This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Drop; Oil Falls Below $70 – First Time Since December 2021

September 11, 2024

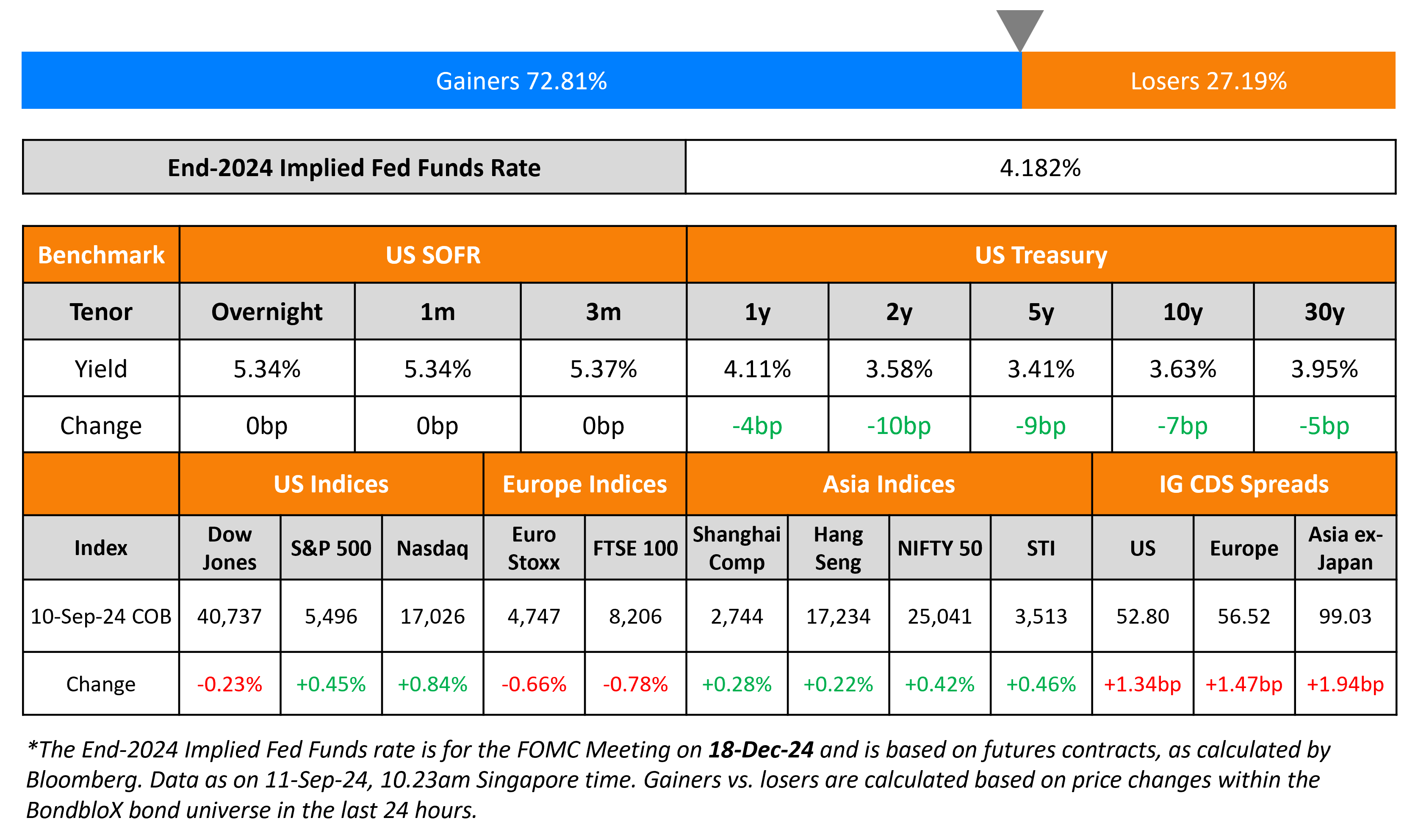

US Treasury yields dropped across the curve by 7-10bp. The US Treasury’s 3Y auction saw strong demand with a bid-to-cover of 2.66x (vs. 2.55x last month) and an indirect acceptance rate of 78.2% (vs. 64.4% last month). Oil prices fell below $70/bbl, its lowest since December 2021 with analysts noting that excess supply fears are weighing-in. US IG CDS spreads widened by 1.3bp and HY CDS spreads were wider by 6bp. Looking at US equity indices, the S&P and Nasdaq were both higher by 0.5% and 0.8% respectively.

European equity markets ended lower. Looking at Europe’s CDS spreads, the iTraxx Main spreads were wider by 1.5bp while Crossover spreads widened by 7.9bp. Asian equity indices have opened in the red this morning. Asia ex-Japan CDS spreads widened by 1.9bp.

New Bond Issues

New Bonds Pipeline

- Hewlett Packard Enterprise hires for $ bond

Rating Changes

- Fitch Places Quzhou Development’s ‘CCC+’ Rating on Watch Negative

- Germany-Based DekaBank Outlook Revised To Positive On Stronger Group Support Capacity; ‘A/A-1’ Ratings Affirmed

Term of the Day

Builder Basket

A builder basket is a basket that has the potential to increase during the life of the facilities, based on the performance of the borrower through retained excess cash flow or a percentage of consolidated net income. They generally recognize a borrower’s ability to utilize a portion of the profits or cashflows generated, so that a better performance by the borrower results in bigger increases in the quantum of the builder basket. This provides freedom to utilize any excess cash for purposes beyond debt servicing.

Talking Heads

On Stocks Unlikely to Sink Into Bear Market – Goldman Sachs Strategists

The odds of an outright bear market are slim as the economy is also in part being supported by a “healthy private sector”… stocks could decline into the year end, hurt by higher valuations, mixed growth outlook and policy uncertainty

On Fed to cut rates by 25bp and twice more in 2024: Reuters poll

Stephen Stanley, Santander.

“The employment report was soft but not disastrous. On Friday, both Williams and Waller failed to offer explicit guidance on the pressing question of 25bp vs. 50 on Sept. 18, but both offered a relatively benign assessment… in my view, to a 25bp cut”

Aditya Bhave, BofA

“If the Fed were to cut by 50bp in September, we think markets would take that as an admission it is behind the curve and needs to move to an accommodative stance”

On BOJ’s Bond Buying Cuts Carve Out Opening for Japanese Investors

Ayako Sera, Sumitomo Mitsui Trust Bank

“Higher bond yields have made long-term investors more constructive on Japanese bonds”

Tsuyoshi Ueno, NLI Research Institute

“The key to future demand for Japan’s bonds is whether banks and foreign investors will continue to increase their holdings”

Top Gainers & Losers-11-September-24*

Go back to Latest bond Market News

Related Posts: