This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Ease Across the Curve; Turkey Keeps Rates on Hold at 50%

August 21, 2024

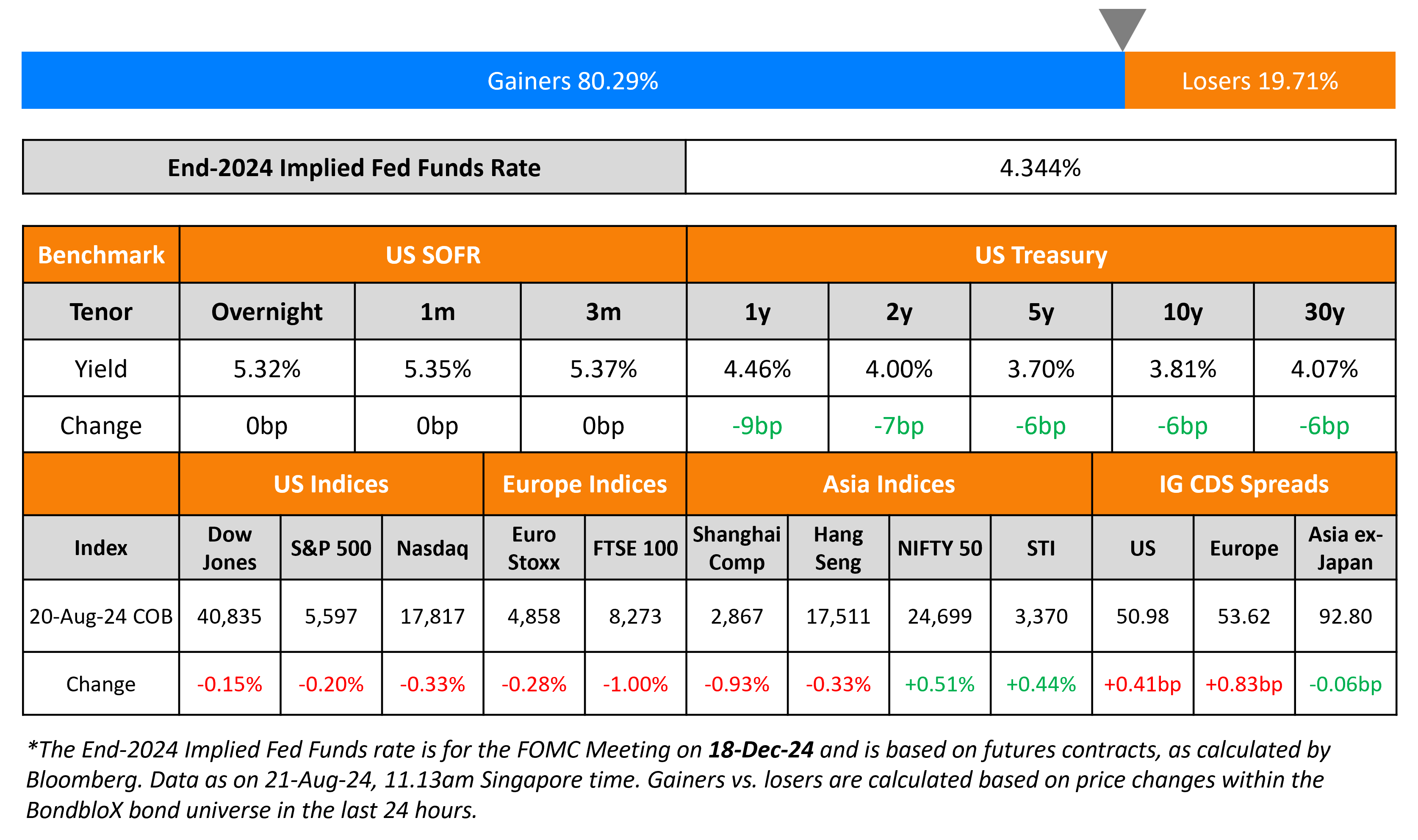

US Treasury yields fell across the curve by 6-9bp. Fed Governor Michelle Bowman said that she remains cautious about any shift in Fed policy because of potential continued upside risks for inflation. She said that overreacting to any single data point could hurt the progress that has been made. US IG CDS spreads widened by 0.4bp while HY CDS spreads widened by 1.8bp. Looking at US equity indices, the S&P and Nasdaq were lower by 0.2% and 0.3% respectively.

European equity markets ended lower too. Looking at Europe’s CDS spreads, the iTraxx Main spreads widened 0.8bp while Crossover spreads were wider by 2.8bp. Turkey’s central bank, the CBRT kept policy rates on hold at 50% with a focus on the outlook for prices, amid slowing domestic demand and sticky services inflation. Asian equity indices have opened lower this morning. Asia ex-Japan CDS spreads were flat.

New Bond Issues

- Wuxi Hengting $ 3Y at 5.5% area

Avic Inernational Leasing raised $300mn via a 3Y bond at a yield of 4.662%, 43bp inside initial guidance of T+125bp area. The senior unsecured bonds are rated Baa1. The bonds have a change of control put at 101. Proceeds will be used for debt replacement.

BOC (Dubai) Branch raised $400mn via a 3Y green FRN at SOFR+55bp, 50bp inside initial guidance of SOFR+105bp area. The senior unsecured bonds are rated A1/A/A.

DBJ raised $600mn via a 3Y bond at a yield of SOFR+52bp, 3bp inside initial guidance of SOFR MS+55bp area. The senior unsecured bonds are unrated. Net proceeds will be exclusively to finance/refinance in whole or in part, existing and/or future projects or businesses which meet the eligibility criteria.

BNP Paribas raised €1.25bn via a 10NC5 Tier 2 bond at a yield of 4.159%, ~32.5bp inside initial guidance of MS+200/205bp area. The subordinated notes are rated Baa2/BBB+/A-, and received orders of over €4.35bn, 3.5x issue size.

Rating Changes

- Fitch Assigns Uber Technologies, Inc. First-Time ‘BBB’ IDR; Outlook Stable

- Moody’s Ratings withdraws Bluestar’s ratings

Term of the Day

Bearer Bonds

A bearer bond is an unregistered debt security that could be issued by sovereigns or corporates. Unlike typical bonds, no records of the ownership or transactions are maintained for bearer bonds. The physical possessor of these bonds is the presumptive owner since there is no registered owner. Another difference is with respect to coupon payments. Coupons for bearer bonds are physically attached to the security so that the possessor can redeem these through an authorised agent. As with registered bonds, the bearer bonds are also negotiable and have a stated maturity date and coupon rate. The lack of legislation makes these bonds ideal instruments for tax evasion and money laundering. Such types of bonds were common in the 19th and 20th centuries and are no longer issued by the US treasury.

Talking Heads

On Fed predicted to deliver three quarter-point rate cuts this year: Reuters poll

Jonathan Millar, Barclays

“The basis for the cuts that we have is mostly because inflation is coming down. It’s not so much that activity is slowing… labor market is hanging in there just fine… not really any reason for (Fed) to panic”

Michael Gapen, BofA

“We’re not convinced there’s a downdraft in activity around the corner that’s going to prompt large rate cuts from the Fed”

On Hedge Funds Using Dollars for New Carry Trades – Citi

“We’ve seen our positioning sentiment on the US dollar starting to turn much more bearish. An environment where people are speculating about rate cuts has fueled risk appetite… We’ve been concerned about the FX carry trade for a while now

On Indian Inflation Must Slow to 4% For a Rate Cut – RBI Governor Shaktikanta Das

“We are completely focused on inflation, we are keeping a close eye on growth”… will be a “serious policy mistake” to cut rates based on the one-off dip in inflation

Top Gainers & Losers-21-August-24*

Go back to Latest bond Market News

Related Posts: