This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

UBS, UAE, Lloyds, Commerzbank Price Bonds; Brent Touches $94/bbl

September 19, 2023

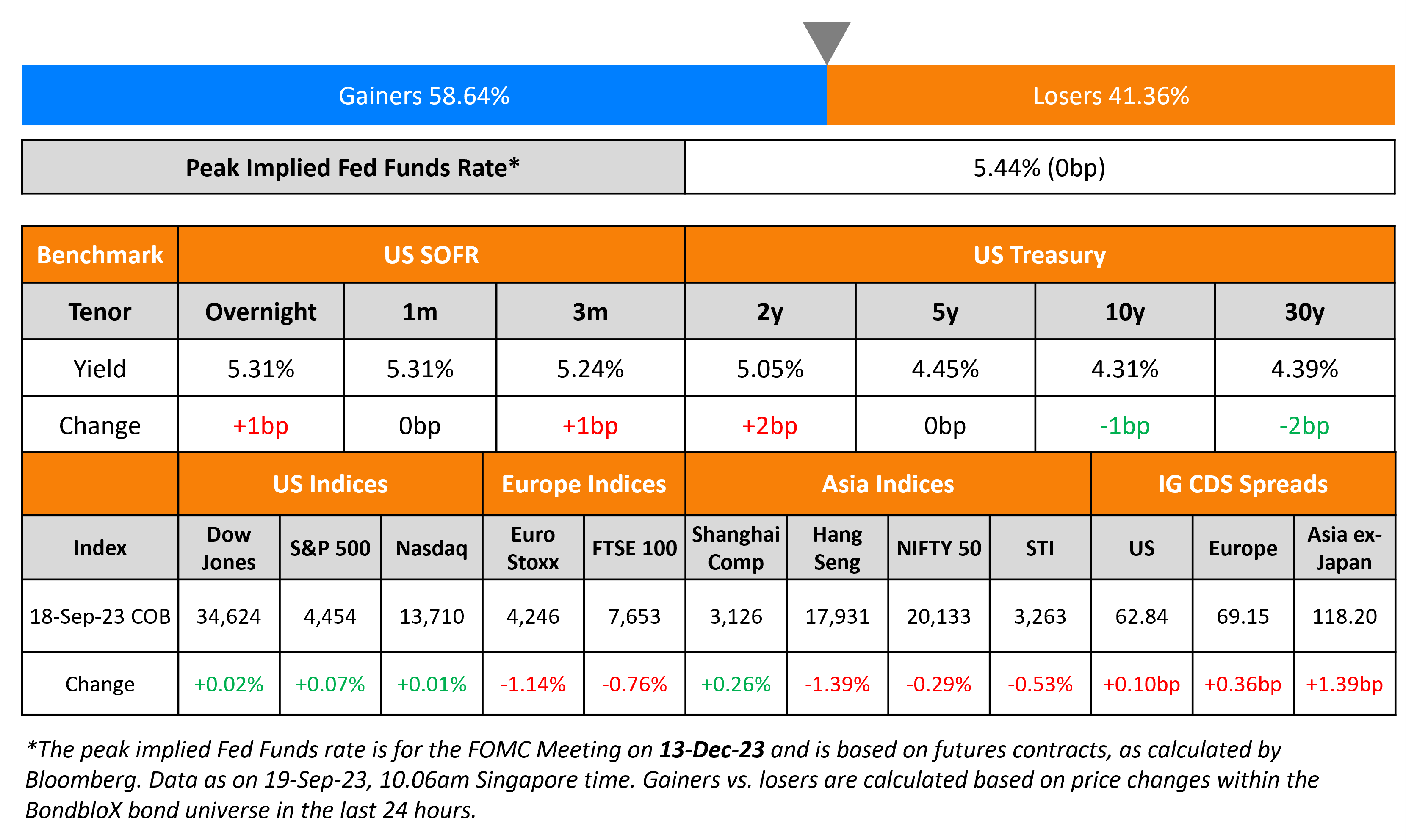

US Treasury yields were flat yesterday with no major data points from the US. Markets now await the FOMC decision later tomorrow where the Fed is expected to keep rates steady. The Fed’s latest dot plot will also be published tomorrow alongside the decision on rates with the guidance being the key, especially with regard to their November meeting. In credit markets, US IG CDS spreads were 0.1bp wider while HY spreads widened by 40.6bp. The S&P and Nasdaq were broadly flat on Monday. Brent crude prices have moved higher to trade at over $94/bbl, its highest levels this year. On a YTD basis, Brent has jumped 17% higher and over the last three months, prices are higher by 25%, thus adding to inflationary pressures.

European equity markets ended slightly lower yesterday. In credit markets, European main CDS spreads were wider by 0.4bp with crossover spreads widening 1.9bp. Asian equity markets have opened mixed this morning and Asia ex-Japan CDS spreads have widened 1.4bp.

New Bond Issues

UBS raised $4.5bn via a three-part deal. It raised:

- $1.25bn via a 4.25NC3.25 bond at a yield of 6.327%, 20bp inside initial guidance of T+180bp area. If uncalled in 2026, the coupon will reset at the US 1Y Treasury rate plus a spread of 160bps. The new bonds are priced 16.3bp tighter to its existing 1.364% 2027s that yield 6.49%.

- $1.5bn via a 6NC5 bond at a yield of 6.246%, 20bp inside initial guidance of T+200bp area. If uncalled in 2028, the coupon will reset at the US 1Y Treasury rate plus a spread of 180bps.

- $1.75bn via a 11NC10 bond at a yield of 6.301%, 20bp inside initial guidance of T+220bp area. If uncalled in 2033, the coupon will reset at the US 1Y Treasury rate plus a spread of 200bps. The new bonds offer a new issue premium of 11.1bp over its existing 5.959% 2034s that yield 6.19%.

The senior unsecured bonds have expected ratings of A-/A (S&P/Fitch). This is UBS’s first dollar denominated deal at the holding company level since the acquisition of Credit Suisse.

Commerzbank raised €600mn via a 5.5NC4.5 green senior non-preferred bond at a yield of 5.328%, 30bp inside initial guidance of MS+225bp area. If uncalled in 2028, the coupon will reset at the 3M Euribor plus a spread of 195bps and will be paid quarterly. The bonds have expected ratings of Baa2/BBB-, and received orders over €5bn, 8.3x issue size. Proceeds will be used for eligible green projects in accordance with Commerzbank’s Green Framework.

Lloyds raised €1.25bn via a 8NC7 bond at a yield of 4.853%, 30bp inside initial guidance of MS+190bp area. If the bonds are uncalled in 2030, the coupon will reset at the EUR 1Y mid-swap rate plus a spread of 160bps. The senior unsecured bonds have expected ratings of A3/BBB+/A, and received orders over €3.6bn, 2.9x issue size.

UAE raised $1.5bn via a 10Y bond at a yield of 4.917%, 25bp inside initial guidance of T+85bp area. The senior unsecured bonds have expected ratings of Aa2/AA- (Moody’s/Fitch), and received orders over $7bn, 4.7x issue size. Proceeds will be used in accordance with the state’s public debt strategy. This is UAE’s third issuance of dollar bonds after having raised $4bn via a three-trancher in 2021 and $3bn via a two-trancher in 2022.

LG Energy raised $1bn via a two-tranche green deal. It raised $400mn via a 3Y bond at a yield of 5.738%, 40bp inside initial guidance of T+140bp area. It also raised $600mn via a 5Y bond at a yield of 5.77%, 40bp inside initial guidance of T+170bp area. The senior unsecured bonds have expected ratings of Baa1/BBB+ and received combined orders over $5bn, 5x issue size. For the 3Y, it received orders of over $1.8bn with asset/fund managers allocated 63% of the deal, central banks/official institutions/insurers taking 20%, and banks taking the remainder. APAC made up 55%, EMEA 20% and the US 25%. The 5Y received over $3.2bn of orders with asset/fund managers taking 67%, central banks/official institutions/insurers allocated 22% and banks taking the remainder. APAC accounted for 54%, EMEA 25% and the US 21%. Proceeds will be used to finance/refinance new or existing projects related to low carbon transportation and energy efficiency in accordance with the issuer’s green financing framework.

New Bond Pipeline

- NBN hires for $ 5Y/10Y bond

- Emirates NBD hires for Sustainable bond

Rating Changes

- Fitch Upgrades AXA SA to IFS ‘AA’; Outlook Stable

- Fitch Upgrades Generali to IFS ‘A+’; Outlook Stable

- Fitch Upgrades Credit Mutuel Arkea to ‘A+’; Outlook Stable

- Fitch Changes Outlook on thyssenkrupp AG to Positive; Affirms ‘BB-‘ IDR

- Moody’s affirms Howmet Aerospace Inc.’s Ba1 CFR; outlook positive

Term of the Day

Initial Price Guidance (IPG)

Initial price guidance (IPG) refers to the proposed yield on a new bond issue. Based on the IPG, investors will place orders with the lead managers of the new bond issue. Once the lead managers have received orders for the proposed bond, they will decide the final pricing on the bond, which in most cases will be tighter (lesser) than the IPG.

Talking Heads

On Fed unlikely to raise rates in November – Goldman Sachs

“On November, we think that further labor market rebalancing, better news on inflation, and the likely upcoming Q4 growth pothole will convince more participants that the FOMC can forgo a final hike this year, as we think it ultimately will”

On Carry Trade Minting 42% Profit and Sparking Push Into New Market

Dirk Willer, head of global macro and EM strategy at Citigroup

“If you think the BOJ is in play, then you get yen strength out of that and need to be careful, while the PBOC is still easing policy”

Simon Harvey, head of FX analysis at Monex Europe

“The yen whipsaw is something that’s really, really kind of preventing people from engaging in Japan based carry-trades”

Alessio de Longis, head of investments at Invesco Solutions

“We still see the yuan as an attractive funding currency, given its low yields, low volatility and moderately expensive valuations”

“I think corporates are coming around to the idea that debt financing costs might not be any better, really, later this year or into early 2024. We’ve got some political events coming up…. If you would have told me a year and a half ago that the Fed would raise rates by 5.25% and that the default rate would still be hovering around 4%, I don’t think I would have really thought that was a likely outcome”

Top Gainers & Losers- 19-September-23*

Go back to Latest bond Market News

Related Posts: