This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Rally; UBS, ING, San Miguel Launch $ Perps

September 5, 2024

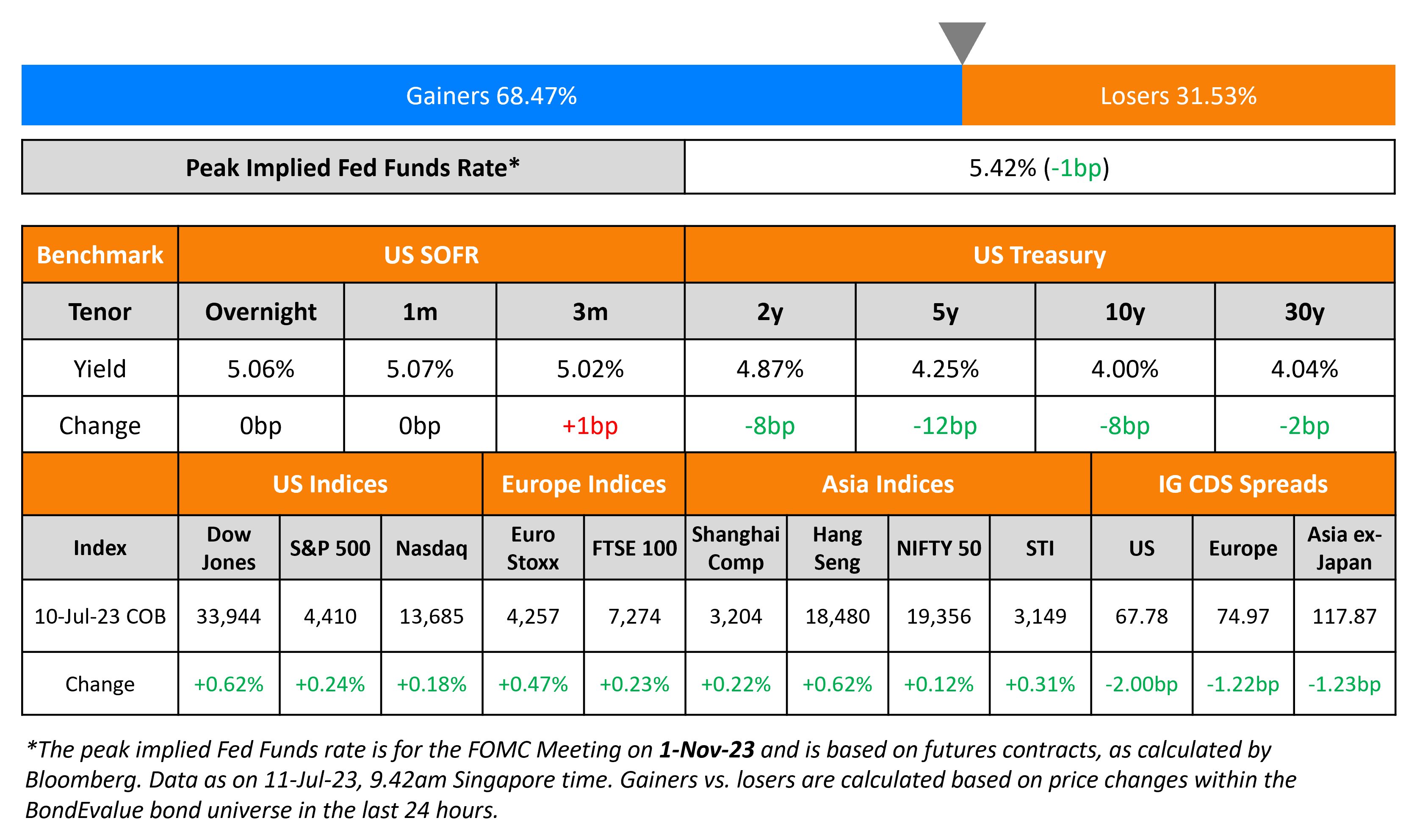

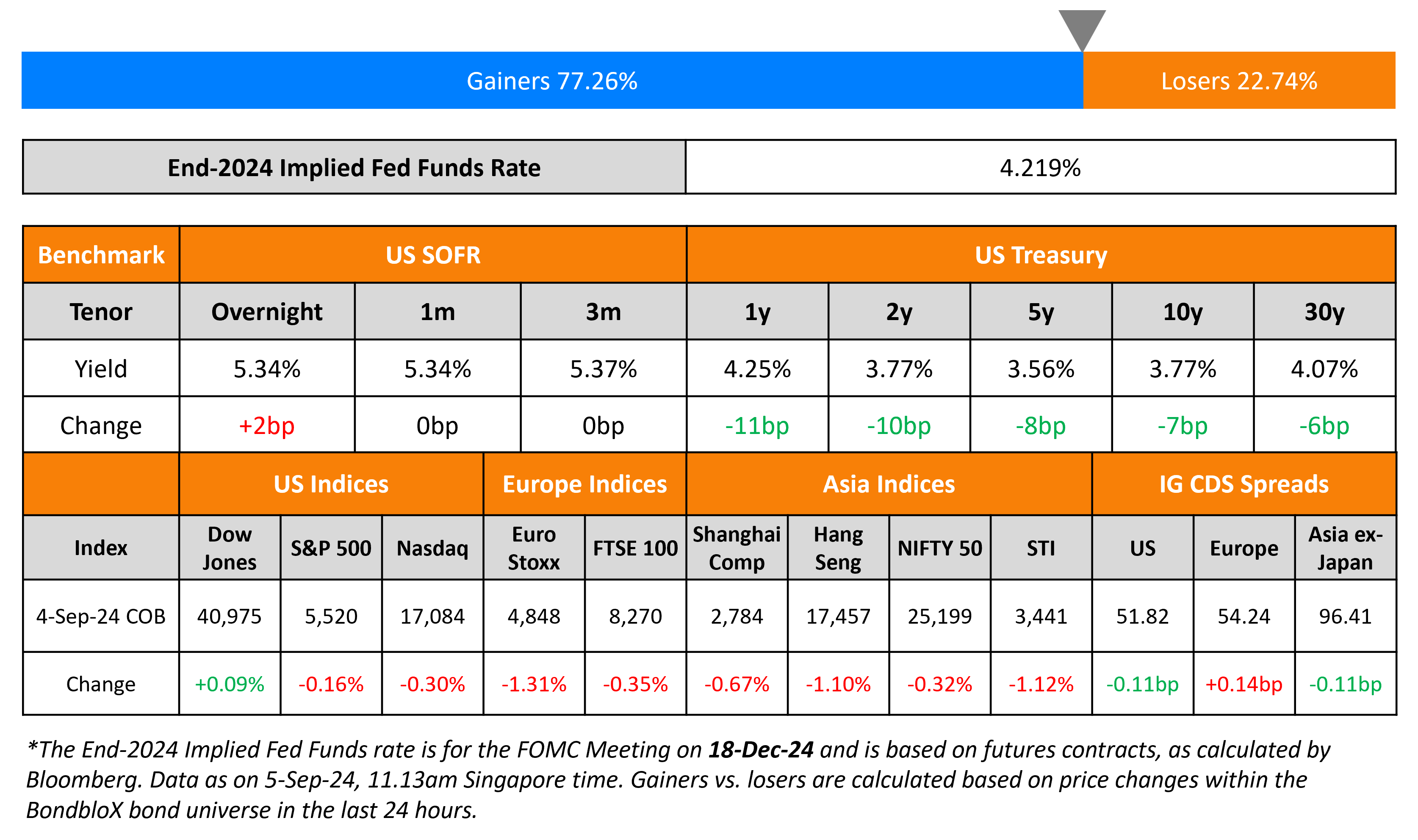

US Treasury yields fell by 7-10bp across the curve. US JOLTS Job Openings rose by only 7.67mn as compared to expectations of 8.1mn, as concerns about the labor market yet again resurfaced. Looking at the Fed Funds Futures, markets are pricing-in a little more than 100bp in Fed rate cuts by end-2024. US IG CDS spreads tightened by 0.1bp and HY CDS spreads were flat. Looking at US equity indices, the S&P and Nasdaq were down by 0.2% and 0.3% respectively.

European equity markets ended lower too. Looking at Europe’s CDS spreads, the iTraxx Main spreads were wider by 0.1bp while Crossover spreads widened by 0.9bp. Asian equity indices have opened almost flat this morning. Asia ex-Japan CDS spreads tightened by 0.1bp.

New Bond Issues

- San Miguel Global Power $ PerpNC5 at 9% area

- UBS $ PerpNC5.5 at 7.5% area

- ING Groep $ PerpNC10 AT1 at 7.875% area

- KHFC $ 5Y at T+85bp area

Canara Bank raised $300mn via a 5Y bond at a yield of 4.896%, 25bp inside initial guidance of 6.50% area. The senior unsecured notes are rated Baa3/BBB-. Net proceeds will be used by its IFSC Banking Unit towards general corporate purposes or any other offshore branch to meet funding requirements.

Deutsche Bank NY raised $2.5bn via a two-part senior non-preferred deal. It raised $1.25bn via a 6NC5 bond at a yield of 4.999%, 30bp inside initial guidance of T+130bp area. It also raised $1.25bn via a 11NC10 bond at a yield of 5.403%, 30bp initial guidance of T+195bp area. The senior unsecured bonds are rated Baa1/BBB/A-. Proceeds will be used for general corporate purposes.

Uber raised $4bn via a three-part offering. It raised:

- $1.25bn via a long 5Y bond at a yield of 4.308%, 30bp inside initial guidance of T+105bp area. The new notes are priced at a new issue premium of 20bp over its existing 4.346% 2026s that yield 4.93%.

- $1.5bn via a 10Y bond at a yield of 4.809%, 30bp inside initial guidance of T+135bp area.

- $1.25bn via a 30Y bond at a yield of 5.363%, 30bp inside initial guidance of T+160bp area. The new notes are priced at a new issue premium of ~27bp over its existing 6.375% 2029s that yield 5.03%.

The senior unsecured notes are rated Baa2/BBB-/BBB. A portion of the net proceeds will be used to fully repay outstanding loans under its term loan agreement. Remaining proceeds will be used to redeem its outstanding 8% 2026s in November, and for general corporate purposes.

Bank of Sharjah raised $500mn via 5Y bond at a yield of 5.477%, 25bp inside initial guidance of 6.3% area. The senior unsecured notes are rated BBB+.

Credit Agricole raised $1.5bn via a two-part senior non-preferred deal. It raised $1bn via a 4NC3 bond at a yield of 4.631%, 30bp inside initial guidance of T+130bp area. It also raised $500mn via a 4NC3 FRN at SOFR+121bp vs. initial guidance of SOFR equivalent area. The senior unsecured bonds are rated A3/A-/A+.

Santander UK Group Holdings raised $1bn via a 6NC5 bond at a yield of 4.858%, 25bp inside initial guidance of T+155bp area. The senior unsecured notes are rated Baa1/BBB/A. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Vedanta hires for $ 5NC2/7NC3 bond

- Al Ahli Bank of Kuwait hires for $ PerpNC5.5 bond

Rating Changes

- Fitch Upgrades Piraeus Bank to ‘BB’; Outlook Positive

- Greece-Based Alpha Bank Rating Raised To ‘BB+’ On Improved Capitalization Post AT1 Issuance; Outlook Stable

- Fitch Upgrades National Bank of Greece to ‘BB+’; Outlook Positive

- Lumen Technologies Inc. Downgraded To ‘CC’ On Proposed Debt Exchange; Outlook Revised To Negative

- Fitch Downgrades West China Cement’s Ratings to ‘B-‘; on Rating Watch Negative

Term of the Day

CET1 Ratio

Common Equity Tier 1 (CET1) Ratio is a financial ratio applicable to banks to measure its core capital as against its Risk Weighted Assets (RWA). Core Capital (CET1 Capital) includes common equity and stock surplus (share premium), retained earnings, statutory reserves, other disclosed free reserves, capital reserves representing surplus arising out of sale proceeds of assets and balance in income statement at the end of the previous financial year. RWAs are calculated to measure the minimum regulatory capital required to be held by banks to maintain solvency. The calculation methodology is such that the riskier the asset, the higher the RWAs and the greater the amount of regulatory capital required. CET1 capital must be at least 4.5% of RWAs according to Basel III.

Contingent Convertible (CoCos) bonds/AT1s commonly have triggers based on CET1 ratios – if the bank’s CET1 ratio falls below a certain threshold, the bonds would convert into equity.

Talking Heads

On warning against keeping restrictive policy stance for too long – Fed’s Raphael Bostic

“We must not maintain a restrictive policy stance for too long… I do not sense a looming crash or panic among business contacts. However, the data and our grassroots feedback describe an economy and labor market losing momentum”

On US Bond Volatility to Eclipse Europe as Economy Cools

Marco Meijer, Mediolanum International

ECB is “pretty predictable… Fed policymakers will either lower rates by half a point or open the door for bigger cuts at subsequent meetings”

Michael Brown, Pepperstone

“Such data-dependence can and does induce higher volatility… Particularly at turning points in the policy cycle, such as (now)”

On Says Interest Rates Can Be Cut at Next Meeting – ECB’s Kazaks

“Next week we have the ECB’s council meeting, and to to my mind — looking at the data that we have at available at the moment — we can take the next step in the direction of decreasing rates”

Top Gainers & Losers-05-September-24*

Go back to Latest bond Market News

Related Posts: