This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

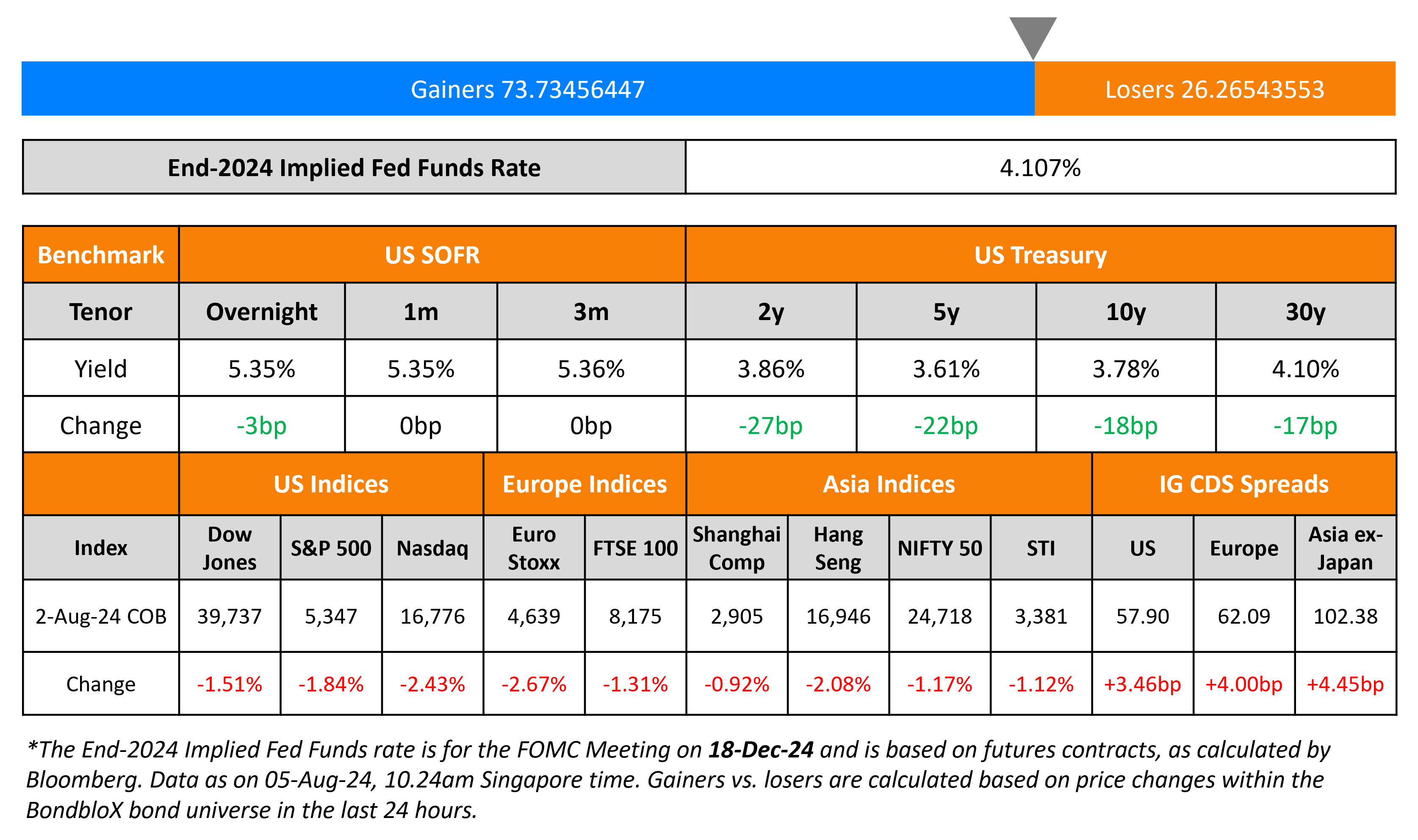

Treasuries Soar on Weak Jobs Report; Markets Price-in 50bp Sep Rate Cut

August 5, 2024

US Treasury yields tumbled on the back of the weak jobs data. The 2Y dropped by a massive 27bp to 3.86, with the 5Y and 10Y yields down 22bp and 18bp. US NFP for July rose by 114k vs. expectations of 175k. Also, June’s print was revised lower to 179k from 206k. The Unemployment Rate rose to 4.3% from 4.1% and the Average Hourly Earnings (AHE) YoY fell to 3.6% vs. expectations of 3.7% and the prior month’s 3.9%. Separately, Chicago Fed President Austan Goolsbee said that Fed officials would “never want to over react to any one month’s numbers”. However, he said that they may have to respond to if unemployment rises above the neutral rate.

Looking at Fed Funds Futures, markets are now pricing-in a 76% probability of a 50bp rate cut in September. Besides, markets are also beginning to price-in a possible 125bp in rate cuts by end-2024, from 75bp a week earlier. US equities saw a sharp sell-off on Friday, with the S&P and Nasdaq down over 1.8% and 2.4% respectively. US IG and HY CDS spreads widened by 3.5bp and 22bp respectively.

European equity markets ended lower too. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 4bp and 22bp respectively. Asian equity indices have opened in the red this morning. Asia ex-Japan CDS spreads were wider by 4.5bp.

New Bond Issues

NWD raised $400mn via a long 3.5Y bond at a yield of 8.625%. The senior unsecured bonds are unrated. Proceeds will be used on-lent to the guarantor and/or its subsidiaries for general corporate purposes, manage its capital profile and to refinance existing debt including for funding the purchase of the notes tendered under its concurrent tender offer announced on 1 August 2024.

Rating Changes

- Fitch Upgrades American Airlines Sr. Secured to ‘BB/RR2’; Affirms IDR at ‘B+’; Outlook Stable

- Fitch Downgrades Kenya to ‘B-‘; Outlook Stable

- Intel Corp. Ratings Placed On CreditWatch Negative On Business Underperformance

- Fitch Revises Istanbul’s Outlook to Positive; Affirms IDRs at ‘B+’

- Fitch Revises Vulcan’s Outlook to Positive; Affirms IDR at ‘BBB’

Term of the Day

Non-Farm Payrolls (NFP)

Non-Farm Payrolls (NFP) is a key data point that is released by the US Bureau of Labor Statistics (BLS) usually on the first Friday of every month. NFP measures net changes in employment excluding agricultural, local government, private household and not-for-profit sectors over the past month and is a key economic indicator in the United States. A high reading of the NFP is considered a positive sign for the US economy while a negative reading is considered a sign of a slowdown in the US jobs market. The NFP indicator is closely watched by traders, especially as it is one of the first monthly economic indicators to be released, and because of the direct relationship between job creation and economic growth.

Talking Heads

On Credit Traders Rush to Hedge on US Economy Fears

Raphael Thuin, Tikehau Capital

“Weaker macro and impact on earnings going forward is the one underpriced risk in the markets in our view. This could end up affecting credit spreads, at a time when valuations are nowhere near cheap”

Viktor Hjort, BNP Paribas

“There is a cyclical theme to it which hasn’t been present before”

Matt King, Satori Insights

“The usual effect is that people hedge using the liquid CDS index and then sell their bonds later. Usually what forces the cash index to move is if people start to have significant outflows”

On Market Plunge Has Investors Bracing for Turbulent End to 2024

Seema Shah, chief global strategist, Principal Asset Management

“Historically, the start of rate cuts tends to be bad for stocks. However, we have to be careful to not keep looking to history, as it can be somewhat misleading”

Emily Roland, John Hancock Investment Management

“The Fed has all the rationale in place to go ahead and start cutting. Equity markets are reacting in a “bad news is good news” fashion”

Anthony Roth, Wilmington Trust Investment Advisors

“Our view is that we’re in a strongly disinflationary economy, that the Fed’s 2% target is very achievable… inflation will come down to 2% to 2.25% by the end of 2025”

On Economy Healthy With Key Questions Around Job Market – Richmond Fed President, Thomas Barkin

“We’ve been through two years, two-and-a-half years of very frothy labor markets… question is, of course, are we normalizing or are we weakening?… It gets to the question of whether we’re going to plateau or whether unemployment’s going to rise”

Top Gainers & Losers- 05-August-24*

Go back to Latest bond Market News

Related Posts: