This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Stable Ahead of NFP Report

December 6, 2024

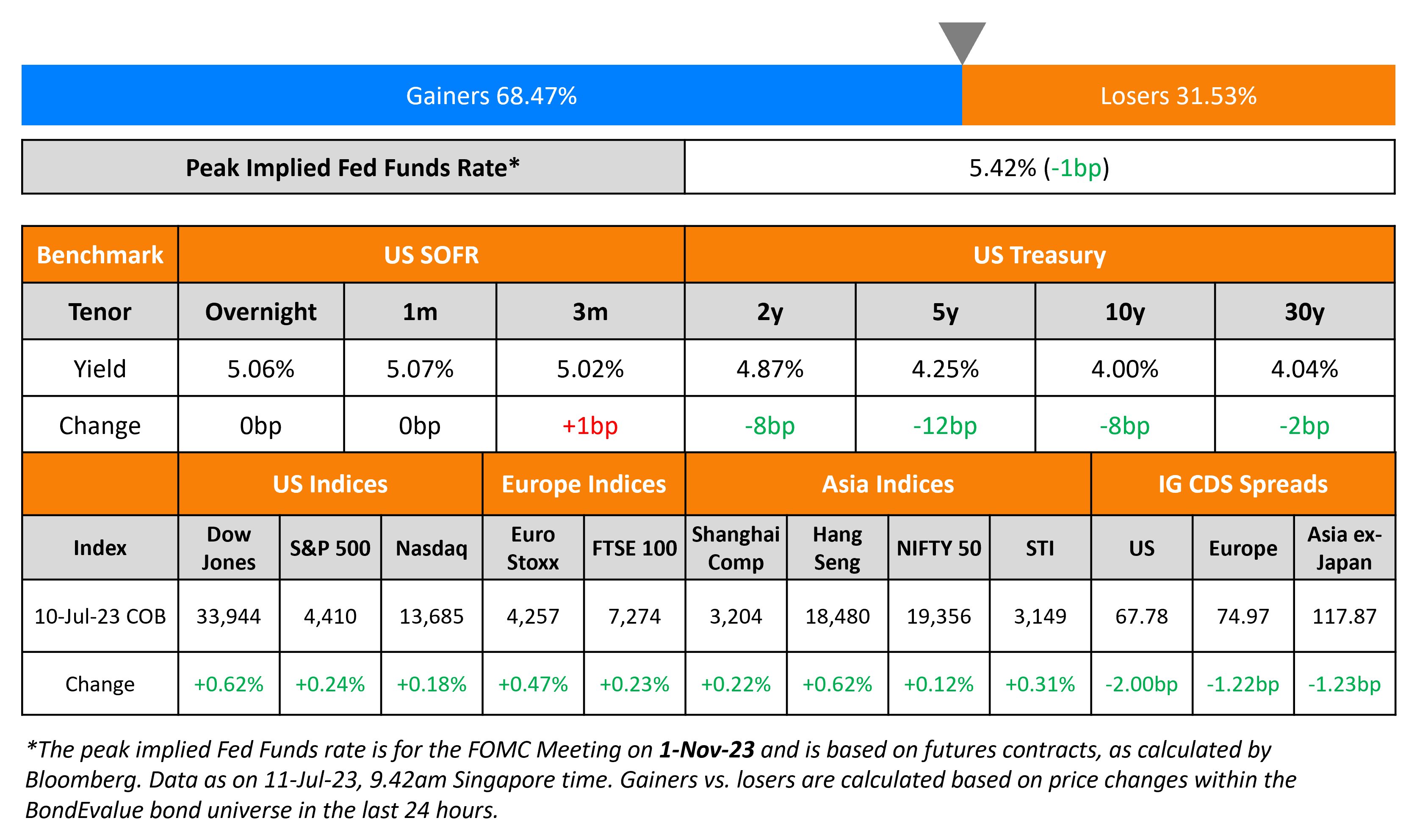

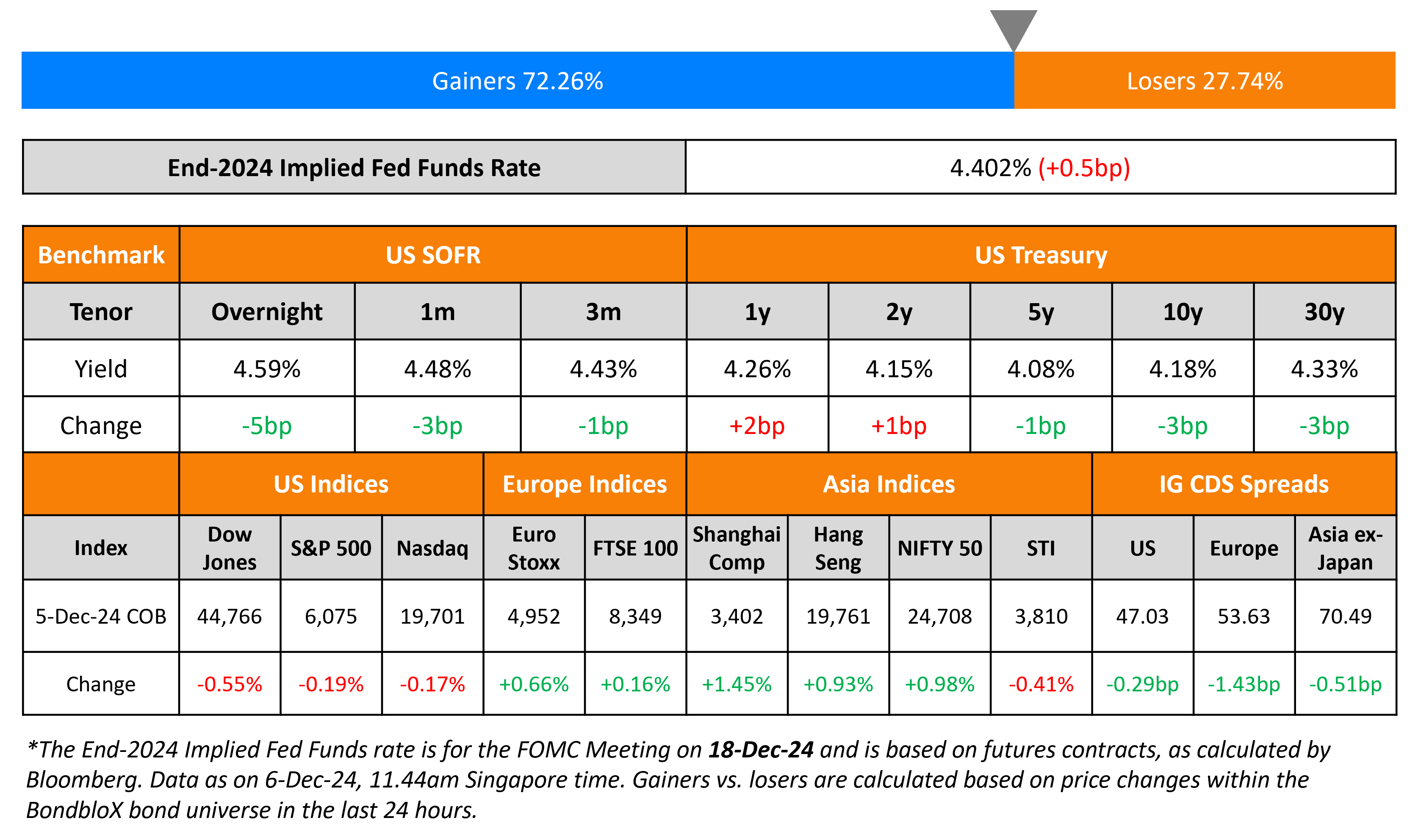

US Treasury yields were broadly stable on Thursday. Initial jobless claims for the previous week rose by 224k, higher than expectations of 215k. Markets expect US NFP to see a 220k pick-up, with the unemployment rate expected to hold steady at 4.1%. Average hourly earnings are expected to ease slightly to 3.9% YoY from 4.0%. At present, markets are pricing-in a 70% probability of a 25bp rate cut by the Fed in December.

US IG and HY CDS spreads widened by 0.3bp and 0.6bp respectively. Looking at US equity markets, the S&P and ended 0.2% lower. European equities ended higher. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 1.4bp and 4bp respectively. The French Prime Minister Michel Barnier resigned from his post after the government was toppled in a no-confidence vote. Asian equities have opened broadly higher this morning. Asia ex-Japan CDS spreads were 0.5bp tighter.

New Bond Issues

Hertz raised $500mn via a tap of its 12.625% 2029s at a yield of 10%, ~37.5bp inside initial guidance of 10.25-10.50%. The senior secured first lien notes are rated Ba3/B. Proceeds will be used to repay outstanding borrowings under its revolving credit facility.

Rating Changes

-

Gajah Tunggal Upgraded To ‘B’ On Enhanced Liquidity Buffer; Outlook Stable

-

Talen Energy Supply LLC Debt Ratings Lowered On $600 Million Term Loan B Upsizing To Fund Share Repurchases

-

Hertz Global Holdings Inc. Senior Secured Debt Rating Lowered To ‘B’ From ‘B+’ On Proposed Add-On

-

Fitch Downgrades CVR Energy to ‘B+’; Assigns ‘BB+’/’RR1’ to Proposed Term Loan B; Outlook Stable

-

Starbucks Corp. Outlook Revised To Negative On Expected Temporary Elevation In Leverage; ‘BBB+’ Ratings Affirmed

-

Singapore Post Ltd. ‘BBB’ Rating Placed On CreditWatch Negative Over Strategy Reset

New Bonds Pipeline

- Buenos Aires hires for $ bond

Term of the Day

Portfolio Trading

Portfolio trading is a mechanism in which dealers move large baskets of bonds in a single trade often using ETFs, hence pricing and transacting an entire portfolio at one shot. The benefit of portfolio trading it to move large buckets of risk with ease by executing fewer, larger trades to reduce market impact, cost and reducing the time taken to execute on portfolios. As ICE notes, it is an “all or none” execution style. Bloomberg notes that portfolio trading has stalled in recent volatility as it becomes harder for dealers to set prices on those bonds when price are rapidly.

Talking Heads

On Worries Credit Markets Are Priced for Complacency

Kathy Jones, Charles Schwab

“There is a sense now of real complacency that’s priced into the market. It’s priced as if nothing will ever go wrong… It’s not a bad time to kind of take a step back and make sure you know what’s going on”

Meghan Graper, Barclays

“If you were to be a borrower in the market with a deal, it can prove to be problematic”

On Junk Bond Experts See Some Widening of Spreads Next Year

Matt Mish, UBS

“We generally think spreads are rich, but they’re not nosebleed rich”… spreads should be in the “mid-300s”

Winnie Cisar, CrediSights

“Not to say 2025 is going to be a particularly dire year, but we think the spread environment is a little tight for where fundamentals are going to go”

Oleg Melentyev, BofA

“We think that the longer, natural rate of spreads is not in the 200s”

On High-Grade Bond Spreads Can Tighten More – Invesco

“How much do you need to get paid for something that doesn’t ever really default?… likelihood of any significant panic is significantly less”… improved liquidity due to increased portfolio trading and increasingly high credit quality can pull spreads tighter.

Top Gainers and Losers- 06-December-24*

Go back to Latest bond Market News

Related Posts: