This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Rally on Softer CPI as Rate Cuts Get Priced Further

July 12, 2024

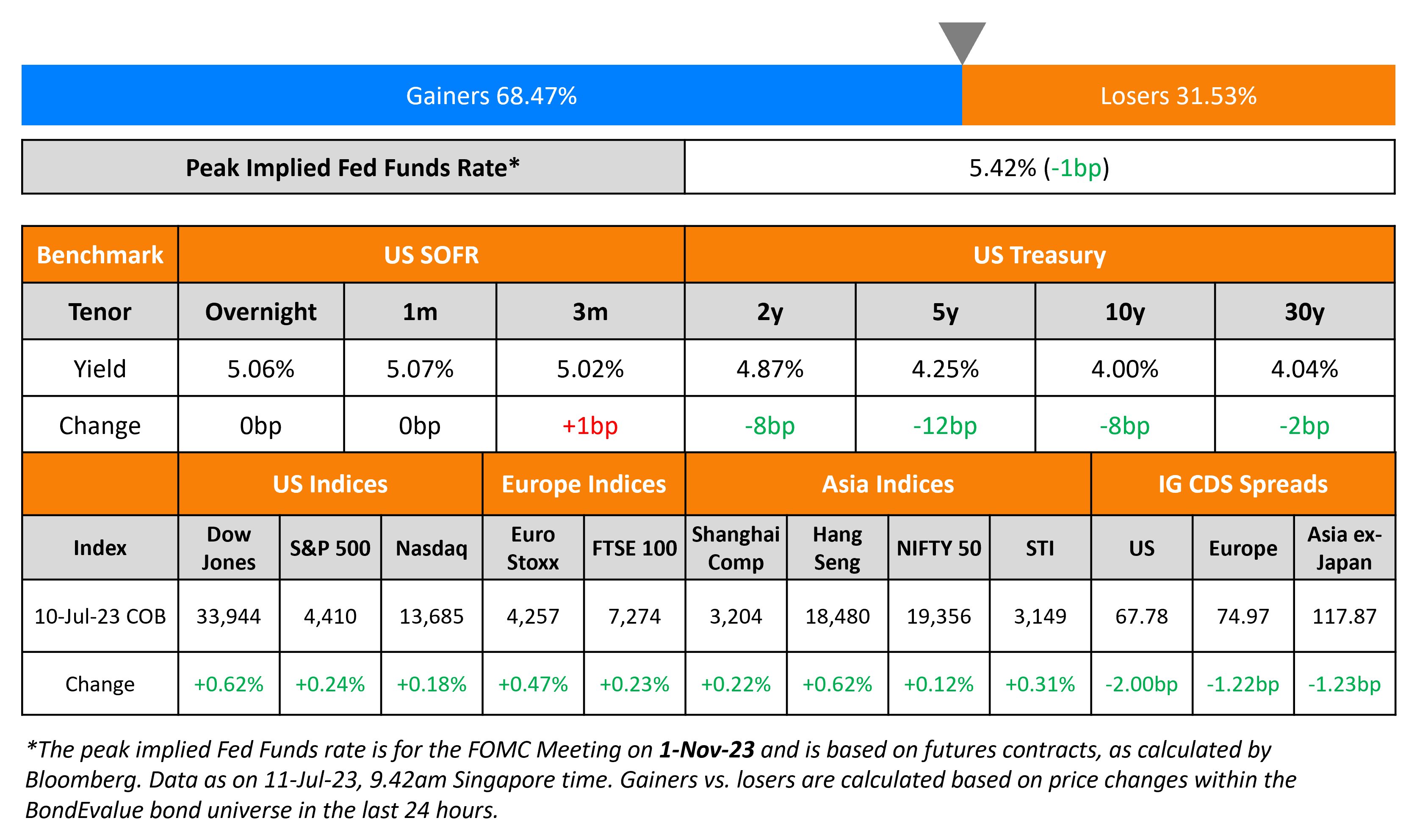

US Treasury yields fell on Thursday, with the 2s10s curve bull steepening by 3bp following the soft inflation report. The 2Y yield fell 9bp and the 10Y was down 6bp after US CPI YoY for June rose 3.0%, softer than expectations of 3.1% and the prior 3.3% print. Core CPI YoY rose 3.3%, again softer than expectations and the prior print of 3.4%. On a MoM basis, the CPI registered its first drop in four years, down by 0.1%, while Core CPI gained 0.1%. Both 2Y and 10Y Treasury yields are at their lowest levels since March. Over 78% of dollar bonds in our universe rallied, helped by the move lower in Treasury yields as seen in the table above.

On the back of softer inflation, San Francisco Fed President Mary Daly indicated it was likely that “some policy adjustment will be warranted”. Chicago Fed President Austan Goolsbee said the latest data gave proof that inflation is on a path towards 2%. While markets already priced-in a 25bp Fed rate cut in September and December prior to the inflation release, they are now penciling a possible third rate cut in November, as per the Implied Fed Funds Rate at year end. Looking at equity markets, S&P and Nasdaq ended lower by 0.9% and 2.0% respectively, with Nvidia down 5.6% and Meta down 4.1%. US IG spreads were 0.3bp tighter and HY CDS spreads were tighter by 3.3bp.

European equity indices ended higher. In credit markets, the iTraxx Main and Crossover spreads were tighter by 0.4bp and 0.5bp respectively. Asian equity indices have opened mixed this morning. Asia ex-Japan CDS spreads were 1.2bp tighter.

New Bond Issues

New Bonds Pipeline

- Piramal Capital hires for $ 3.5Y bond

- Mirae Asset hires for $ 3Y/3.5Y bond

- Resolution Life hires for $ 7Y T2 bond

Rating Changes

- AVIC International Upgraded To ‘BBB’ On Business Recovery And Increasing Financial Flexibility; Outlook Stable

- Moody’s Ratings upgrades Bank of Cyprus’ long-term deposit ratings to Baa1, from Baa3, changes outlook to stable

- Fitch Downgrades Lippo Karawaci to ‘RD’ on DDE; Upgrades to ‘CCC+’ on Improved Liquidity

- Fitch Downgrades Liquid Telecom to ‘CCC+’

Term of the Day

Bull Steepening

Bull Steepening refers to a change in the yield curve where short-end rates move down faster than long-end rates. This not only has a steepening effect on the entire yield curve but also has a net effect of interest rates moving lower and bond prices moving higher.

Similar terms include Bear Steepening, Bull Flattening and Bear Flattening. If the yield curve moved lower and bond prices moved higher, it is considered a bull move, while the opposite is a bear move. If the effect of the move is to steepen the curve, it would either be a Bear Steepening or a Bull Steepening. If the effect was to flatten the curve, it would be a Bear Flattening or Bull Flattening.

Talking Heads

On IMF sees US Fed in position to cut interest rates later this year

IMF spokesperson Julie Kozack

“We do support the Fed’s data-dependent and cautious approach to monetary policy. We also do expect that the Fed will be in a position to reduce rates later this year, and that assessment continues to hold?

On US economy looks back on track to 2% inflation – Chicago Fed President Austan Goolsbee

“My view is, this is what the path to 2% looks like… By not moving, we are tightening … and it’s starting from a level of restrictiveness that is as high as it’s been in decades”… “excellent” news and along with May’s reading suggested stronger-than-expected inflation prints in January were just a “bump in the road”

On US Treasury Countering Misconceptions Over Debt-Sales Strategy

“We issue securities in a regular and predictable fashion as part of our strategy to borrow at the lowest cost over time… Regular and predictable issuance doesn’t mean that Treasury steadfastly ‘stays the course’ even when presented with new information and situations”

On Forecasting Earlier Start to Fed Rate Cuts After CPI Data – JPMorgan

“We now think this paves the way for a first cut in September (previously November), followed by quarterly cuts thereafter”

Top Gainers & Losers- 12-July-24*

Go back to Latest bond Market News

Related Posts: