This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Sell Off on Waller’s Comments Supporting Two More Hikes

July 17, 2023

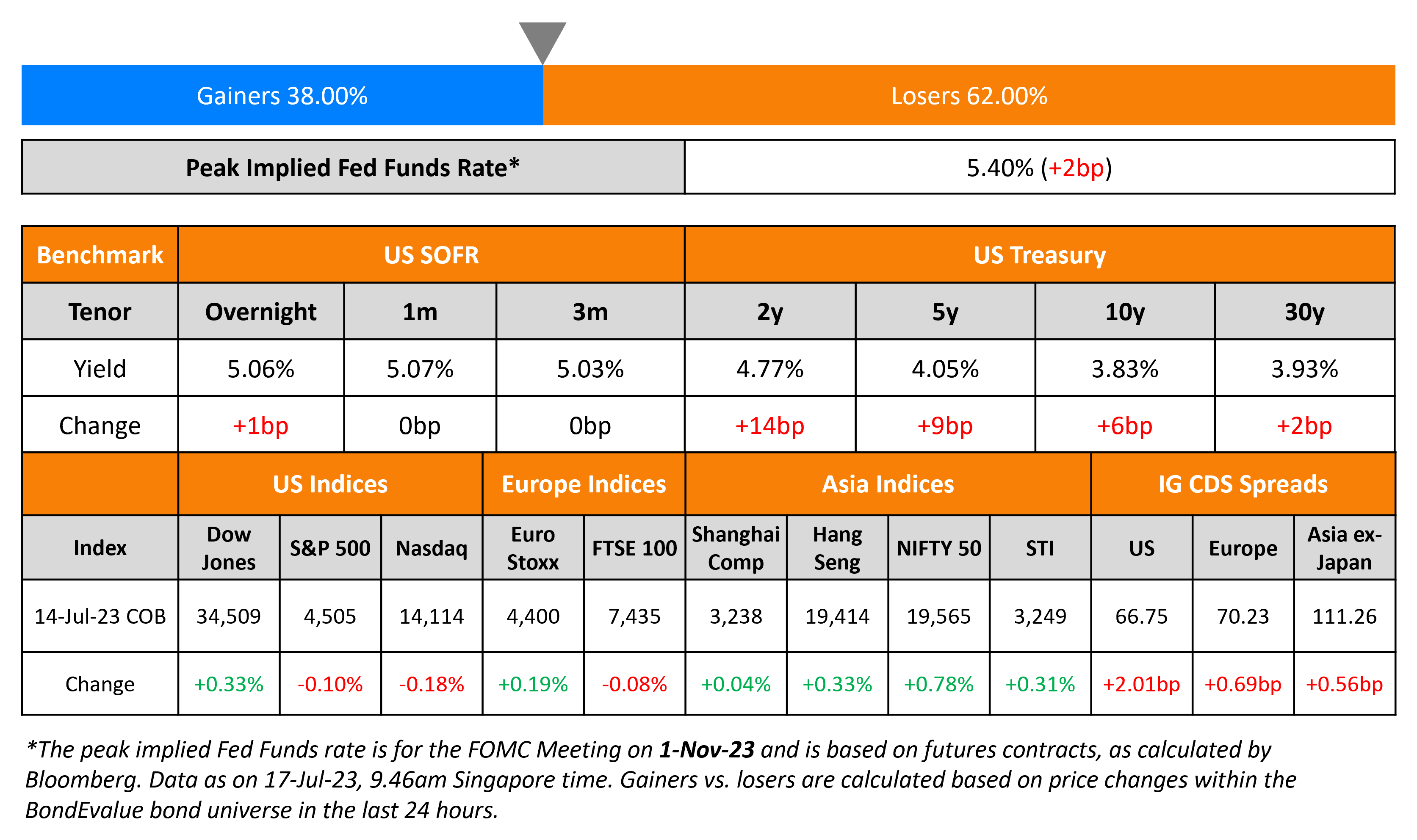

Treasuries sold off across the curve led by the short-end with 2Y yield higher by 14bp. This comes after Fed Governor and voting member Christopher Waller gave his support for two more 25bp hikes this year. He said that he sees “no reason why the first of those two hikes should not occur” at the July meeting. Separately, the Michigan’s consumer sentiment indicator for rose to 72.6, the highest level since September 2021. This figure was higher than the 64.4 figure previously and forecasts of 65.5. Expectations of a 25bp rate hike at the July 26 FOMC meeting currently stands at 96%, with the probability of a further 25bp hike now at 30% at the November FOMC meeting. The peak Fed Funds rate rose by 2bp to 5.40%. US equity indices ended slightly lower with the S&P and Nasdaq down by 0.1-0.2%. Credit spreads continued to widen with US IG and HY CDS spreads wider by 2bp and 9.4bp respectively.

European equity indices closed marginally higher with European main CDS spreads 0.7bp wider while Crossover CDS were wider by 3.8bp. Asia ex-Japan CDS spreads also widened, by 0.6bp and Asian equity markets have opened with a positive bias today.

New Bond Issues

New Bond Pipeline

-

Hanhwa Q Cells hires for $ 5Y green bond

-

Shinhan Financial hires for $ 5Y social bond

Rating Actions

- Moody’s upgrades Ford’s corporate family and senior unsecured ratings to Ba1; outlook stable

- Fitch Upgrades Pakistan Water and Power Development Authority to ‘CCC’ on Sovereign Rating Action

- Fitch Downgrades Pemex’s IDRs to ‘B+’ on Rating Watch Negative

- Moody’s downgrades Azure Power Energy and Azure Power Solar Energy; will withdraw both ratings

- Brazilian Airline Azul S.A. Downgraded To ‘SD’ Following Distressed Debt Exchange

Term of the Day

Selective Default

A Selective Default (SD) credit rating is assigned by S&P when the rating agency believes that the obligor/issuer has selectively defaulted on a specific issue or class of obligations but it will continue to meet its payment obligations on other issues or classes of obligations in a timely manner. A rating on an obligor/issuer is also lowered to D or SD if it is conducting a distressed debt restructuring.

Talking Heads

On Further US Rate Hikes – Fed Governor Christopher Waller

“The robust strength of the labor market and the solid overall performance of the U.S. economy gives us room to tighten policy further… I see no reason why the first of those two hikes should not occur at our meeting later this month… If inflation does not continue to show progress and there are no suggestions of a significant slowdown in economic activity, then a second 25-basis-point hike should come sooner rather than later, but that decision is for the future.”

On the Attractiveness of Long-Term Bonds as Peak Rates Near

Nisha Patel, managing director of SMA portfolio management at Parametric Portfolio Associates

“We like the idea of extending and adding duration at this point in the cycle… Historically, over previous tightening cycles, yields have tended to decline (during the period between the last hike and the first rate cut).”

Strategists at Bank of America

“Going long duration at the end of the hiking cycle is a more consistent trade than the steepener, which is more conditional on a harder landing outcome from the Fed.”

Eddy Vataru, fixed income manager at Osterweis Capital Management

“I love duration here…(inflation) has scope to fall below 2%.”

Michael Franzese, head of fixed income trading at MCAP

“You have a lot of investors looking now to make a bet and buy (if yields move back up)…We may see a wave of new buying coming in, as Treasuries are an asset that could start to accrete really well for investors when the Fed does eventually start cutting.”

On Recession in the US – CIO for Global Fixed Income at BlackRock Rick Rieder

“I just think a recession is grossly overstated as a phenomenon today without some massive shock to the system… When you have a consumer-oriented, service-oriented economy, it’s much more stable than people give credit to… I’m much more confident that inflation is going to come down than I am that the unemployment rate is going to come up…Let (interest rates) marinate and it’ll do its work.”

On High-Yield EMs Issuing Bonds

Guido Chamorro, co-head of EM hard-currency debt at Pictet Asset Management

“High-yield sovereigns are fair game to issue this second half…After all, they are the ones that need funding the most.”

Samantha Singh, senior markets strategist at Rand Merchant Bank

“Frontier markets, which include most African economies, will likely find it generally harder to come to market stil…Even those with big reform agendas could struggle to issue eurobonds in the near term unless they do pay up a bit.”

On the Beginning of a Global Bond Rally – CIO for fixed income at JPMorgan Bob Michele

“More and more indicators are at levels you only see in recession. We are buying every backup in yields…The considerable central bank tightening is starting to bite hard in the real economy.”

Top Gainers & Losers – 17–July-23*

Go back to Latest bond Market News

Related Posts: