This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Sell-Off on Stronger Than Expected ISM Manufacturing

April 2, 2024

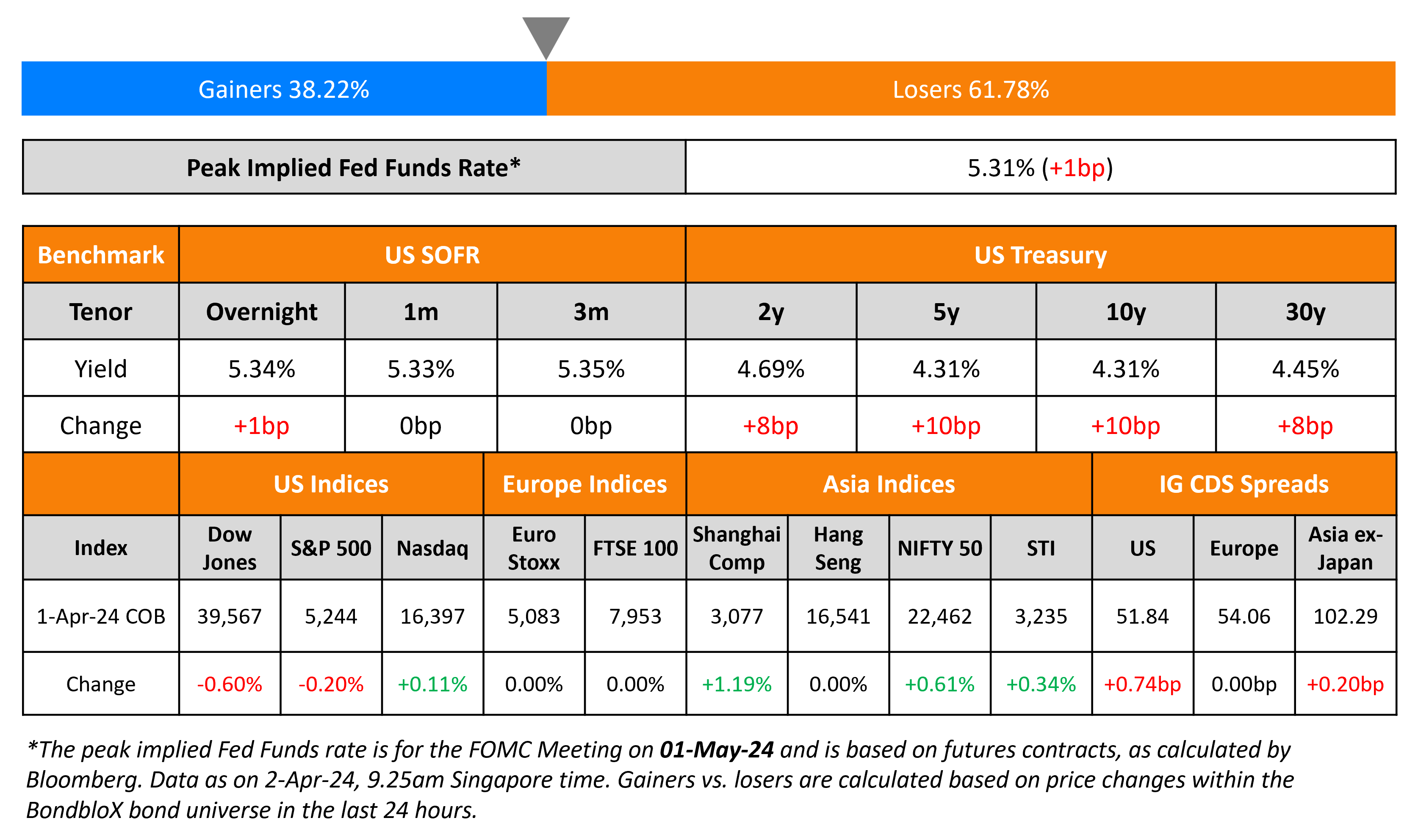

US Treasuries sold-off across the curve by 8-10bp on Monday after a stronger than expected US ISM Manufacturing PMI print. The reading for March came at 50.3, its first expansionary print in 18 months, higher than expectations of 48.4 and February’s 47.8. Looking at the sub-components, the Price Paid Index rose further to 55.8 from 52.5 priorly, and above expectations of 53. New Orders also picked up to 51.4 from 49.2 and was higher than expectations of 49.8. The Employment Index however, stayed in contractionary territory of 47.4, albeit higher than the prior 45.9 reading and in-line with expectations. Immediately, following the stronger than expected data, the probability of a June rate cut by the Fed dipped below 50%. It currently stands at 56% vs. 65% a week ago. Credit markets saw the US IG CDS spreads widen 0.7bp and the HY spreads widen 3.5bp. Looking at equity indices, S&P ended lower by 0.2% and Nasdaq higher by 0.1%.

European equity indices and CDS markets were closed. Asian equity markets have opened in the green today. Asia ex-Japan IG CDS spreads were 0.2bp wider.

New Bond Issues

New Bond Pipeline

- Nexa Resources hires for $ 10Y bond

- Movida Participações hires for $ bond

- Engie SA hires for $ 10Y/30Y bond

We are Hiring: Fixed Income Credit Sales

The BondbloX Team is growing! We’re currently looking for a passionate fixed income sales person who can join our Singapore office and ride the fixed income electronification wave with us.

Our ideal candidate will have 6 to 12 years of experience in cash bond sales / research / product management in exchanges, brokers, banks or EAMs. If you or anyone you know is interested, please write to our co-founder and CEO, Dr. Rahul Banerjee at rahul.banerjee@bondblox.com.

Rating Changes

- Moody’s upgrades GEO Group’s CFR to B2, outlook stable

- Fitch Downgrades Bally’s Corporation’s IDR to ‘B’; Outlook Negative

- JPMorgan Chase Outlook Revised To Positive On Franchise Strength And Ability To Deliver Solid Results; Ratings Affirmed

- Talen Energy Supply LLC Outlook Revised To Positive On Data Center Sale, Debt Repayment; Rating Affirmed At ‘B+’

Term of the Day

Frontier Market Bonds

These are bonds issued by frontier markets, considered to be smaller/riskier/more illiquid compared to emerging markets. These are generally considered the next generation of emerging markets. Aberdeen notes that from a geographical standpoint, “Africa is most associated with frontier markets”. Some examples of frontier markets are Guatemala, Bolivia, Kenya, Zambia, Ghana, Pakistan, Sri Lanka etc.

Talking Heads

On ‘Modest’ Growth, Warning on US Debt – Citadel’s Ken Griffin

“It is irresponsible for the US government to incur a deficit of 6.4% when unemployment is hovering around 3.75%… must stop borrowing at the expense of future generations”

On Fed Bank Borrowing Program ‘Too Good to Pass Up’

Lou Crandall, Wrightson ICAP economist

“Banks in many districts found the concessionary terms of the program too good to pass up in early January… If the Fed finally begins to cut rates this summer, alternative funding sources will become more attractive”

On EM Assets Lower Amid Thin Liquidity, US Data

Claudia Ceja, a strategist at BBVA Mexico

“After the strong rally I think this type of overreaction to positive data can continue, especially if the US labor market does not show strong signs of slowdown”

Top Gainers & Losers- 02-April-24*

Go back to Latest bond Market News

Related Posts: