This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Rally on Softer NFP, Wage Growth, ISM Services

May 6, 2024

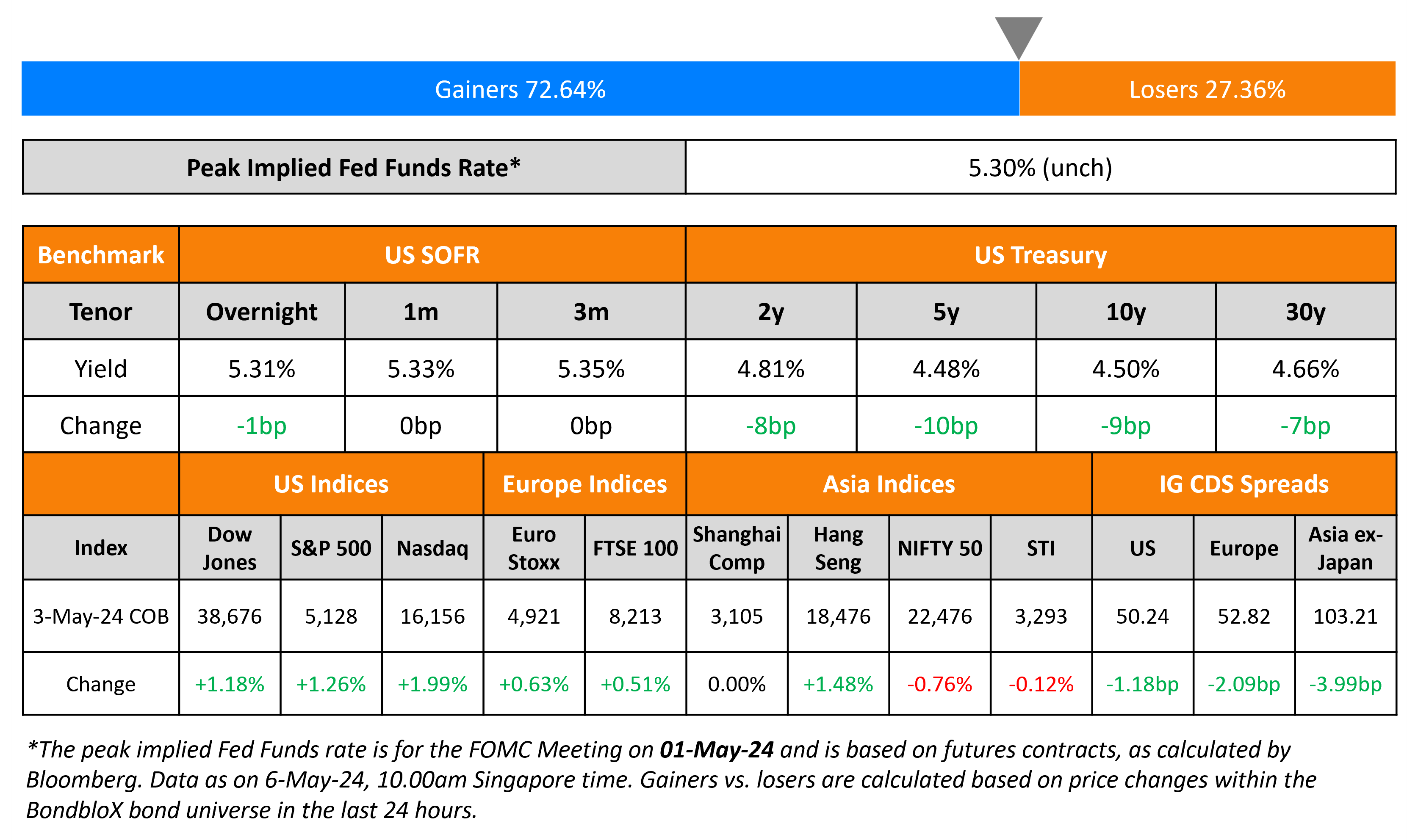

US Treasury yields dropped by 8-10bp across the curve after softer than expected data. US Non-Farm Payrolls (NFP) disappointed with job additions of 175k in April vs. expectations of 240k. Average Hourly Earnings rose 3.9%, lower than the expected 4.0%, while the unemployment rate rose slightly to 3.9% vs. expectations of 3.8%. The rise in hourly earnings was at its slowest pace since July 2021. Later, the ISM Services Index also disappointed expectations of 52, by falling into contractionary territory at 49.4. This was the first time it has gone below the 50-mark since December 2022. Looking at the sub-components, the Prices Paid Index jumped to 59.2 but the Employment Index fell to 45.9.

Following the softer than expected data, CME probabilities indicate that markets are now pricing-in 50bp of Fed rate cuts by end-2024. Separately, New York Fed President John Williams said that the 2% target for inflation was key to achieving price stability and economic prosperity. Also, Chicago Fed President Austan Goolsbee said that each members’ economic expectations should be added to the Fed’s dot plots. S&P and Nasdaq ended higher by 1.3% and 2% respectively. US IG CDS spreads tightened 1.2bp and HY spreads were 6.3bp tighter.

European equity markets were broadly higher. The iTraxx main CDS spreads tightened 2.1bp and the crossover CDS spreads tightened 10.4bp. Asian equity indices have opened mixed this morning. Asia ex-Japan CDS spreads tightened 4bp.

New Bond Issues

- Thomson Medical Group S$ 3Y at 5.6% area

New Bonds Pipeline

- Korea Expressway hires for $ 3Y/5Y bond

Rating Changes

- Turkiye Upgraded To ‘B+’ On Economic Rebalancing; Outlook Positive

- Fitch Revises Egypt’s Outlook to Positive; Affirms at ‘B-‘

- Fitch Revises Nigeria’s Outlook to Positive; Affirms at ‘B-‘

- Intelsat S.A. Ratings Placed On CreditWatch Positive On Proposed Acquisition By SES

- Altice USA Inc. ‘B-‘ Rating On CreditWatch Negative On Elevated Competition And Weak Financial Results

Term of the Day

Non-Farm Payrolls

Non-Farm Payrolls (NFP) is a key data point that is released by the US Bureau of Labor Statistics (BLS) usually on the first Friday of every month. NFP measures net changes in employment excluding agricultural, local government, private household and not-for-profit sectors over the past month and is a key economic indicator in the United States. A high reading of the NFP is considered a positive sign for the US economy while a negative reading is considered a sign of a slowdown in the US jobs market. The NFP indicator is closely watched by traders, especially as it is one of the first monthly economic indicators to be released, and because of the direct relationship between job creation and economic growth.

Talking Heads

On EM Optimism Dashed by Fed as Currencies, Bonds Sink

Phoenix Kalen, head of EM research at SocGen

“This year has disappointed the expectations early on regarding the claim of victory over global inflation. Inflation has proven to be a much tougher adversary for central banks to tackle… expecting some version of stagflation to materialize, with attendant adverse impact on EM currencies and short-dated EM rates”

Valentina Chen, co-head of EM debt in London

“US rate repricing narrows the real rate differentials between EM and the US. This makes the asset class less attractive from a carry perspective”

On Warning of a Credit Market ‘Reckoning’ – TCW Investment Chief Whalen

“We think the pricing is totally inconsistent with the potential risks… at some point probably this calendar year you’re going to get a reckoning… We’re seeing slowing all over the economy… History would suggest that by the time the Fed actually starts cutting, the economy’s on the downward trend”

On Fed-Obsessed Traders Needing the Economy to Get its Story Straight

Mohamed El-Erian, president of Queens’ College

“There is a concern that the Fed is overly data-dependent. And what does that do? It amplifies the volatility in the market.”

Lindsay Rosner, head of multi-sector fixed income at GSAM

“The biggest moment this week was Powell noting hikes are ‘unlikely’. That coupled with the soft landing print this morning means there is great opportunity in yields”

Top Gainers & Losers- 06-May-24*

Go back to Latest bond Market News

Related Posts: