This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

TD Launches S$ Perp; Ulker, Citic, ANZ Launch $ Bonds

July 2, 2024

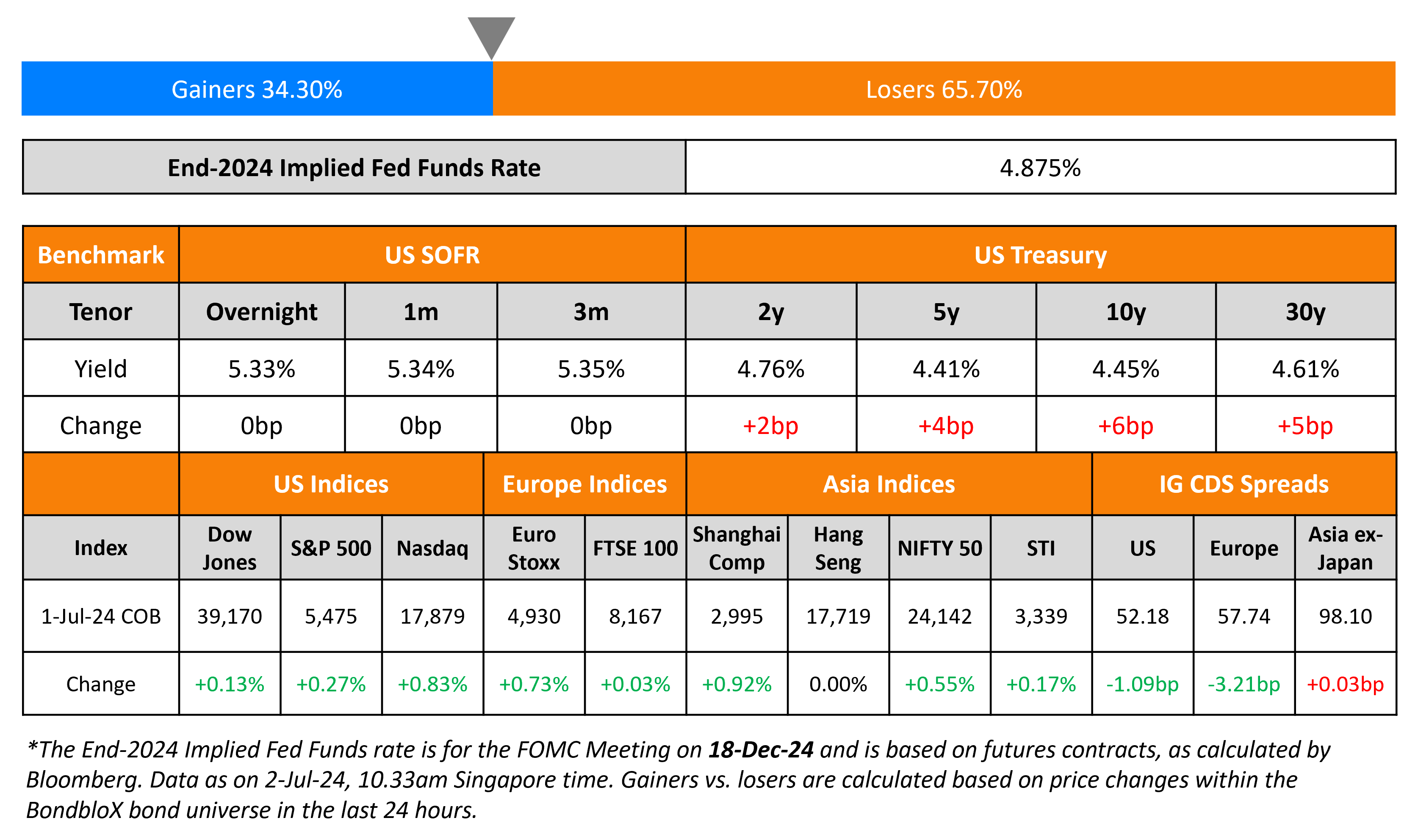

US Treasuries sold-off further with the 2s10s curve bear steepening for a second straight day, by 4bp, despite softer US economic data. The ISM Manufacturing Index came in at 48.5 for June, below expectations of 49.1 and the prior month’s 48.7. Among sub-components, the Prices Paid component continued to stay in expansion territory, albeit easing to 52.1 vs. the estimated 55.9 and prior month’s 57.0. The New Orders index rose to 49.3 from 45.4 while Inventories dropped to 45.4 from May’s 47.9 reading. Looking at equity markets, S&P and Nasdaq were up 0.3% and 0.8%, respectively. US IG spreads were 1.1bp tighter and while HY CDS spreads tightened by 2.7bp.

European equity indices ended higher. In credit markets, the iTraxx Main and Crossover spreads were tighter by 3.2bp and 9.4bp respectively. German inflation eased to 2.5% YoY in June from 2.8% in May, after two prior months of acceleration. However, ECB President Christine Lagarde indicated that the central bank was in no hurry to cut rates. Asian equity indices have opened higher this morning. Asia ex-Japan CDS spreads were flat. China’s Caixin Manufacturing PMI in June was marginally higher at 51.8 vs. expectations of 51.5 and the prior 51.7 print. This was its highest reading since May 2021.

New Bond Issues

- TD Bank S$ PerpNC5 at 5.8% area

- Ulker $ 7NC3 at 8.25-8.375% area

- China Citic Bank London $ 3Y Green FRN at SOFR+105bp area

- ANZ Bank NZ $ 10NC5 T2 at T+180bp area

New Bonds Pipeline

- Astrea 8 Pte. hires for S$ bond

- Warba Bank hires for $ 5Y Green Sukuk

- NongHyup Bank hires for $ 3Y/5Y bond

- Ho Bee Land hires for S$ 5Y Green bond

- Samvardhana Motherson hires for $ 5Y bond

Rating Changes

- Fitch Upgrades Tupras to ‘BB-‘; Outlook Stable

- Moody’s Ratings upgrades CF Industries, Inc. to Baa2, outlook changed to stable

- Fitch Downgrades Intel’s Ratings to ‘BBB+’; Affirms Short-Term Ratings at ‘F2’; Outlook Stable

- Spirit AeroSystems Inc. Ratings On CreditWatch Positive Following Acquisition By Boeing

Term of the Day

Tuna Bonds

Tuna Bonds were bonds issued by Mozambique in 2013 to finance Mozambican state-owned fishing company EMATUM’s plans to develop tuna fishing. Credit Suisse, which helped facilitate the transaction is set to face a trial after funds from the tuna bond issuances were used for purchasing military equipment instead. Mozambique will pay $220mn debt to end the Tuna bond saga.

Talking Heads

On IG Bond Sales Expected to Stay Heavy Over Summer

Maureen O’Connor, Wells Fargo & Co.

“It’s going to be more about the corporates in late July and early August that are going to drive issuance in the near term”

Robert Tipp, PGIM Fixed Income,

“As an issuer, you will not be faulted for borrowing now… expectations (are) that spreads on corporate bonds can only go one way. They are at what people see as historic tights”

On Schroders, UBS Global Wealth Pushing Gold as Key Haven This Year

Johanna Kyrklund, Schroders

“The kind of risks we see… are better covered through gold, which also has the benefit of doing quite well if we’re wrong”… fixed income still has a place in portfolios

Mark Haefele, CIO for UBS GWM

“We’ve seen a lot of central banks buying in gold, which we think is going to continue”

On Volatility The Only Certainty for Traders Parsing French Results

Ales Koutny, Vanguard Asset

“The RN still has a path for absolute majority, but based on yesterday results it’s a very narrow one… this broad back up in levels give investors a great entry point across European credit and European periphery”

Alberto Gallo, CIO and co-founder, Andromeda Capital

“Investors are overestimating risks. There’s a record-high amount of short positioning in European sovereigns and especially credit… You want to own equities and credit, not government debt.”

Top Gainers & Losers- 02-July-24*

Go back to Latest bond Market News

Related Posts: