This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Rally on Softening Data

May 16, 2024

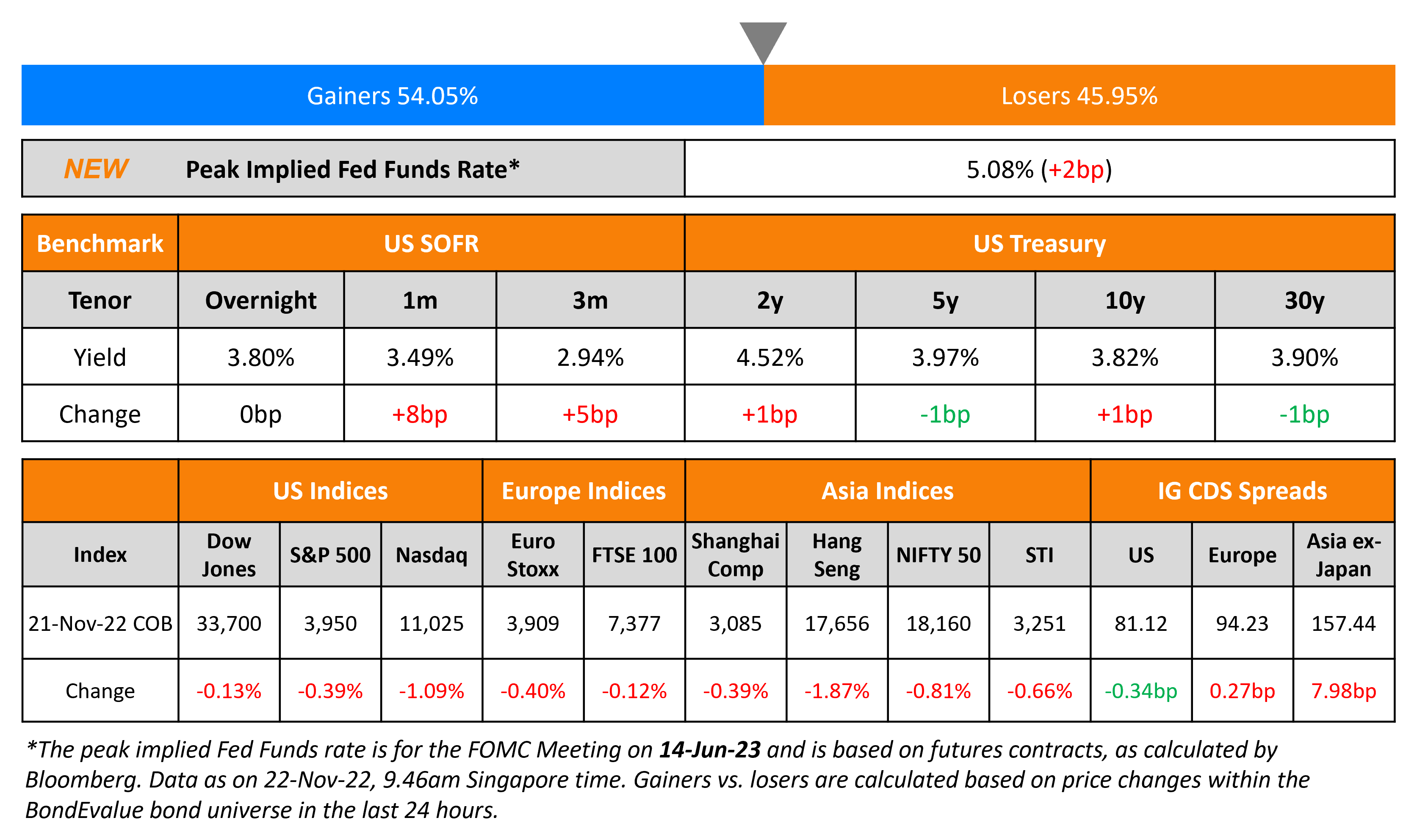

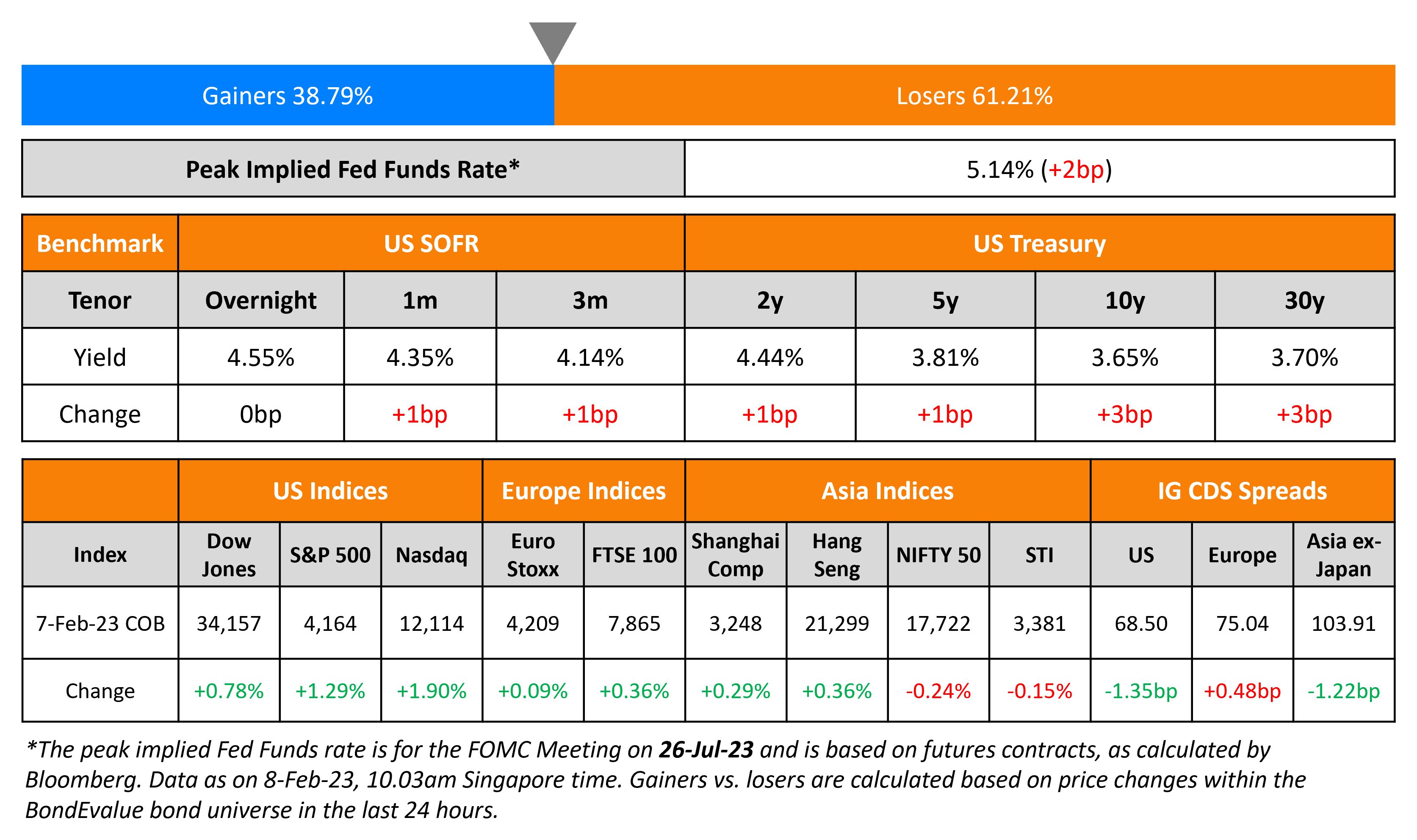

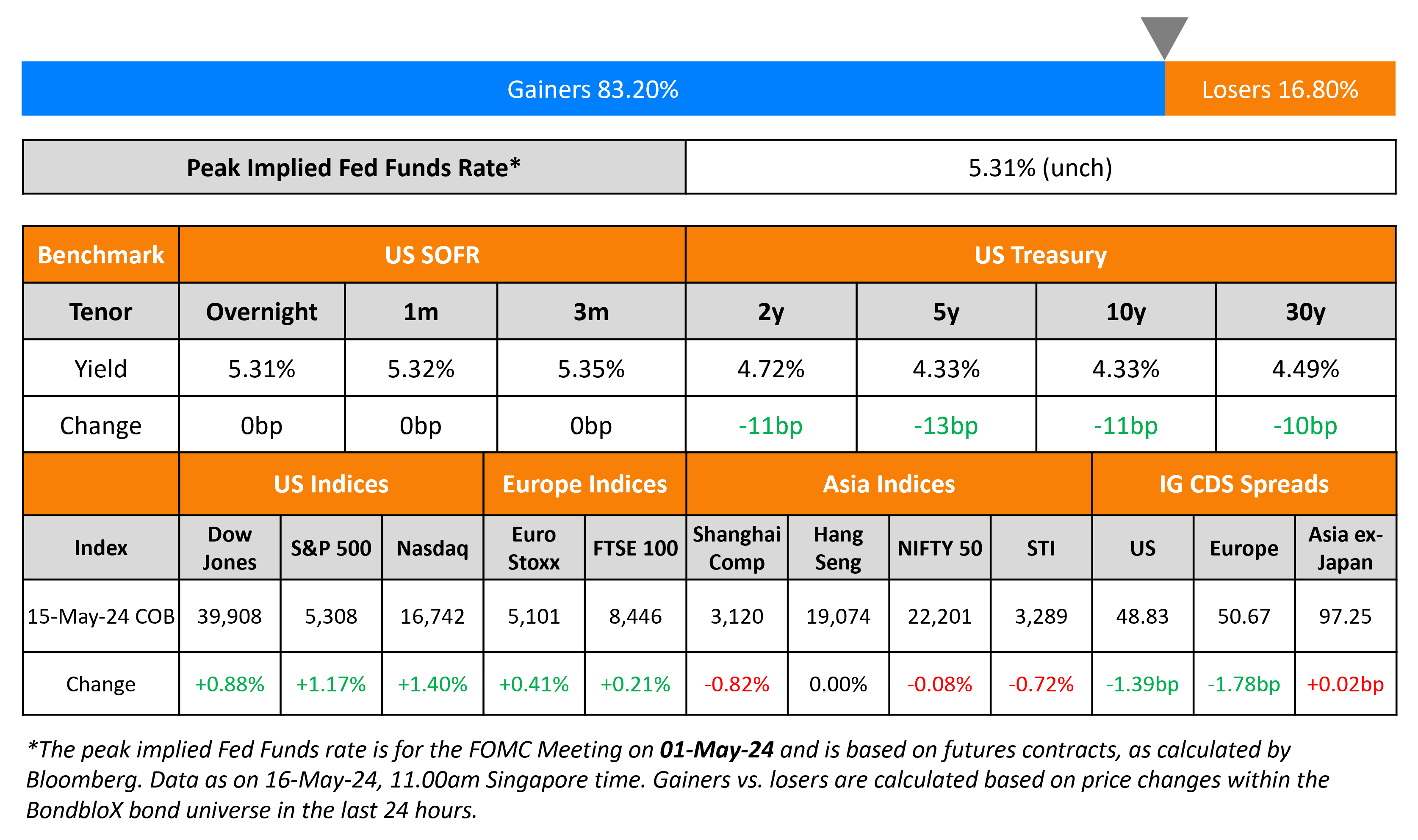

US Treasuries rallied across the curve with yields falling by over 10bp on Wednesday, after economic data showed a softening in inflation and growth. US headline CPI came at 3.4%, in-line with expectations, but registering a drop from the prior 3.5% reading. The Core CPI reading came at 3.6%, also in-line with expectations, but registering a drop from the prior 3.8% reading. Headline Retail Sales saw no growth in April vs. expectations of a 0.4% growth, while March’s numbers were revised lower from 0.7% to 0.6%. Core Retail Sales saw a deceleration, coming-in at -0.1% in April vs. expectations of a 0.2% growth, while March’s numbers were revised lower from 1.0% to 0.7%. S&P and Nasdaq were up 1.2-1.4%. US IG CDS spreads tightened 1.4bp and HY spreads were 9bp tighter.

European equity markets were higher too. Europe’s iTraxx main CDS spreads were 1.8bp tighter and crossover spreads were 9.3bp tighter. Asian equity indices have open higher this morning. Asia ex-Japan CDS spreads were flat.

Only 1 Day To Go: Click here to reserve your seat

.png)

New Bond Issues

Goldman Sachs raised $3.5bn via a two-trancher. It raised $2.65bn via a 3NC2 bond at a yield of 5.414%, 22bp inside initial guidance of of T+90bp area. It raised $850mn via a 3NC2 FRN at SOFR+75bp vs. inside initial guidance of SOFR equivalent area. The senior unsecured notes are rated A1/A+/A+. Proceeds will be used for general corporate purposes. The new 3NC2 bond was priced at a new issue premium of 29.4bp over its existing 3.85% bonds due January 2027 (callable in January 2026) that currently yield 5.12%.

BP Capital Markets raised $2.5bn via a three-trancher. It raised:

- $750mn via a 3.5Y bond at a yield of 5.017%, 15bp inside initial guidance of T+65bp area

- $750mn via a 5.5Y bond at a yield of 4.975%, 17.5bp inside initial guidance of T+80bp area. The new bonds were priced at a new issue premium of 8bp over its existing 4.699% 2029s that currently yield 4.895%.

- $1bn via a 10Y bond at a yield of 5.227%, 17.5bp inside initial guidance of T+105bp area. The new bonds were priced at a new issue premium of ~7bp over its existing 4.989% 2034s that currently yield 5.16%.

The senior unsecured bonds are rated A1/A-/A+. Proceeds will be used for general corporate purposes, including working capital and the repayment of existing debt of BP and its subsidiaries.

HDB raised S$1.1bn via a 7Y bond at a yield of 3.46%. The senior unsecured notes are rated AAA. Proceeds will be used to finance development programs of HDB and its working capital requirements, as well as to refinance existing borrowings.

New Bond Pipeline

- SMIC SG Holdings hires for $ bond

Rating Changes

-

Moody’s Ratings upgrades Banca Monte dei Paschi di Siena S.p.A.’s deposit and senior unsecured ratings, outlook changed to stable

- Altice USA Inc. Downgraded To ‘CCC+’ On Capital Structure Sustainability Concerns; Outlook Negative

- Fitch Downgrades Shenzhen International to ‘BBB’; Outlook Stable

- Moody’s Ratings downgrades Vivo Energy to Ba1; Stable outlook

-

Fitch Revises Indofood CBP’s Outlook to Positive; Affirms at ‘BBB-‘

Term of the Day

New Issue Premium

A new issue premium refers to the incremental higher yield (yield premium) on an issuer’s newly issued bond over bonds by the same issuer with a similar maturity. A newly issued bond by an issuer typically offers a higher yield to its own comparable bond to entice investor demand in the security. Sometimes, if an issuer does not have a comparable bond with a similar maturity, but does have a yield curve (i.e., other bonds issued across different maturities), analysts can interpolate and arrive at an estimated yield for a hypothetical comparable. However, while new issue premiums are typically the case, it is not necessary that an issuer’s new bond would always have a new issue premium.

Talking Heads

On Treasuries Rally as US Data Reignites Bets on Fed Cuts This Year

Glen Capelo, managing director at Mischler Financial

“The implications of the CPI data is that it brings even a July Fed cut into play… all bullish for the front-end of the Treasury market.”

Tom Porcelli, chief US economist at PGIM Fixed Income

“People hear cuts, and I think that immediately conjures up images of the Fed getting aggressive… We think this is going to be a very modest reduction

On Global corporate defaults doubling from March to April – S&P

Global corporate debt defaults more than doubled in April from March to their highest monthly tally since October 2020… April saw 18 defaults globally, led by the 10 U.S. defaults worth $7.1bn… “Looming maturities, strained operations, and elevated refinancing costs were among the main reasons for the increase in bankruptcies”

Top Gainers & Losers- 16-May-24*

Go back to Latest bond Market News

Related Posts: