This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Pull Back Slightly; Vakifbank Prices $ AT1 at 10.125%

April 18, 2024

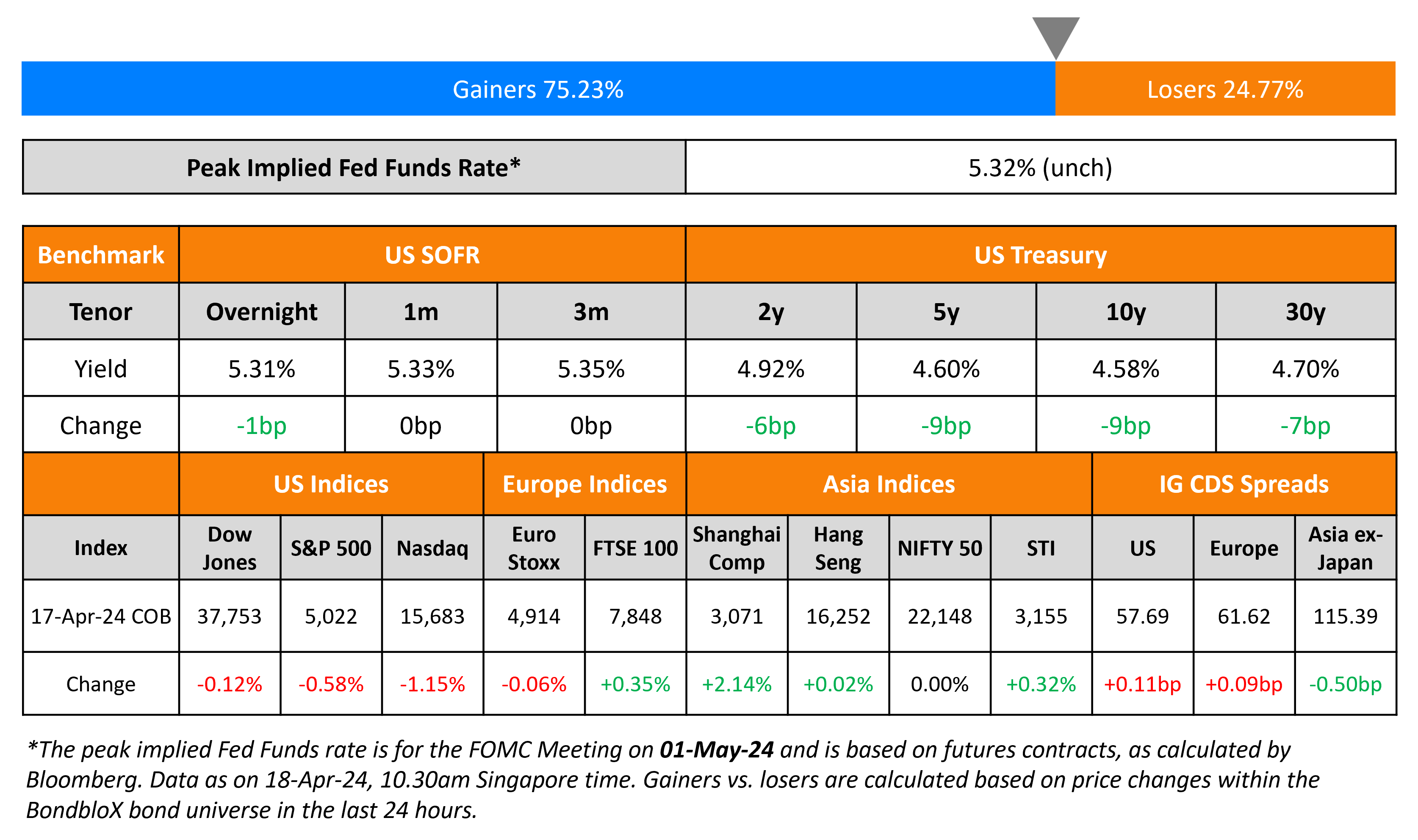

US Treasury yields dropped across the curve by 6-9bp on Wednesday, in a pullback from the recent spike higher in yields. The Fed’s Beige Book reported that overall economic activity has expanded slightly since late February, with 10 out of 12 districts seeing slight or modest economic growth. This was higher than the eight districts seen in the previous report. It noted that consumer spending barely increased and that employment rose at a slight pace, while wages grew at a moderate pace in 8 out of 12 districts. Also, price increases were modest on average, with the Red Sea disruptions and Baltimore bridge collapse not resulting in a widespread price increase thus far. Meanwhile, firms’ ability to pass on cost increases to consumers also weakened considerably, leading to smaller profit margins, the report added. US IG CDS spreads widened 0.1bp and HY spreads were flat. The S&P and Nasdaq fell by 0.6% and 1.2% respectively.

European equity indices ended mixed. European IG CDS spreads widened 0.1bp and crossover spreads were 1bp wider. Asian equity markets have opened higher today. Asia ex-Japan IG CDS spreads were 0.5bp tighter.

New Bond Issues

- LG Electronics $ 3Y/5Y at T+135/150bp area

Vakifbank raised $550mn via a PerpNC5.25 AT1 bond at a yield of 10.125%, 37.5bp inside initial guidance of 10.5% area. The junior subordinated notes are rated CCC (Fitch). The coupons are fixed until 24 July 2029, and if not redeemed, it resets then and every five years at the 5Y CMT plus the reset margin of 549.3bp. If at any time the CET1 ratio of the issuer and/or the group is less than 5.125%, then a trigger event would occur. This is the fourth Turkish bank AT1 issued this year after YapiKredi, Akbank and TSKB issued similar bonds earlier this year. Below is a table comparing the latest issuance with the above three issuances from other Turkish banks, sorted by the yield-to-call (YTC).

Morgan Stanley raised $8bn via a four-part deal.

The senior unsecured bonds are rated A1/A-/A+. The 4NC3 bonds are priced at a new issue premium of 6.5bp over its existing 4.21% 2028s (callable in 2027) that currently yield 5.56%. The 11NC10s are priced at a new issue premium of 4.1bp over its existing 6.627% 2034s (callable in 2033) that currently yield 5.79%.

RBC raised $1bn via a 60NC5 bond at a yield of 7.5%, 37.5bp inside initial guidance of 7.875% area. The junior subordinated note is unrated. Proceeds will be used for general corporate purposes.

Hyundai Card raised $500mn via a 5Y bond at a yield of 6.03%, 35bp inside initial guidance of T+170bp area. The senior unsecured bonds are rated Baa1/BBB+.

Guangzhou Finance Holdings raised $150mn via a 2Y bond at a yield of 5.45%, 55bp inside initial guidance of 6% area. The senior unsecured bonds are rated A- (Fitch). The bonds have a change of control put at 101. Proceeds will be used for refinancing existing offshore debts.

Rating Changes

- Moody’s Ratings downgrades Longfor’s ratings to Ba2/Ba3; outlook negative

- Petrofac Ltd. Downgraded To ‘CCC-‘ Due To Debt Restructuring; Outlook Negative

- Moody’s Ratings downgrades China Overseas Land & Investment’s ratings; revises outlook to stable

- Meituan Outlook Revised To Positive On Improving Profitability And Cash Flow Visibility; ‘BBB’ Rating Affirmed

Term of the Day

Trigger Event

Triggers, or trigger events are an important feature of contingent convertible (CoCo) or additional tier 1 (AT1) bonds and define when the loss absorption mechanism is activated. Triggers can either be mechanical or discretionary. Mechanical triggers are numerically defined and most commonly refer to the bank’s capital ratio level. Discretionary triggers, also known as point of non-viability (PONV) triggers are based on supervisors’ judgement of the bank’s solvency position. On occurrence of a trigger event, an AT1’s loss absorption mechanism kicks in, which may include a conversion to equity and/or a principal write-down, both of which boost the bank’s capital position.

Talking Heads

On Ecuador Bonds Gain Most in EM as New IMF Deal Nears – Finance Minister Juan Carlos Vega

“We’re in very advanced talks with the Fund and hope to make a positive announcement of having reached a staff-level agreement… going to be able to announce good news as soon as next week”

On Sri Lanka Poised for Bondholder Deal by Mid-May – StanChart

“We think timelines are critical and expect an agreement by mid-May… With bonds currently trading close to our current probability-adjusted recovery value under the government’s proposal at 11% exit yields, we see possible upside”

On EM Assets Rebounding With IMF Meetings in Focus

Ian Simmons, a London-based fund manager at Fiera Capital

“The only thing that has changed is a reset for Fed rate cut expectations…. positive drivers present at the start of the year are still there”

Top Gainers & Losers- 18-April-24*

Go back to Latest bond Market News

Related Posts: