This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields March Higher; JPMorgan to Add India to EM Bond Index

September 22, 2023

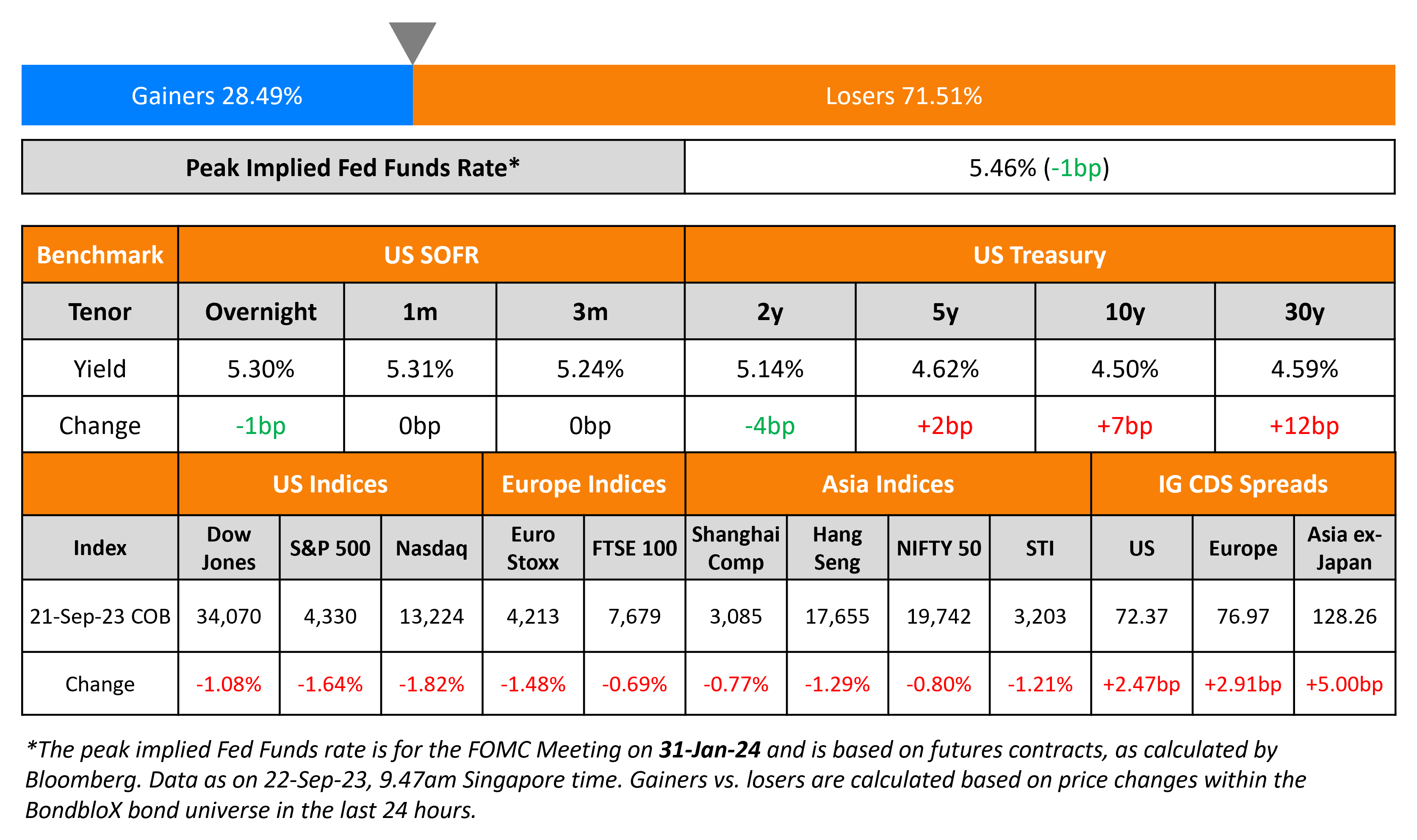

US long-end Treasury yields spiked higher with the 30Y yield up 12bp to 4.59%. However, 2Y yields were down 2bp as the yield curve steepened. The move continues the march higher in yields following a hawkish Fed meeting earlier this week. With the spike in 30Y yields, long-term bonds of IG-rated issuers like Berkshire Hathaway, Amazon, Apple, Boeing, GE, Temasek and others dropped by over 2.5%. US initial jobless claims dropped by 20k to 201k for the prior week. Both credit and equity markets were under pressure with the continued rise in rates. In credit markets, US IG CDS spreads jumped wider by 2.5bp while HY spreads widened by 11.5bp. The S&P and Nasdaq fell 1.6-1.8%.

European equity markets ended lower too. In credit markets, European main CDS spreads were wider by 2.9bp while crossover spreads widened 13.4bp. The Bank of England held its key rate at 5.25%, ending a series of 14 successive hikes since December 2021. Markets had expected a 50% chance of a rate hike. Also, Turkey hiked its policy rate by 500bp to 30% (scroll down for more details). Asian equity markets have opened broadly higher this morning. Asia ex-Japan CDS spreads have widened 5bp. Separately, JPMorgan will add Indian government bonds to its EM bond index from June 2024 after several months of expectations to be added into the index. The move is set to see an uptick in foreign inflows to the nation’s debt market.

New Bond Issues

SocGen raised €2.5bn via a two-part deal. It raised €1.5bn via a 3Y senior preferred bond at a yield of 4.295%, 25bp inside initial guidance of MS+95bp area. The bonds have expected ratings of A1/A/A, and received orders over €2bn, 1.3x issue size. Proceeds will be used for general financing purposes. It also raised €1bn via a 6NC5 green senior non-preferred bond at a yield of 4.869%, 25bp inside initial guidance of MS+175bp area. If uncalled after 5 years, the coupon will reset at the 3m Euribor plus a spread of 150bps and will be paid quarterly. The bonds have expected ratings of Baa2/BBB/A-, and received orders over €1.9bn, 1.9x issue size. Proceeds for this tranche will be used to finance/refinance eligible activities of the “Green Categories” as defined in the Sustainable and Positive Impact Bond Framework of the Issuer.

Industrial Bank of Korea (IBK) raised $600mn via a 5Y social bond at a yield of 5.457%, 30bp inside initial guidance of T+115bp area. The senior unsecured bonds have expected ratings of Aa2/AA- (Moody’s/Fitch), and received orders over $2bn, 3.3x issue size. Proceeds will be used to finance/refinance new and/or existing loans extended to entities or projects that fall within the employment generation social eligible category, in particular, small- and medium-sized enterprises and start-up companies that have been established for a period of less than seven years at the time of such financing and/or refinancing. Furthermore, IBK commits to only target eligible SMEs and start-up companies that meet the definition of woman-owned enterprise set forth by the IFC.

Oceaneering raised $200mn via a tap (Term of the Day, explained below) on its existing 6% 2028s at 91.5 to yield 8.377%. The senior unsecured bonds are currently rated B1/ BB-. Proceeds, together with cash on hand, if necessary, will be used to fund a tender offer for $400mn of its outstanding 4.650% 2024s. Bondholders who tender the notes before 26 September 2023 (Tender Deadline) will receive $1000 per $1,000 in principal.

New Bond Pipeline

- Korea Land & Housing Corp hires for $ Social bond

- NBN hires for $ 5Y/10Y bond

- Emirates NBD hires for Sustainable bond

Rating Changes

-

Moody’s upgrades Stena AB’s CFR to Ba3 from B1; outlook stable

- Moody’s revises Yuexiu Property’s outlook to negative; affirms Baa3 ratings

- Moody’s revises China Overseas Land & Investment’s outlook to negative; affirms Baa1 ratings

- Moody’s places China Vanke’s ratings on review for downgrade

- Moody’s revises Greentown’s outlook to negative; affirms ratings

- Moody’s places China Jinmao’s ratings on review for downgrade

Term of the Day

Tap

A ‘tap’ refers to a bond issuance wherein the issuer issues more of an existing bond rather than issue a new bond. Taps, also known as re-openings, are common in the bond market and can be quoted as a price or yield during the initial price guidance stage of issuance.

Oceaneering raised $200mn via a tap on its existing 6% 2028s at a yield of 8.377%.

Talking Heads

On JPMorgan Adding India to Its EM Bond Index from June 2024

Nagaraj Kulkarni, co-head of Asia rates ex-China at StanChart

“Foreign investors will have access to a large, idiosyncratic factors driven market, while domestic investors will welcome investors with varying risk-return preferences”

Charu Chanana, a strategist at Saxo Markets

“With inflation coming under control, the inclusion will open more gates for foreign capital to flow into India”

On Warning Bond Investors Face Record Third Year of Losses – Bill Gross

“The 10 year Treasury is already priced for a 2% inflationary world”. Historically 10Y notes yield 135bp more than the fed funds rate. Even if the policy rate drops to 2.5%, that puts the 10Y yield close to 4% “under the best of possible scenarios”… bond markets are headed for an unprecedented third year of losses, because of sticky inflation and widening deficits.

On Morgan Stanley’s Trading Desk Seeing Fragility Rising in Stocks

“A hawkish Fed has shaken the market, and while not yet at the point of activating significant forced selling, that point is getting much closer. Even at flat prices, trend signals in the market will start to turn negative… It is not a done deal that an incrementally hawkish Fed has the ability to be that negative catalyst this time around… But further pricing out of cuts – to maybe shifting to actual hikes – could be a problem”

On Argentina Investors Seeing Rally in YPF Bonds Running Out of Steam

Ray Zucaro, CIO at RVX Asset Management

“Now maybe looks like a good time to sell”

Paula La Greca, corporate analyst at TPCG

“YPF bond prices lack the fundamental support to continue rising”

Fabricio Gatti, a portfolio manager at Novus Asset Management

“At these prices I prefer Argentina’s sovereign debt.If Argentina defaults on its sovereign bonds, the collapse in YPF’s bonds will be even greater”

Top Gainers & Losers- 22-September-23*

Go back to Latest bond Market News

Related Posts: