This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Move Higher on Tech Sell-Off

January 28, 2025

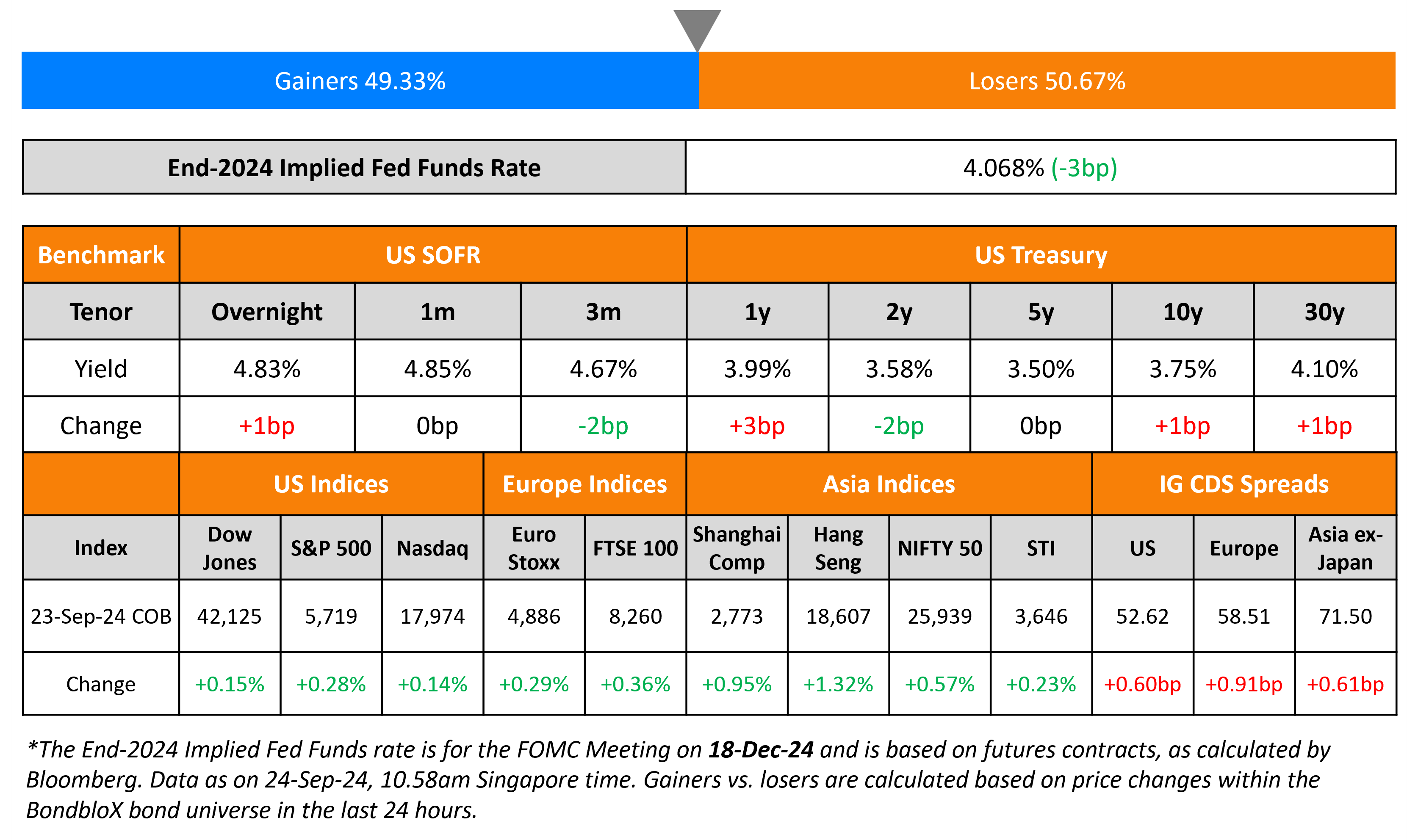

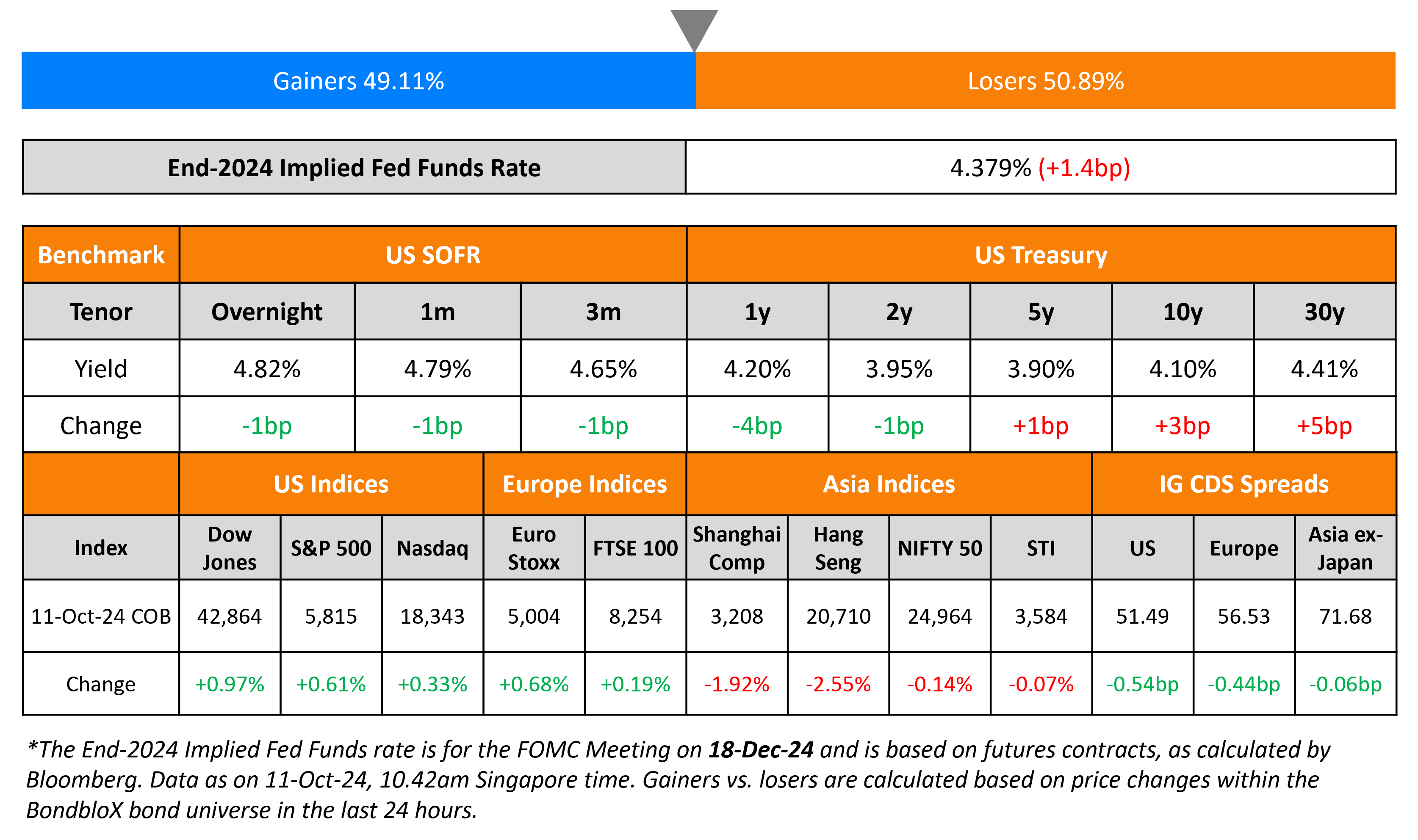

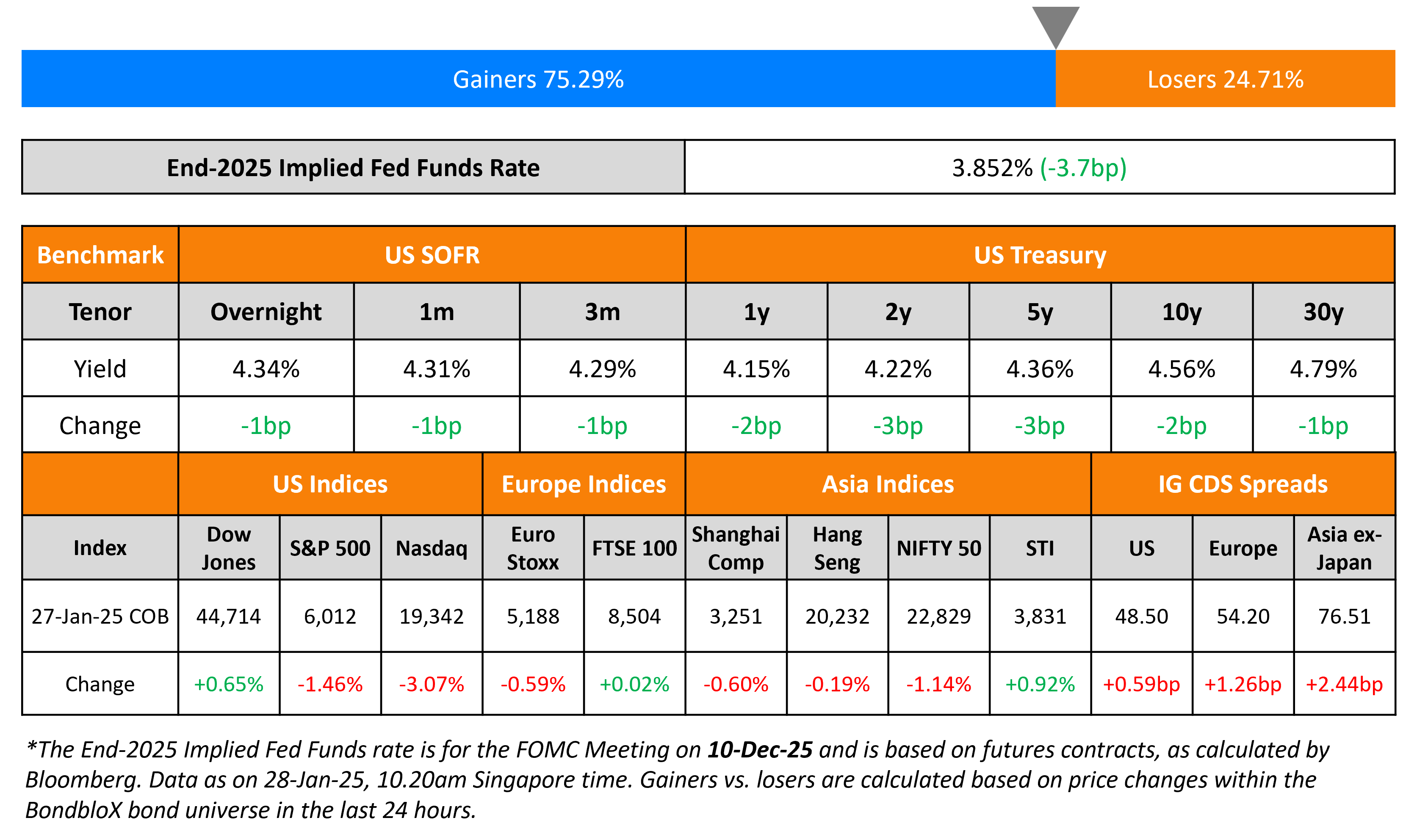

US Treasury yields moved lower across the curve by ~3bp. A broad flight-to-quality move on the back of a tech led equity sell-off saw a bid on Treasuries. US equity markets sold-off sharply, with the S&P down 1.5% while the Nasdaq fell by 3.1%. This was driven by news about Chinese start-up DeepSeek, that demonstrated a lower-cost AI model, leading to a correction across valuations in the US tech sector. Particularly, Nvidia’s shares fell 16.9%, dragging the Nasdaq lower. Following this, markets are now again pricing-in two rate cuts by the Fed this year, as per Fed Fund Futures – the first of which is expected in June and the second in December. Separately, the 5Y Treasury note auction saw solid demand, with a bid-to-cover ratio of 2.4x, akin to the previous month.

US IG and HY CDS spreads widened by 0.6bp and 3.7bp respectively. European equities ended mixed. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 1.3bp and 5.4bp respectively. Asian equities have opened mixed this morning. Asia ex-Japan CDS spreads were 2.4bp wider.

New Bond Issues

Mexico raised €2.4bn via a two-trancher. It raised €1.4bn via a long 8Y bond at a yield of 4.769%, 25bp inside initial guidance of MS+255bp area. It also raised €1bn via a long 12Y bond at a yield of 5.181%, 25bp inside initial guidance of MS+290bp area. The notes are rated Baa2/BBB/BBB-. Proceeds will be used for general budgetary purposes.

Rating Changes

-

Ecotone Upgraded To ‘B-‘ On Reduced Refinancing Risks; Outlook Stable

-

Moody’s Ratings changes Cleveland-Cliffs’ outlook to negative; affirms ratings

-

Moody’s Ratings takes actions on four Argentinean banks following sovereign upgrade

Term of the Day: Risk-Off

Risk-off is an indication of global market sentiment wherein investors switch out from risky assets (i.e. risk-off) into safer assets on the back of increased uncertainty. This can be due to geopolitical risk, poor economic data or a crisis. Most typically, during a risk-off environment, US Treasuries and gold tend to perform better as they are considered haven assets. On the other hand, risk-on indicates positive investor sentiment wherein investors switch into risky assets (i.e. risk-on) from safer assets on improved prospects of economic growth. This can be due to improved political environment, strong economic data, strong corporate earnings, or a recovery from a crisis.

Talking Heads

On Corporate Bonds ‘a Real Deal’ for Investors – Vanguard

“Yields are attractive compared with those observed since the 2008 global financial crisis. Relative to history, we are back to a more normal fixed income regime… Uneven economic environments can produce higher market volatility but also uncover new opportunities”

On US Yields Falling to Lowest This Year Amid Haven Bid on Tech Slump

Chris Diaz, Brown Advisory

“It’s the by-the-book, flight to quality to the Treasury market, as risky assets plummeted”

George Saravelos, Deutsche Bank

“The clearest analogy that comes to mind is the DotCom unwind of the 2000s… external shock forced a large sector-specific unwind of US tech valuations”

On EM investors eyeing frontier assets shielded from Trump’s tariff threats

Thierry Larose, Vontobel

“The frontier markets are likely to be more insulated than the others, because I don’t think that countries like Nigeria or Sri Lanka or Paraguay … will be a target anytime soon for this administration”

Nick Eisinger, Vanguard

“High yield has also done generally pretty well – it’s been doing well for a few months now. We still think those are interesting parts of the market.”

Magda Branet, AXA Investment Managers

“Mexico, Vietnam, Malaysia… will be more targeted”

Top Gainers and Losers- 28-January-25*

Go back to Latest bond Market News

Related Posts: