This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

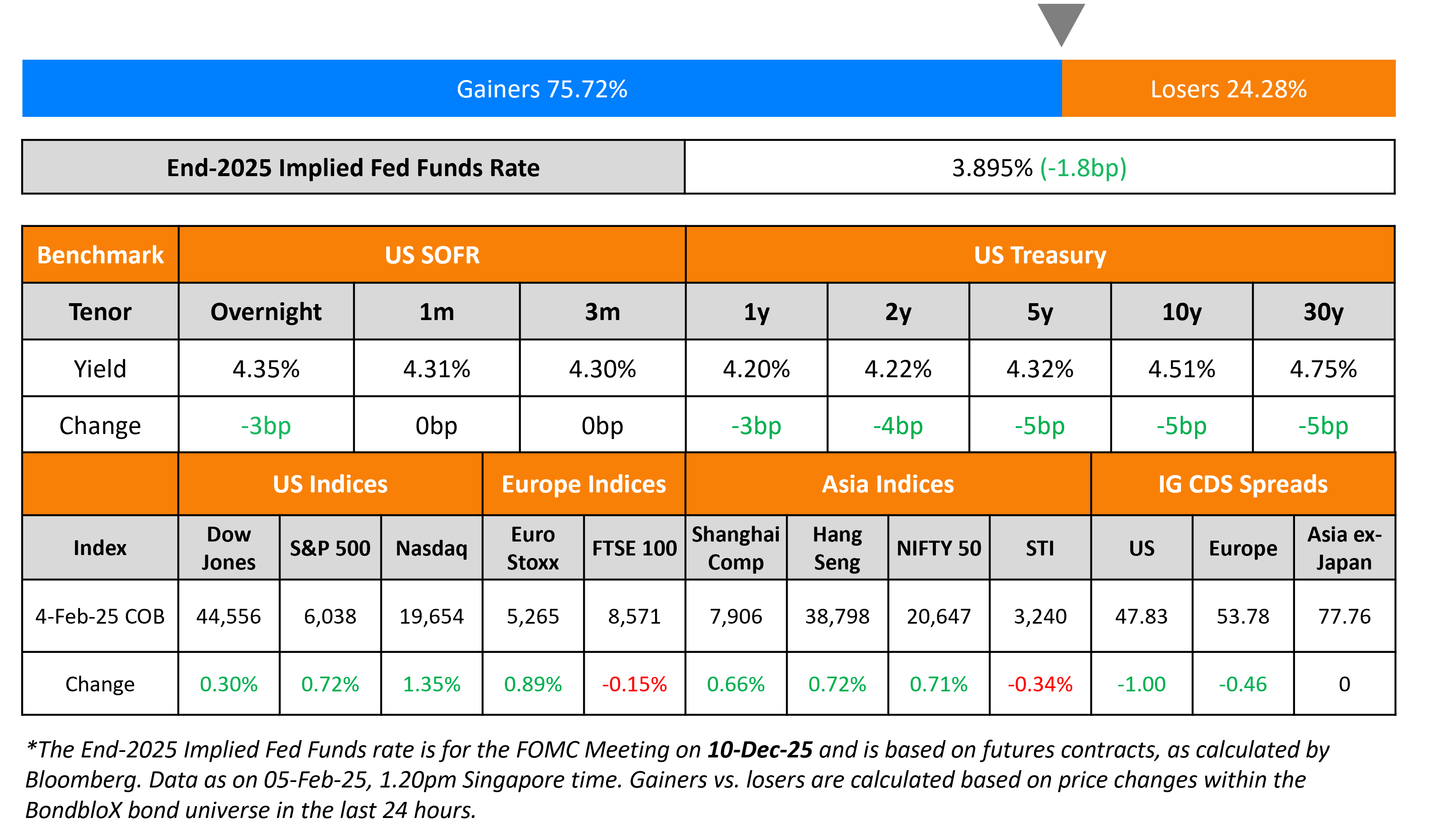

Treasury Yields Ease by 4-5bp, China Announces Retaliatory Tariffs

February 5, 2025

US Treasury yields fell by 4-5bp across the curve. US JOLTS job openings for December unexpectedly declined to 7.6mn vs expectations of 8mn. Separately, China’s Finance Ministry announced retaliatory tariffs of 15% on US LNG and coal imports, and 10% on crude oil, farm equipment and certain cars. The new tariffs will commence on February 10. This comes on the back of an additional 10% tariffs imposed by the new US administration on Chinese goods, that took effect yesterday.

US equity markets rallied, with the S&P and Nasdaq higher by 0.7% and 1.4% respectively. US IG and HY CDS spreads widened 1bp and 3.9bp respectively. However, European equities ended higher. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.5bp and 3.9bp respectively. Asian equity markets have opened broadly mixed this morning. Asia ex-Japan CDS spreads were unchanged.

New Bond Issues

New Bonds Pipeline

- Kepco hires for $ bond

Rating Changes

-

Royal Caribbean Cruises Ltd. Ratings Raised to ‘BBB-‘ On Favorable Bookings And Expected Sustained Credit Measure Improvement; Outlook Stable

-

Telecommunications Tower Operator Helios Towers PLC Upgraded To ‘BB-‘ On Reduced Country Risk; Outlook Stable

-

Selecta Group B.V. Downgraded To ‘SD’ (Selective Default) Due To Missed Interest Payment

-

Moody’s Ratings changes outlook for Smiths Group plc to negative from stable following strategic actions announcement; Baa2 ratings affirmed

Term of the Day: Carry Trades

Carry trades are a popular trading strategy where an investor borrows money from a country with low interest rates (and a weaker currency) and invests the money in another country’s asset with a higher interest rate. Historically, a famous example has been the Japanese yen-funded carry trade. This was mainly owing to the zero-to-negative interest rates in Japan for the better part of two decades, and bets that rates there would remain at rock bottom levels. In this case, investors globally and even locally would borrow at low interest rates in Japan and invest the money in overseas equities and bonds like the US stock market. Carry trades typically work well when central bank policy certainty is high and expectations are for low market volatility.

Talking Heads

On Traders More Neutral on US Bonds as Tariffs Cloud Outlook

Ed Al-Hussainy, Columbia Threadneedle

“You have to be super careful about whatever your story of the economy is — you’ve got to be careful about actually putting money to work behind it. A lot of people have become much more neutral on duration and not wanting to take that volatility”

On Investors Can Bet on World’s Top Carry Trade Lasting – Mehmet Simsek, Turkey’s finance minister

“You could bank on real exchange-rate appreciation lasting as long as the program delivers. Right now, the delivery is there. I can tell you that there are more opportunities going forward.”

On Being Ready to Short French Bonds Again – Citigroup Strategists

“This might stabilize/further tighten OAT spreads in the near-term, but medium-term negatives remain from political, economic, fiscal and rating risks. We would look for tactical shorts if 10-year OAT-Bund breaches 70bp”

Top Gainers and Losers- 5-February-25*

Go back to Latest bond Market News

Related Posts: