This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries March Higher on Softer PPI

August 14, 2024

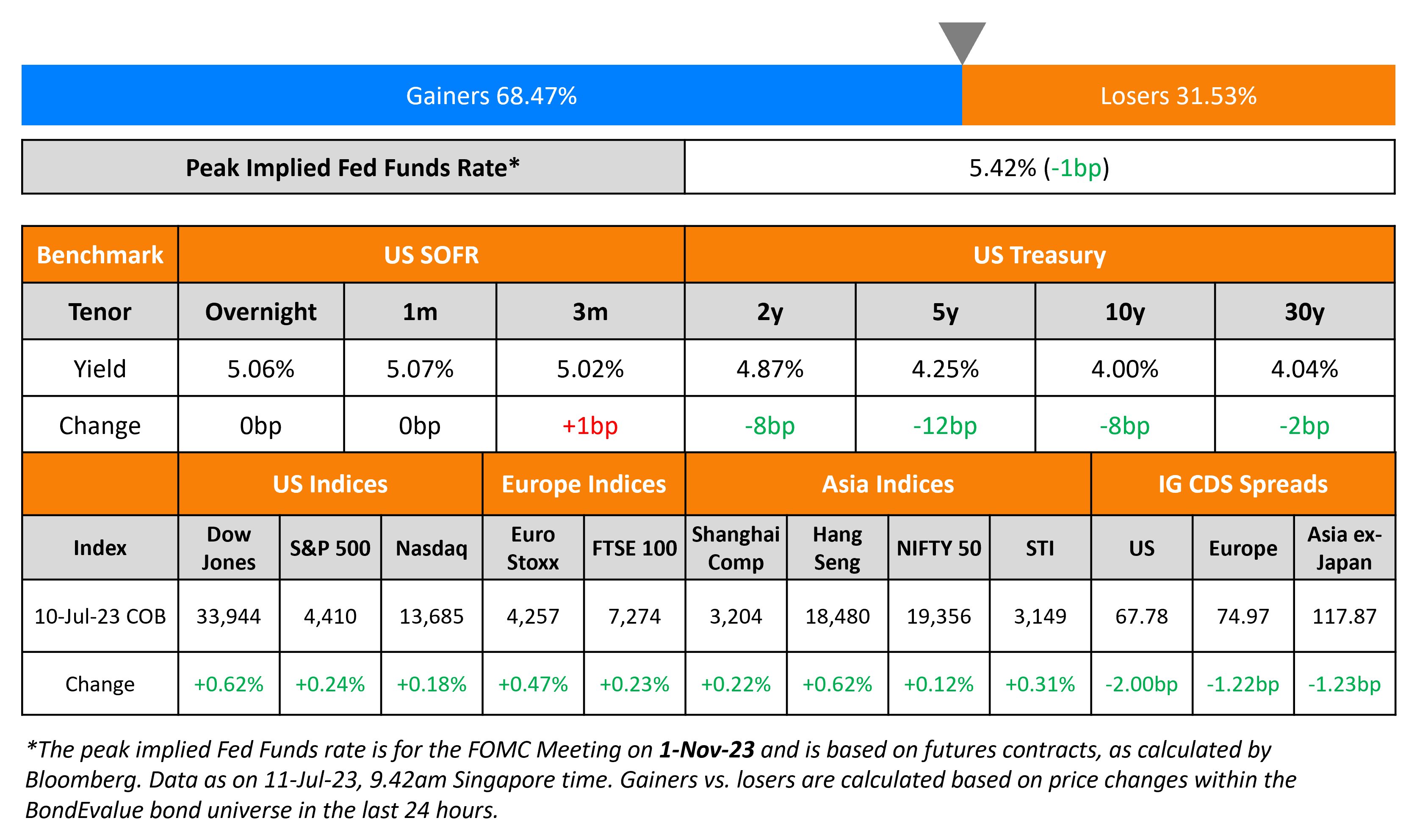

US Treasury yields fell again by 5-7bp across the curve. US PPI in July rose by 2.2% YoY, lower than the surveyed 2.3% and prior 2.6%. Core PPI rose by 2.4%, lower than the surveyed 2.6% and prior 3.0% reading. Markets now await the CPI and Core CPI prints later today that are expected at 3.0% and 3.2% respectively. Separately, Atlanta Fed President Raphael Bostic said that he was looking for “a little more data” before supporting rate cuts, noting that the Fed wants “to be absolutely sure” about it. He did note that he was encouraged by recent inflation numbers. Looking at US equities, S&P rose 1.7% and Nasdaq rallied by over 2.4%. US IG CDS spreads tightened by 1.9bp while HY CDS spreads tightened by 8.9bp.

European equity markets also ended higher. Looking at Europe’s CDS spreads, the iTraxx Main spreads widened 0.3bp while Crossover spreads were tighter by 0.9bp. Asian equity indices have opened mixed today morning. Asia ex-Japan CDS spreads were tighter by 0.7bp.

New Bond Issues

Zhuji State-Owned Assets raised $520mn via a 3Y sustainability bond at a yield of 5.55%, 45bp inside initial guidance of 6% area. The senior unsecured notes are unrated. Zhuji State-owned Assets Management is the guarantor. Proceeds will be used for refinancing offshore debts in accordance with its sustainable finance framework. The bonds have a change of control put at 101.

Rating Changes

- Warner Music Group Corp. Upgraded To ‘BBB-’ From ‘BB+’ As Industry Tailwinds Support Low Leverage; Outlook Stable

- Fitch Downgrades Ukraine to ‘RD’

- Moody’s Ratings downgrades China Vanke’s ratings to B1/B2; outlook negative

- Operadora de Servicios Mega Downgraded To ‘CC’ On Missed Coupon Payment; Ratings Placed On CreditWatch Negative

Term of the Day

Offer For Sale (OFS)

Offer for Sale (OFS) refers to a mechanism for promoters/owners to sell their shares in publicly listed companies to raise additional funds for the company. The purpose is to sell shares to outside investors and raise additional capital for various purposes like growth, expansion etc. It is considered as a shorter and easier way to raise capital unlike IPOs, and retail investors, FIIs, qualified institutional buyers (QIBs) can bid for such shares.

Talking Heads

On Credit Markets Should Listen to Stocks’ ‘Fear Gauge’

Boaz Weinstein, CIO of Saba Capital

“VIX and credit spreads tend to be correlated. A VIX that high with credit spreads very moderate is pretty unprecedented”

Brian Gelfand, TCW Group

“We think the VIX is more appropriately calibrating risk. Credit spreads are still pricing in complacency. We expect spreads to continue to widen…”

Lawrence Gillum, LPL Financial

“Current growth scare is causing spreads to move higher but only back to levels seen late last year”

Peter Tchir, Academy Securities

“A little bit more nervous about the economy… could push spreads wider, but I’m not panicked”

On Hedge Fund Mount Lucas Selling Treasuries

“There’s no more juice left to squeeze from that long bond trade for us… We’re moving to a point where it will be quite hard to outdo the market”

On fear fading in US stocks, quick return to calm unlikely as per history

JJ Kinahan, President of Tastytrade.

“Once (VIX) settles into a range, then people will get a little more passive again. But for six months to nine months, it usually shakes people up”

Mark Hackett, Nationwide

“It wouldn’t be surprising to see potentially overblown reactions to this week’s CPI number, retailer earnings and retail sales”

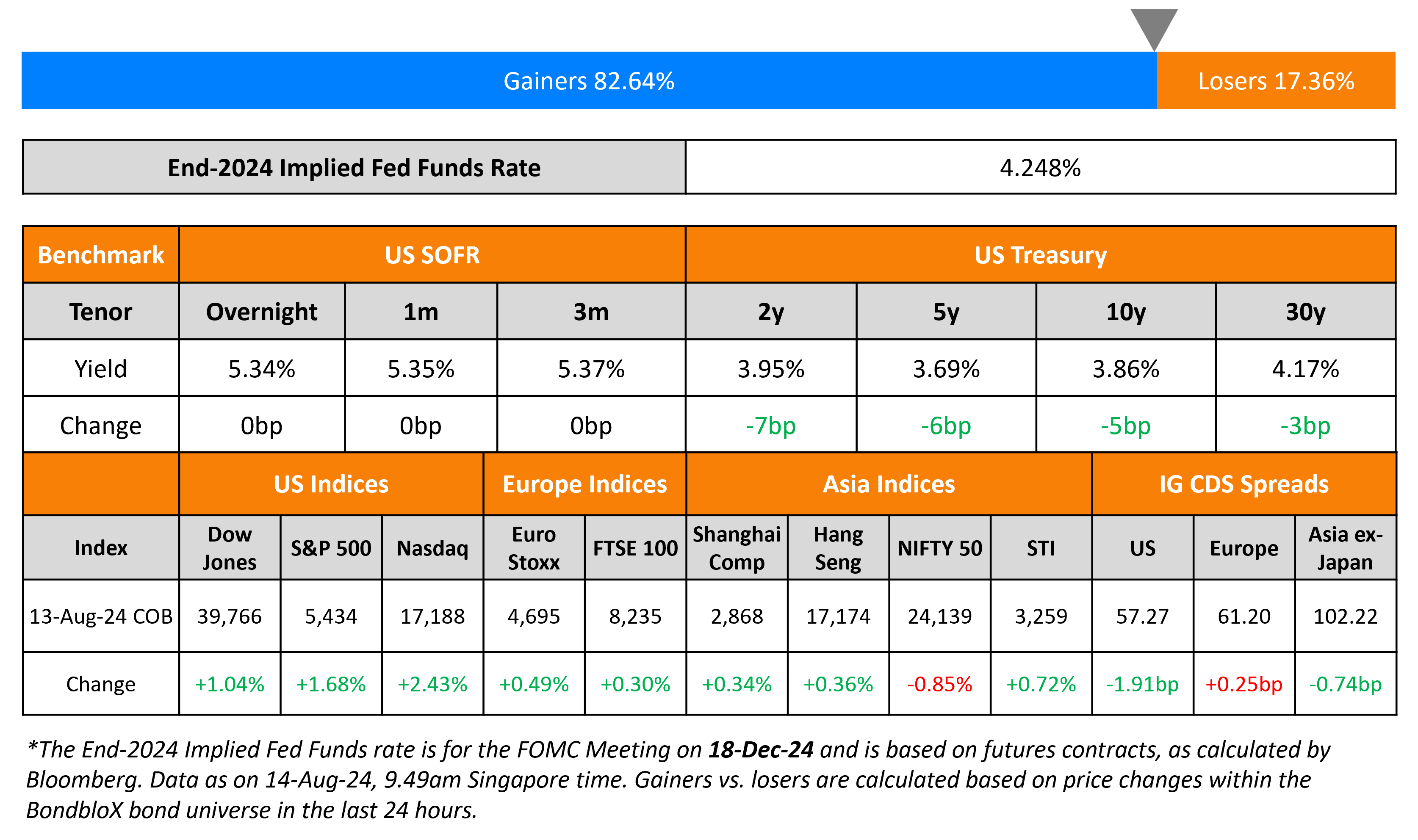

Top Gainers & Losers-14-August-24*

Go back to Latest bond Market News

Related Posts: