This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

UBS Launches S$ PerpNC5.5 AT1 at 5.85% area

June 18, 2024

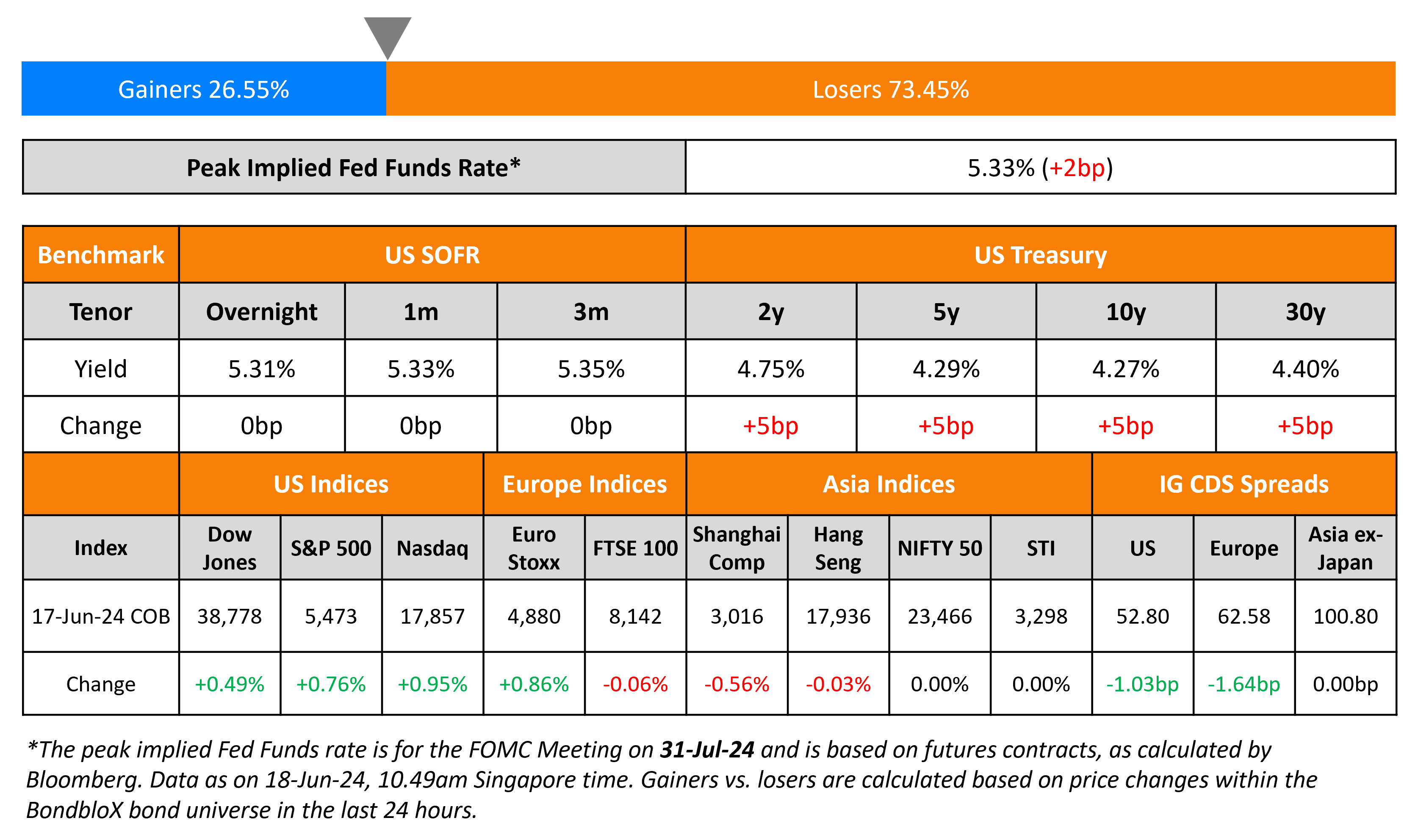

US Treasury yields inched higher by 5bp on Monday, after a risk-off move on Friday was led by political risks emerging from Europe. The spread between France and Germany’s 10Y government bond yields widened sharply to over 75bp from 50bp earlier. This came on the back of negative sentiment regarding the far-right party potentially taking a majority in the French parliament. However, concerns eased on Monday after the far-right leader Marine Le Pen said that she would work alongside President Emmanuel Macron, and not push him out if she wins the snap election.

Separately, the US Import Price Index registered a 0.4% drop vs. expectations of a 0.7% rise, underscoring softening inflationary pressures. The Empire State Manufacturing Index fell by -6 vs. expectations of a larger drop of -10. Separately, Minneapolis and Philadelphia Fed Presidents Neel Kashkari and Patrick Harker sounded a similar view for a single rate cut by the Fed this year. As per CME probabilities, markets continue to expect 50bp in rate cuts by end-2024 as compared to the Fed’s latest dot plots that indicated a 25bp cut. US equity markets ended higher on Monday, with the S&P and Nasdaq up by 0.8-1%. US IG and HY CDS spreads tightened by 1bp and 4.4bp respectively.

European equity markets recovered on Monday, after a sharp sell-off on Friday. Similarly, Europe’s iTraxx Main and Crossover CDS spreads eased by 1.6bp and 1.9bp respectively, after seeing a sharp widening of 8bp and 25bp respectively on Friday. Asian equity indices have opened in the green this morning. Asia ex-Japan CDS spreads were flat.

New Bond Issues

- UBS S$ PerpNC5.5 AT1 at 5.85% area

- BOC $ 3Y/2Y FRN Sust at SOFR+100/95bp areas

- Hyundai Capital America $ 2Y/3Y/3Y FRN/5Y/7Y at T+105/115/SOFR eq/135/145bp areas

- Continuum Green Energy $ 9NC3 Green @ 7.625% area

Bancolombia raised $800mn via a 10.5NC5.5 bond at a yield of 8.625%, in-line with initial guidance. The subordinated notes are rated Ba3/BB-, and are ranked pari passu with all present or future Tier 2 capital. Proceeds will be used to purchase any of its 6.909% 2027s tendered in its cash tender offer dated June 3, 2024, and for general corporate purposes.

New Bonds Pipeline

- REC Limited hires for $ Long 5Y Green bond

- Korea Gas hires for $ 3Y or 5Y bond

Rating Changes

- Fitch Upgrades NIBC to ‘BBB+’; Outlook Stable

- Cyprus Upgraded To ‘BBB+’ On Reduced Debt Stock; Outlook Positive

- Moody’s Ratings upgrades Zambia’s foreign-currency and local-currency ratings to Caa2 from Ca and Caa3, respectively; maintains stable outlook

- Fitch Downgrades McLaren to ‘CCC+’

- Tenneco Inc.Outlook Revised To Negative From Stable On Lower-Than-Anticipated Profits, Cash Flow; Ratings Affirmed

Term of the Day

Crossover CDS Spreads

The iTraxx Crossover Index is a credit default swap (CDS) based index compiled by IHS Markit (now part of S&P Global) which consists of the 75 most liquid sub-investment grade entities in Europe. The index helps track credit risk in the European high yield market, akin to the Markit HY CDS Index in the US. Performance is tracked in terms of the index’s value and the move in the spreads of the index. A tightening (a move lower) in its CDS spreads implies an easing of credit conditions in the European junk-bond markets which leads to an increase in the value of the index. On the other hand, a widening in its spread (a move higher) implies a worsening in credit conditions, which would lead to a fall in the index’s value. While the iTraxx Crossover Index helps track European high yield spreads, the iTraxx Main index helps track European investment grade spreads. The iTraxx Main index consists of 125 of the most liquid European entities with IG-ratings as published by Markit from time to time.

Talking Heads

On Inflation Must Improve for ECB Cut in September – ECB GC Member, Boris Vujcic

“In order to do more, we need to see more. Any prolongation of the inflation conversion toward the medium-term target weakens the case for an interest-rate cut, and vice versa”

On Data Mattering More Than What the Fed Is Saying to Bond Traders

Gargi Chaudhuri, head of iShares investment strategy, Americas at BlackRock

“They are truly not going to overreact to one or two data points”

Jerome Schneider, head of short-term portfolio management at PIMCO

“Markets right now are reacting, sort of overreacting, to a single set of discrete data points. These positive signals are just beginning to break at sunrise…”

On Debt-Ceiling’s Eventual Return Having Fund Managers On Edge

Mike Bird, PM at Allspring Global Investments

“We’ve been through this debacle many a time. Internally, we have a pretty good strategy about how we can handle the debt ceiling”

Gennadiy Goldberg, head of US interest rate strategy at TD Securities

“Do it and do it in droves because there’s going to be fewer bills out there. This year is the tail end of the big surge”

Top Gainers & Losers- 18-June-24*

Go back to Latest bond Market News

Related Posts: