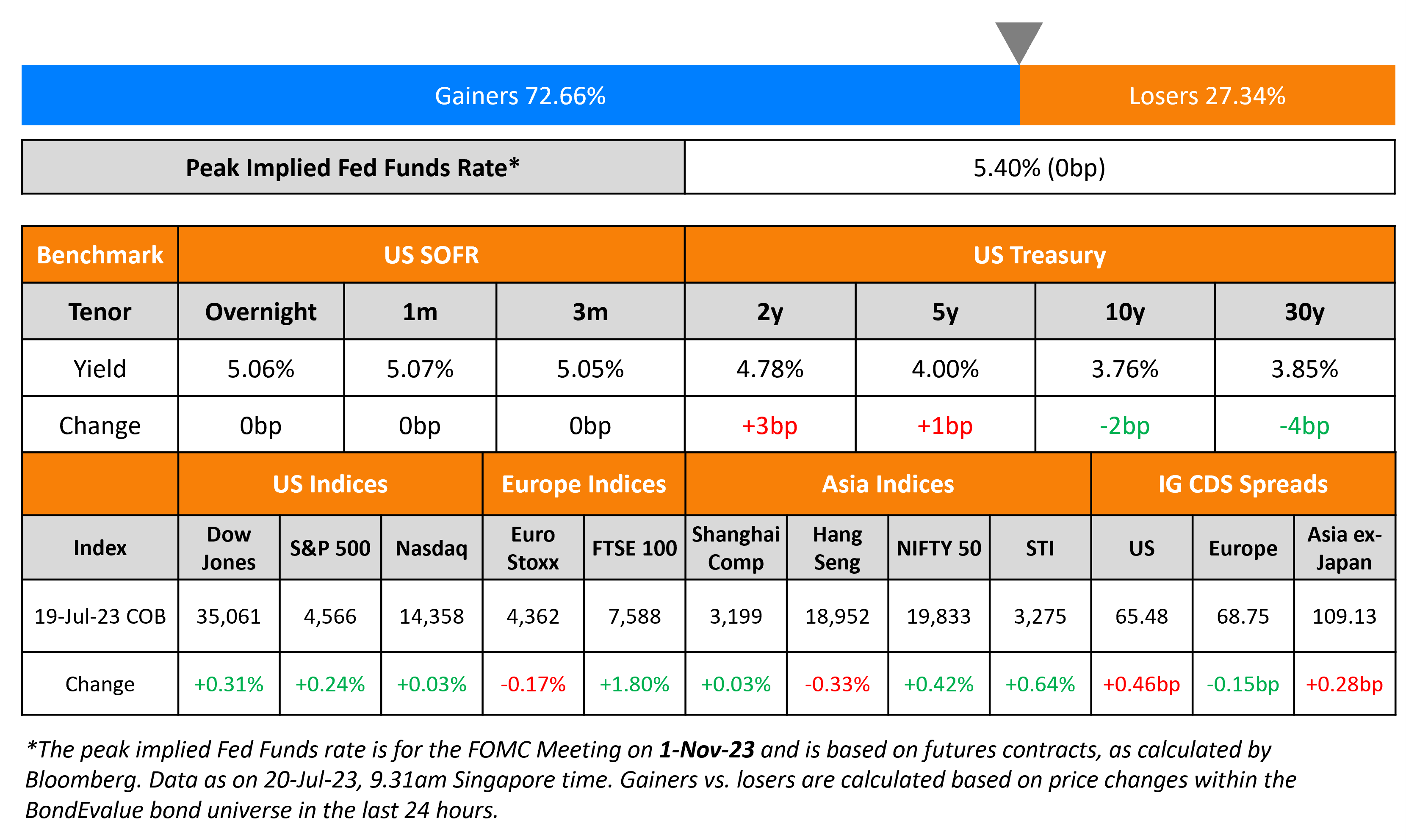

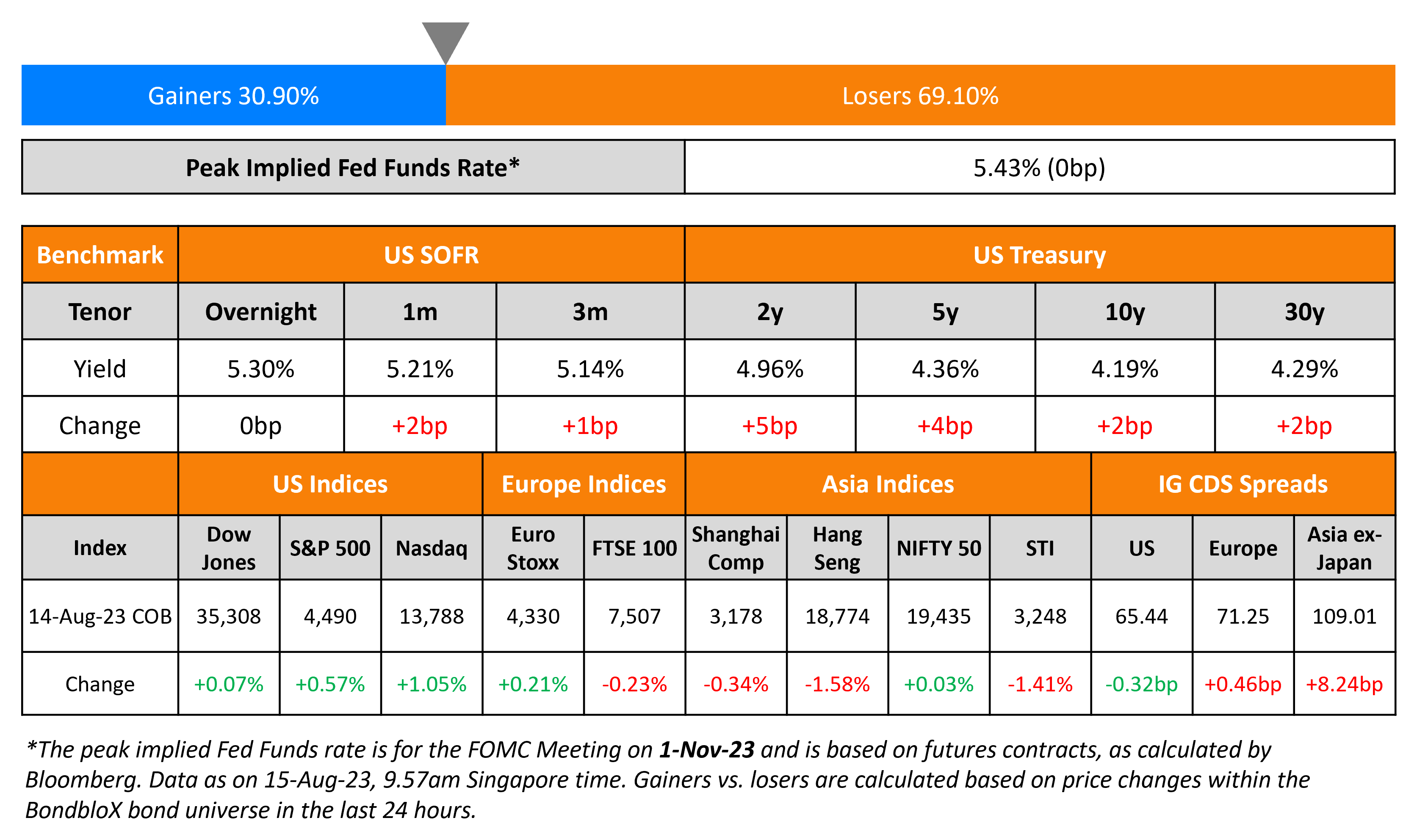

US Treasury yields moved higher led by the 2Y up 5bp as markets expect rates to remain higher for longer. The 10Y breached 4.21% for the first time since November, before closing at 4.19%. US 10Y real yields (Term of the Day, explained below) climbed to 1.84%, a level not seen since 2009 (see chart below), on expectations of interest rates remaining higher than inflation for longer.

The dollar strengthened against major currencies after rallying about 3% over the past month. US IG credit spreads were tighter by 0.3bp and HY CDS spreads tightened by 2.8bp. The S&P and Nasdaq were higher by ~0.6% and ~1%, respectively.

European equity markets ended mixed. In credit markets, European main CDS spreads were 0.5bp wider and Crossover CDS widened 1.4bp. Asia ex-Japan CDS spreads widened 8.2bp. Asian equity markets have opened mixed this morning.

New Bond Issues

-

Lloyds S$ 10NC5 Tier 2 at 5.5% area

Bank of America raised $5bn via a four-part deal as detailed below.

The 2Y and 3Y FRN coupons will be reset at the overnight SOFR plus 78bps and 102bps respectively, and will be paid quarterly. The senior unsecured bonds are rated Aa1/A+/AA. Proceeds will be used for general corporate purposes. The newly issued 3Y fixed-rate notes offer a 12.6bp new issue premium over its existing 3.5% 2026s that are currently yielding 5.4%.

New Bond Pipeline

-

Continuum Green hires for $ 450 mn 3.5Y Green bond

Rating Changes

- Moody’s upgrades senior unsecured rating of Lockheed Martin to A2, outlook stable

- WeWork Cos. LLC Downgraded To ‘CCC’ On Going-Concern Qualification, Outlook Negative

- Moody’s downgrades Genesis Energy’s CFR to B2; stable outlook

- Tempur Sealy International Inc. Removed From CreditWatch And Downgraded To ‘BB’ On Higher Leverage; Outlook Stable

- Banco General And Banconal Outlooks Revised To Stable From Negative On Same Action On Sovereign; Ratings Affirmed

Term of the Day

Real Yields

Real yields refer to the yields or returns on a financial instrument after accounting for inflation. It is approximately calculated by deducting the annual inflation rate from the nominal yields or returns. In an inflationary environment, the purchasing power of every dollar invested reduces by the annual inflation rate. This is why investors consider real yields to be an important metric since it indicates a more “real” indication of return compared to nominal yields.

US 10Y real yields are at a 14-year high currently at 1.84%.

Talking Heads

On US 10Y real yields at 14 year high

Ian Lyngen, head of US rates strategy at BMO Capital Markets

“From an economic perspective, the longer inflation-adjusted borrowing costs stay this high, the more material the fallout will be on both corporate and consumer behavior.”

On the biggest treasury ETF exodus since the 2020 meltdown

Winnie Cisar, global head of credit strategy at CreditSights

“With more supply on the way as the government contends with mounting deficits, it’s possible that investors are freeing up cash and pulling out of products such as TLT. It could also be a delayed reaction/acceptance of the bearish yield view that got amped up after the combo of Fitch downgrade, higher-than-expected UST refunding and BoJ announcements”

Katherine Lei, analyst at J.P.Morgan

“Unlike banks, which have holding power and are able to roll over credit to wait for an eventual resolution, alternative financing channels such as trusts may default once trust investors are unwilling to roll over the products”

On China’s Key Bond Yields slide

Rodrigo Catril, currency strategist at National Australia Bank

“It was a big move by the PBOC and for the yuan and the question from here is whether the growth and stimulatory aspect from lower rates outweighs the headwinds from wider US-China rate spreads. The PBOC move leaves the yuan more exposed to movement in US Treasury yields.”

Top Gainers & Losers- 15-August-23*

Other News

UBS to Pay $1.44 Billion to Settle DOJ Mortgage-Bond Case

U.S. Steel shares jump after Esmark makes $7.8-billion offer

Go back to Latest bond Market News

Related Posts: