This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Lower Despite Stronger PPI

July 15, 2024

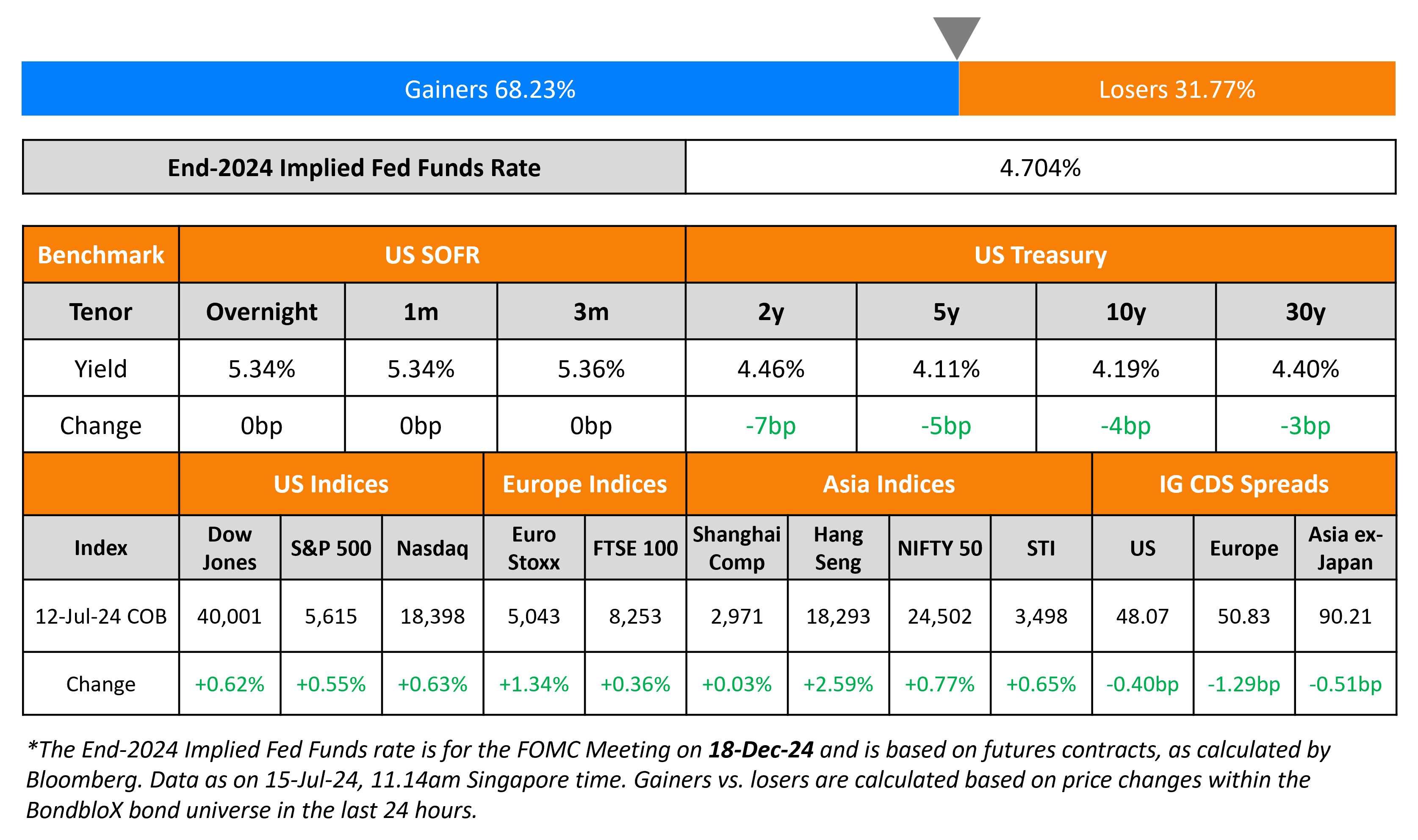

US Treasury yields ended lower across the curve on Friday, despite a stronger expected producer prices report. While the 2Y yield fell 7bp, the 5Y and 10Y yields were down 4-5bp. US PPI for June rose by 2.6% vs. the surveyed 2.3% and the Core PPI rose by 3.0% vs. the surveyed 2.5%. Looking at equity markets, S&P and Nasdaq ended higher by ~0.6% each. US IG spreads were 0.4bp tighter and HY CDS spreads were tighter by 3.1bp.

European equity indices ended higher. In credit markets, the iTraxx Main and Crossover spreads were tighter by 1.3bp and 6.9bp respectively. Asian equity indices have opened mixed this morning. Asia ex-Japan CDS spreads were 0.5bp tighter.

New Bond Issues

-

NongHyup Bank $ 3Y/5Y at SOFR+120bp/T+100bp

-

Qingdao Conson Development $ 3Y at 6.5% area

New Bonds Pipeline

- Piramal Capital hires for $ 3.5Y bond

- Mirae Asset hires for $ 3Y/3.5Y bond

- Resolution Life hires for $ 7Y T2 bond

Rating Changes

- Moody’s Ratings upgrades HMEL’s CFR to Ba1; outlook stable

- Moody’s Ratings upgrades Prosus’ rating to Baa2; outlook stable

- Intrum Downgraded To ‘CC’ After Entering A Binding Lock-Up Agreement With Noteholders; Outlook Negative

- Fitch Revises Outlook on Tata Steel to Negative from Stable; Affirms at ‘BBB-‘

Term of the Day

Dividend Recapitalization

A dividend recapitalization aka dividend recap, is when a company takes on new debt in order to pay special dividends to private investors or shareholders. With this, it reduces the company’s equity financing with regard to debt financing. Dividend recaps can help companies avoid the need to use the profits to distribute dividends to shareholders. Private Equity firms typically use dividend recaps to free up money to give back to its investors, without needing to go for a risky proposition like an IPO.

Talking Heads

On US Politics Threaten Chances of September Fed Cut – Mohd. El-Erian

“There are two factors that complicate a September cut for this Fed. One is they may get one bad data point. The second issue is the politics. How worried are they that there’s going to be an inflationary shock coming after the elections due to policies?”

On Bond Market Hitting a Turning Point as Path Clears for Fed Cuts

Sinead Colton Grant, CIO at BNY Wealth

“All signs point to the Fed starting rate cuts in September. You are seeing a market participant reaction to CPI on the back of a softer June labor market report”

John Madziyire, PM at Vanguard

“Clearly a lot of people missed the yield highs at 4.75%, and there is a bit more FOMO… also more conviction that the cycle is moving in the direction of lower yields”

Molly McGown, rates strategist at TD Securities

“Generally, we think rates will continue moving lower into easing”

On Seeing Traders Flocking to Risky Stocks as Rate Cut Bets Build – BofA

Equities with a generally higher debt burden (small caps and REITs), as well as EM stocks and FTSE 100 Index may stand to benefit as policymakers get closer to easing

Top Gainers & Losers- 15-July-24*

Go back to Latest bond Market News

Related Posts: