This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Sell Off; China Orient Launches $ 5Y

May 30, 2024

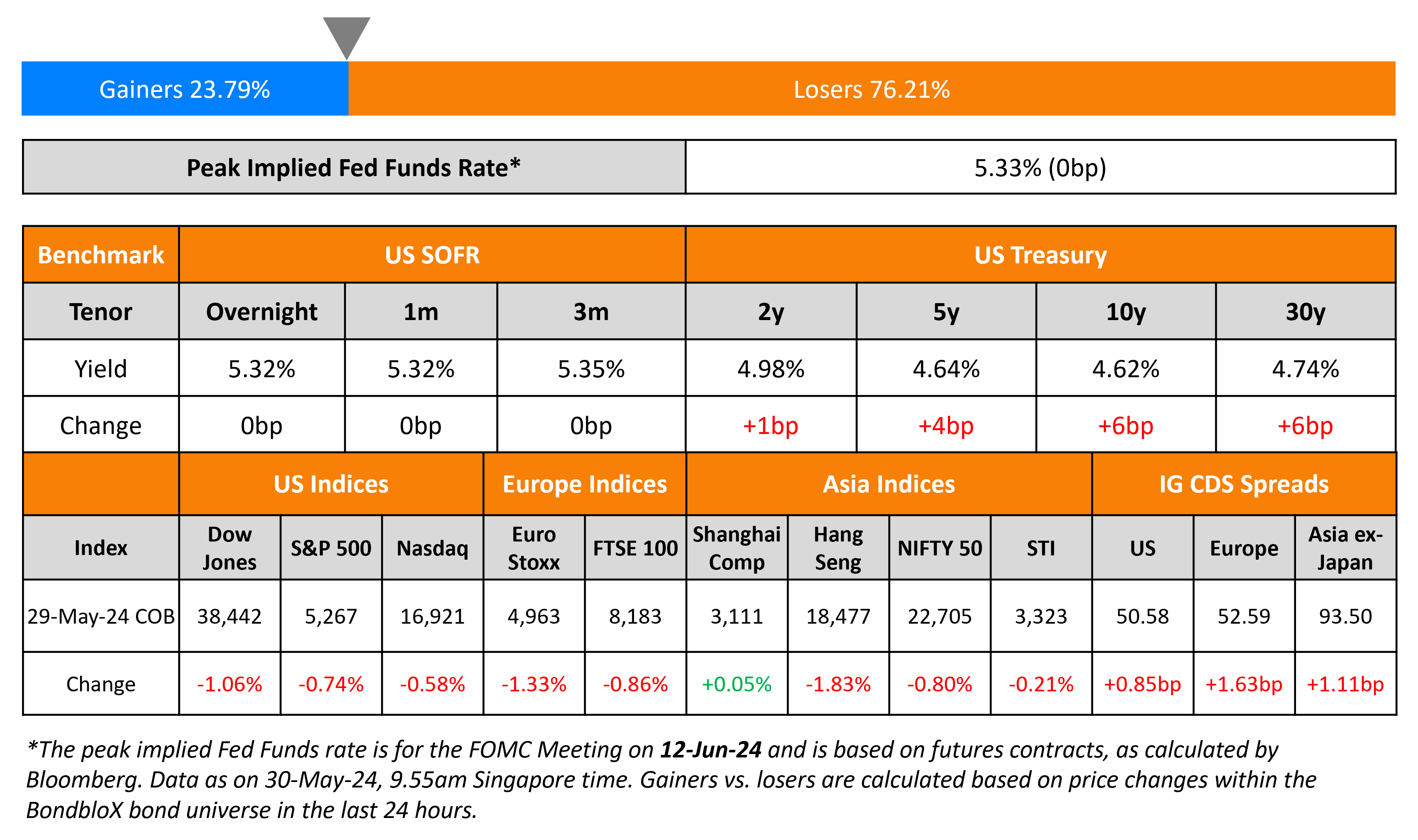

US Treasury yields continued to march higher across the curve, by 4-6bp on Wednesday. Markets are again repricing the number of rate cuts that might occur this year, following comments by Fed speakers. CME probabilities indicate that markets only expect one 25bp rate cut this year, in November. Besides, treasuries also sold-off following a soft 7Y auction that tailed by 1.3bp, just a day after its 2Y and 5Y auctions also tailed and witnessed soft demand with bid-to-cover ratios well below the average. Separately, the Fed’s Beige Book stated that most districts reported “slight or modest growth” and “retail spending was flat to up slightly”. Equity markets saw the S&P and Nasdaq fall by 0.6-0.7%. US IG CDS spreads widened 0.9bp and HY spreads were 7bp wider.

European equity markets ended in the red as well. Europe’s iTraxx main CDS spreads were 1.6bp wider and crossover spreads were wider by 8bp. German inflation ticked higher by 2.8%, vs expectations of 2.7%, just ahead of market expecting a first cut in ECB’s interest rates next week. Asian equity indices have opened in the red this morning. Asia ex-Japan CDS spreads widened 1.1bp.

New Bond Issues

- China Orient Asset Management $ 5Y at T+180bp area

- Krakatau Posco $ 3Y/5Y at T+200/220bp area

Lloyds raised $1bn via a 6NC5 bond at a yield of 5.721%, 23bp inside initial guidance of T+130bp area. The senior unsecured notes are rated A3/BBB+/A. Proceeds will be used for general corporate purposes.

Bank of Nova Scotia raised $2.25bn via a four-trancher.

The senior unsecured bail-in notes are rated A2/A-/AA-. Proceeds will be used for general corporate purposes.

BBVA raised €1.75bn via a two-part deal. It raised €1bn via a 3Y FRN at 3m Euribor+45bp vs. initial guidance of 3m Euribor+70/75bp area. It also raised €750mn via a 6Y bond at a yield of 3.696%, 25bp inside initial guidance of MS+100bp area. The senior preferred notes are rated A3/A/A-. Proceeds will be used for general corporate purposes.

Gulf International Bank raised $500mn via a 5Y bond at a yield of 5.931%, 20bp inside initial guidance of T+150bp area. The senior unsecured notes are rated A3/A- (Moody’s/Fitch).

New Bonds Pipeline

- Continuum Green Energy India hires for $ green bond

- Mashreqbank hires for $ PerpNC5.5 bond

- AIIB hires for $ 2.5Y Digitally Native Note bond

- Paratus Energy Services hires for $ 5Y bond

Rating Changes

- Fitch Upgrades Sabadell to ‘BBB’; Outlook Stable

- Moody’s Ratings has upgraded ASB to Aa3, outlook stable

- India Outlook Revised To Positive On Robust Growth And Rising Quality Of Government Spend; ‘BBB-/A-3’ Ratings Affirmed

- Export-Import Bank of India, IRFC Rating Outlook Revised To Positive Following Sovereign Action; Ratings Affirmed

- Outlook On Indian Govt-Owned NTPC, ONGC, And Power Grid Revised To Positive From Stable; Ratings Affirmed

- Outlook On Six Indian Banks Revised To Positive On Sovereign Action; Ratings Affirmed; ICICI, Axis Bank SACP Revised Up

- Rakuten Group Outlook Revised Up To Stable On Liquidity Improvement; ‘BB’ Rating Affirmed

Term of the Day

Digital Bonds

Digital bonds area a new type of bond issuance that aims to revolutionize traditional bond issuances by leveraging blockchain or Distributed Ledger Technology (DLT). The use of blockchain allows for faster settlement of bond trades among other benefits. Benefits include reducing the cost and time of issuance, distribution and settlement of bonds, and enhancing the security and transparency of transactions.

Talking Heads

On Foreign Funds Returning to Indian Bonds as JPMorgan Inclusion Nears

Barclays Plc strategists including Mitul Kotecha

“Favorable supply and demand dynamics, proactive liquidity management, moderating inflation, and a stable currency bode well for a sustained decline in yields”

On US Banks’ Paper Losses on Some Securities Rose – FDIC

Unrealized losses across the sector on available-for-sale and held-to-maturity securities increased by $39bn to $517bn in Q1… ninth straight quarter of “unusually high unrealized losses”… asset quality metrics “remained generally favorable.”

On Trump’s Tariff Threat Set to Derail Rate Cuts – Deutsche Bank

“Such a shift could counteract at least some of the very positive supply dynamics that are currently allowing strong growth to coincide with disinflation… we see trade policies as possibly adding another reason to keep the Fed on hold into 2025”

Top Gainers & Losers- 30-May-24*

Go back to Latest bond Market News

Related Posts: