This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Jump on Stronger Than Expected CPI

February 14, 2024

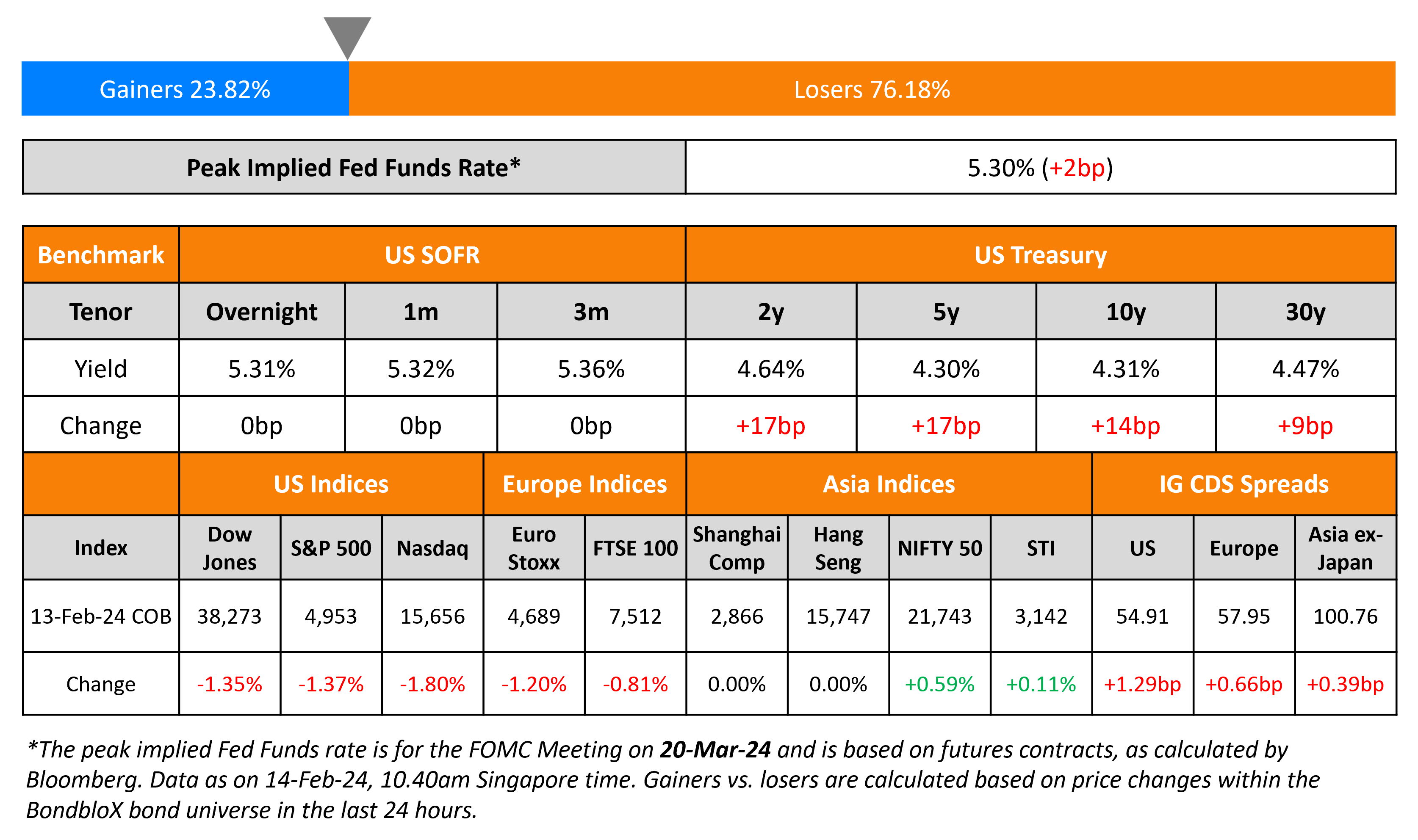

US Treasury yields surged across the curve, following the hotter than expected US inflation print for January. The 2Y yield jumped 17bp higher to 4.64% and the 10Y was up 14bp to 4.31%. Headline CPI was up 3.1% YoY, above expectations of 2.9% and below last month’s 3.4% reading. Meanwhile, Core CPI (excluding food and energy) was up by 3.9%, in-line with last month and above forecasts of 3.7%. The CME probabilities currently indicate that the market is pricing-in nearly 100bp in rate cuts by the Fed with the first cut expected in June. This compares to the earlier 125bp in rate cuts that were being priced-in before the inflation report, where expectations were for the first cut to happen in May. Looking at credit markets, US IG and HY CDS spreads widened 1.3bp and 9bp respectively. S&P fell 1.4% and Nasdaq fell 1.8%

European equity markets ended lower too. Credit markets in the region saw the European main CDS spreads widen by 0.7bp and crossover spreads widen by 7.1bp. Asian equity markets have opened weaker today. Asia ex-Japan IG CDS spreads widened by 0.4bp.

New Bond Issues

New Bond Pipeline

- Daewoo Engineering & Construction hires for S$ bond

- Greenko Mauritius hires for $ bond

Rating Changes

- Siemens AG Upgraded To ‘AA-‘ On Successful Portfolio Transformation And Conservative Financial Policy; Outlook Stable

- Infineon Technologies Upgraded To ‘BBB+’ On Sustained Resilient Free Operating Cash Flow Over The Cycle; Outlook Stable

- Fitch Downgrades Banco de Credito de Bolivia’s VR to ‘ccc’: Affirms IDRs at ‘B-‘; Outlook Negative

- Moody’s takes rating actions on 8 Adani Group entities

- Fitch Revises Vakif Katilim’s Outlook to Stable; Affirms LTFC IDR at ‘B-‘

Term of the Day

Century Bonds

Century bonds are bonds with a maturity of 100 years and are a relatively rare market phenomenon although countries including Argentina, Austria and Mexico and corporates such as Walt Disney and Coca-Cola have issued these in the past. The general idea is for issuers to take advantage of low yield environments and the demand comes from certain institutional clients who have a need to extend the duration of their portfolios such as pension funds and insurance companies. These bonds, like perpetuals, will usually come with a call schedule.

Century bonds are often of great interest to the hedge fund community because of the so-called “high convexity” of the securities. “The convexity of a bond is a measure of the curvature, or degree of the curve, in the relationship between bond prices and bond yields. It shows how the duration of a bond changes as interest rates change,” explained Ioannis Rallis of the SSA team in JP Morgan. “With a high convexity bond, the price falls less if yields go up than it increases when yields go down. That asymmetry is very interesting for some investors who can use it as a hedge if interest rates, as some expect, have further to fall.”

Talking Heads

Peter Cardillo, Chief Market Economist at Spartan Capital Securities

” If this keeps up with another month or two of inflation staying high, you can kiss a June (rate cut) goodbye and we’re probably looking at September. It’s a hotter-than-expected report and it’s part of what the Fed has been alluding to when it says it’s too early to say that inflation has been beaten.”

On Pockets of Stress in US Economy

Jim Zelter, Co-President Apollo Global Management Inc.

” In the context of a broad economy with “massive fundamental strength,” some companies still have a poor business plan, too much debt, or haven’t recovered from Covid. You’re going to have some stray challenges around the edges and there are signs of hardening of economic conditions coming up.”

On Bonds Erasing Gains of December

Prashant Newnaha, Senior Rates Strategist at TD Securities Inc

” January CPI is a game changer — the narrative that Fed disinflation provided scope for insurance cuts is clearly now on the chopping board. There is now a real risk that price pressures begin to shift higher. The Fed can’t cut into this. This should provide momentum for further bond declines.”

Top Gainers & Losers- 14-February-24*

Go back to Latest bond Market News

Related Posts: