This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Rise as PPI Shows Signs of Slowdown in Acceleration

February 14, 2025

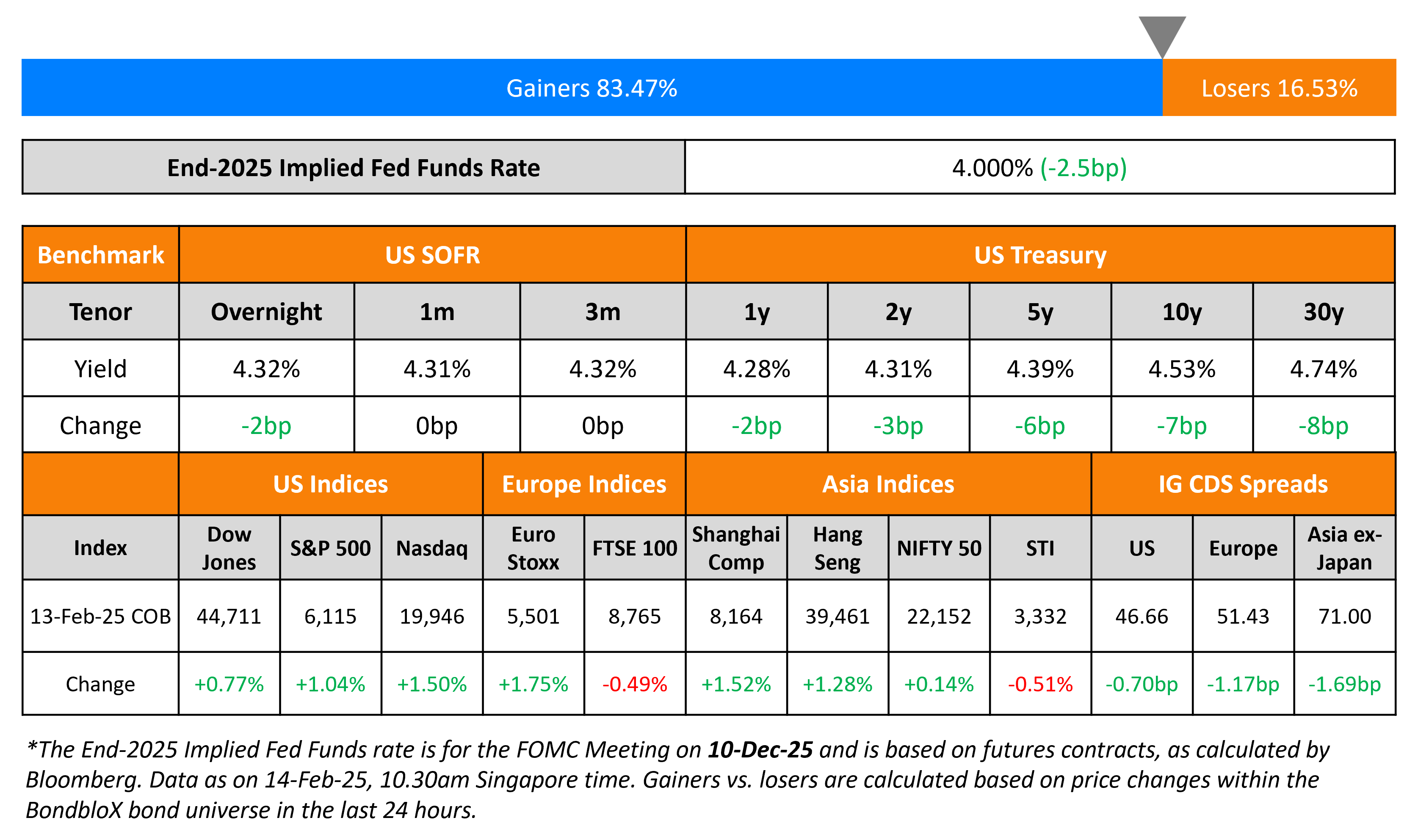

US Treasury yields eased on Thursday, paring back the move seen a day prior to it. The 5Y and 10Y yields fell by 6-7bp. US PPI for January came-in at 0.4% MoM, easing from the prior month’s 0.5% reading. The YoY reading held steady at 3.5%. The Core PPI print came-in at 0.3% MoM, easing from the prior month’s 0.4% reading. The YoY print came-in at 3.6% vs. the prior month’s reading of 3.7%.

US equity markets saw the S&P and Nasdaq end higher by 1% and 1.5% respectively. Looking at credit markets, US IG and HY CDS spreads were 0.7bp and 4bp tighter respectively. European equity markets ended mixed. The iTraxx Main and and Crossover CDS spreads tightened by 1.2bp and 4bp respectively. Asian equity markets have opened mixed. Asia ex-Japan CDS spreads were tighter by 1.7bp.

New Bond Issues

Credit Agricole raised €1.5bn via a PerpNC10 AT1 bond at a yield of 5.875%, 50bp inside initial guidance of 6.375% area. The junior subordinated note is rated BBB-/BBB (S&P/Fitch). If not called before 23 March 2035, the coupon will reset to the 5Y MS+363.6bp. A trigger event will occur if at any time, (a) Crédit Agricole S.A. Group’s CET1 ratio falls or remains below 5.125%, or (b) Crédit Agricole Group’s CET1 ratio falls or remains below 7.0%.

China Greentown raised $350mn via a 3NC2 bond at a yield of 8.45%, 40bp inside initial guidance of 8.85% area. The senior unsecured note is rated B1. Proceeds will be used to refinance existing debt, including, funding its concurrent tender offer.

New Bonds Pipeline

- Emirates NBD hires for $ PerpNC6 bond

- Mongolia hires for $ bond

Rating Changes

-

Fitch Downgrades VF Ukraine to ‘RD’ on DDE; Upgrades to ‘CCC’ on Completion

-

Moody’s Ratings downgrades Orsted’s ratings to Baa2; stable outlook

-

Banca Popolare di Sondrio Outlook Revised To Positive Following BPER Banca Offer; Ratings On Both Banks Affirmed

-

CEC Entertainment LLC Ratings Placed On CreditWatch Negative Due To Approaching Maturity

-

JAB Holding ‘BBB+’ Ratings Placed On Watch Neg On Acquisition Of U.S. Insurance Prosperity Life Group

Term of the Day: Reverse-Yankee Bond

Reverse-Yankee Bond is a bond issued by a US company outside of the US and denominated in a currency other than USD. For example, a US issuer raising debt in Europe denominated in EUR would be considered to be issuing a reverse-yankee bond. In comparison, Yankee Bonds are a type of Eurobond issued and traded in the US and are denominated in USD. Thus, if a foreign non-US based company issues a USD bond which is traded in the US, the bond is considered a Yankee Bond.

America’s Ford Motor raised €750mn via a senior unsecured bond due 2030 at a yield of 4.071%.

Talking Heads

On the effect of Philippine Central Bank suspending its easing cycle on Philippine Peso (PHP)

Christopher Wong, OCBC

“[PHP is] less sensitive to trade friction, given its more-domestic nature, and relative to Asian peers, is less open (to) trade…BSP’s surprise hold, alongside general risk-on mood is constructive for PHP to extend gains”

On skepticism about European stocks after $1tn 2025 rally

Enguerrand Artaz, La Financière de l’Echiquier

“…betting that Europe will outperform the US over the year…a bit of a stretch”

Christopher Dembik, Pictet AM

“Even if the (Russo-Ukrainian) war ended, I’m not sure that a relief rally would last more than a few weeks”

On the safety of US treasuries

Mariya Entina, Doubleline

“Growing fiscal challenges raise serious concerns about the creditworthiness of [the US Government]…in contrast, top-rated corporate credits – like Microsoft – are backed by ample cash-generating assets and significant corporate treasury reserves”

On the flaws of private credit valuations after bankruptcy of Zips Car Wash

Ron Kahn, Lincoln International

“As you get more into distressed, different lenders may get different information and there will be differences in perception of the company’s value…It is not uncommon for Lender A to say this company is garbage, while the other lender says the firm will come back”

Philip Brendel, Bloomberg Intelligence

“I don’t have a lot of confidence that [private credit valuations] are going to be accurate, simply because there is no active trading. That’s really how you get prices”

Top Gainers and Losers- 14-February-25*

Go back to Latest bond Market News

Related Posts: