This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

UBS Launches S$ Perp

February 15, 2024

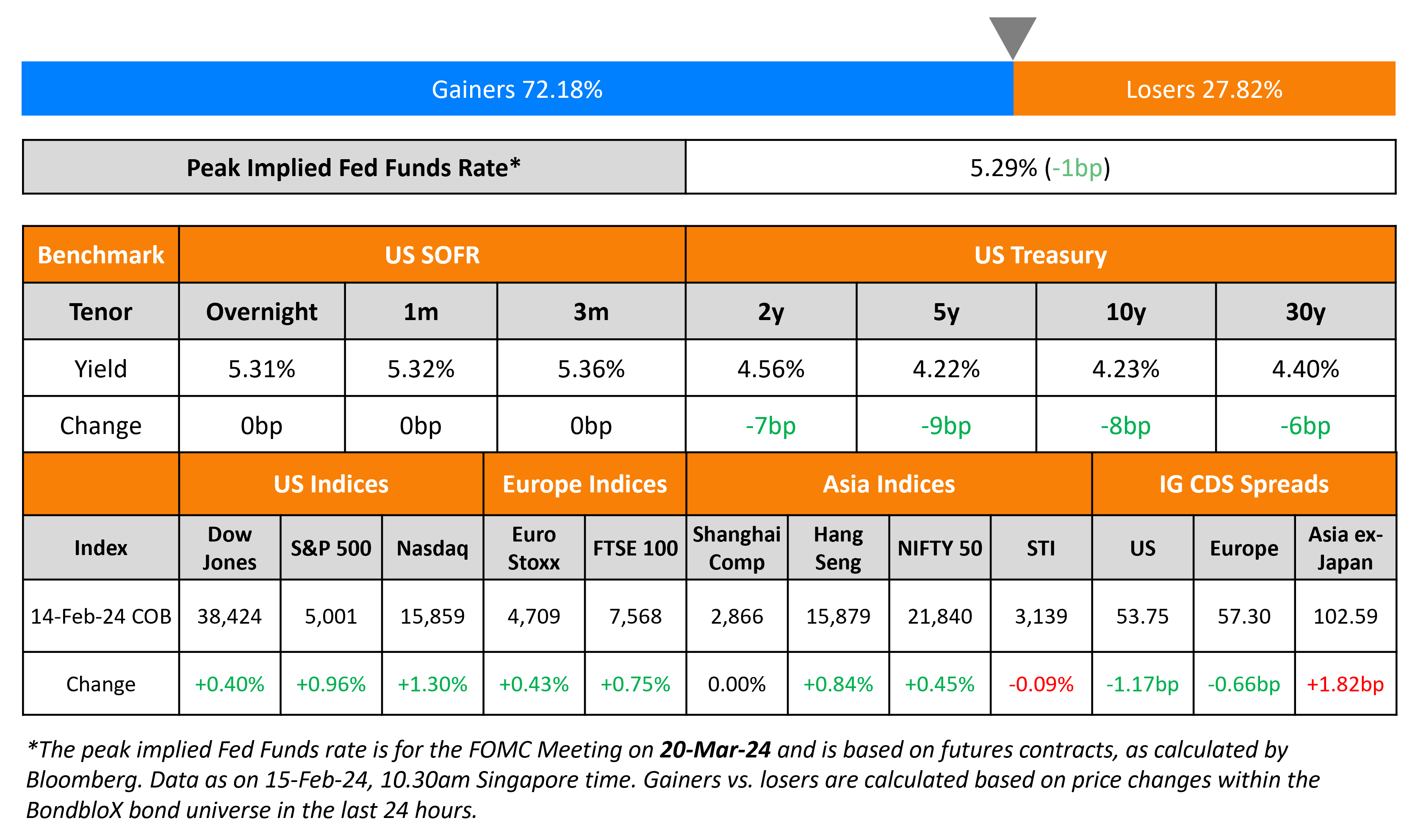

US Treasury yields partially reversed the surge seen across the curve post the inflation report. US Treasury Secretary Janet Yellen hinted that markets were focusing on minor fluctuations in inflation whilst failing to see the bigger trend, which was inflation is moving “decisively down”. Chicago Fed President Austan Goolsbee (non-voter) said that slightly higher inflation data for a few months would still be consistent with a path back to its 2% goal. Fed Vice Chair for Supervision Michael Barr, meanwhile, said US policymakers need to see more data showing inflation is heading back to target levels before they start cutting rates. Looking at credit markets, US IG and HY CDS spreads tightened 1.2bp and 4bp respectively. S&P and Nasdaq rallied 1-1.3%.

European equity markets ended higher too. Credit markets in the region saw the European main CDS spreads tighten by 0.7bp and crossover spreads tighten by 3.3bp. Asian equity markets have opened in the green today. Asia ex-Japan IG CDS spreads widened by 1.8bp.

New Bond Issues

- UBS S$ PerpNC5.5 at 6.125% area

New Bond Pipeline

- Daewoo Engineering & Construction hires for S$ bond

- Greenko Mauritius hires for $ bond

Rating Changes

- Moody’s upgrades Maersk’s ratings to Baa1; outlook stable

- Fitch Upgrades Mattel’s IDR to ‘BBB-‘; Outlook Stable

- Fitch Upgrades Australia’s NBN Co to ‘AA+’; Outlook Stable; Resolves UCO

- Fitch Downgrades eHi to ‘CCC+’; Removes Rating Watch Negative

Term of the Day

CET1 Ratio

Common Equity Tier 1 (CET1) Ratio is a financial ratio applicable to banks to measure its core capital as against its Risk Weighted Assets (RWA). Core Capital (CET1 Capital) includes common equity and stock surplus (share premium), retained earnings, statutory reserves, other disclosed free reserves, capital reserves representing surplus arising out of sale proceeds of assets and balance in income statement at the end of the previous financial year. RWAs are calculated to measure the minimum regulatory capital required to be held by banks to maintain solvency. The calculation methodology is such that the riskier the asset, the higher the RWAs and the greater the amount of regulatory capital required. CET1 capital must be at least 4.5% of RWAs according to Basel III.

Contingent Convertible (CoCos) bonds/AT1s commonly have triggers based on CET1 ratios – if the bank’s CET1 ratio falls below a certain threshold, the bonds would convert into equity.

Talking Heads

On Big Tech Rally on Shaky Ground as Rate View Darkens

Mark Luschini, chief investment strategist at Janney Montgomery Scott

“Market was vulnerable…. reaction might be excessive given this is just one data point, but maybe not relative to the state of valuations”

Sameer Samana, senior global market strategist at Wells Fargo Investment Institute

“A change in Fed policy expectations doesn’t take away tech’s long-term growth drivers”

“I think it is a tremendous mistake to focus on minor fluctuations and to have failed to see the longer-term and bigger trends. And the trend here is that inflation is moving decisively down”

On ‘Bumpy’ path to 2% inflation means soft landing jury still out – Fed’s Michael Barr

“It’s very early to say whether we end up with a soft landing or not… very careful about where we are in that process… confident we are on a path to 2% inflation.. need to see continued good data before we can begin the process of reducing the federal funds rate”

Top Gainers & Losers- 15-February-24*

Go back to Latest bond Market News

Related Posts: