This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Strong US PPI Print, Rises Above Expectations

August 14, 2023

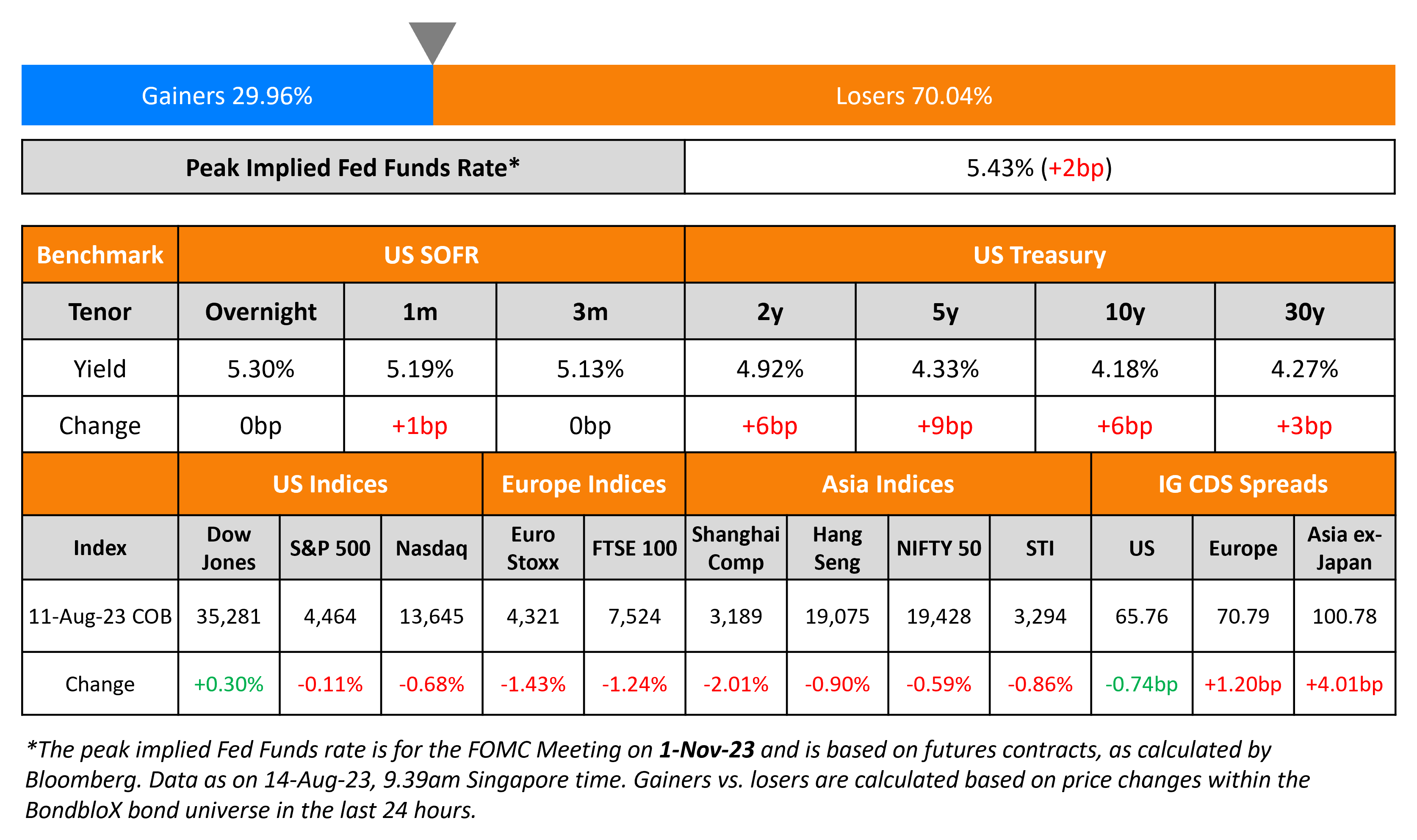

US Treasury yields jumped higher across the curve with the 2Y and 10Y yields up 6bp each. US PPI for July 2023 increased by 0.3%, above estimates of 0.2%. In the 12 months through July, the PPI increased 0.8% after gaining 0.2% in June, boosted by a lower base of comparison last year. Core PPI rose 0.2% MoM after inching up 0.1% in June, in-line with estimates. Core PPI YoY increased 2.7%, matching June’s rise. With the stronger than expected PPI numbers, the higher-for-longer theme weighed on treasuries and market probabilities. The CME probability of a 25bp rate hike stands at 11% for the September meeting, and at 34% for the November meeting. US IG credit spreads were tighter by 0.7bp and HY CDS spreads tightened by 1.4bp. The S&P and Nasdaq were lower by ~0.1% and ~0.7%, respectively.

European equity markets ended lower. In credit markets, European main CDS spreads were 1.2bp wider and Crossover CDS widened 7.2bp. Asia ex-Japan CDS spreads widened 4bp. Asian equity markets have opened weaker this morning.

New Bond Issues

New Bond Pipeline

- Continuum Green hires for $450mn 3.5Y Green bond

- Lloyds hires for S$ 10NC5 Tier 2 bond

Rating Actions

- Allstate Corp. And Core Subsidiaries Downgraded On Weaker Capital And Underwriting Results; Outlook Stable

- Fitch Revises ICD’s Outlook to Stable; Affirms at ‘A+’

- Panama Outlook Revised To Stable From Negative On Solid Growth Prospects; ‘BBB’ Foreign Currency Rating Affirmed

-

Moody’s affirms AAC Technologies’ Baa3 ratings, revises outlook to negative from stable

- Fitch Revises Cardinal Health’s Outlook to Positive; Affirms LT IDR at ‘BBB’

Term of the Day

Sukuk

A Sukuk is a sharia-compliant fixed income instrument that essentially works similar to bonds. In a Sukuk, key differentiators vs. conventional bonds are:

– Investors share partial ownership of an asset rather than it being a debt obligation by the issuer

– The pricing is based on the underlying value of assets rather than credit worthiness

– The holder receives a share of underlying profits rather than interest payments (considered ‘riba’)

Sharia compliance broadly implies that any profits derived from these funding arrangements must be derived from commercial risk-taking and trading only; that interest income is prohibited on lending activities and; that the assets must be halal.

Saudi Arabia plans to issue about SAR 35.9bn ($9.6bn) in sukuk.

To learn more about sukuk, click here

Talking Heads

On Bond Market’s Newfound Economic Optimism

Manuel Hayes, senior portfolio manager at London-based asset manager Insight Investment.

“The rate of defaults for junk bonds, the riskiest form of U.S. debt, in the broad U.S. high-yield index stood at around 1% this year, much lower than expectations of 5% to 8% at the beginning of the year. Default rates even in the worst-case scenario of a prolonged high rate environment are now expected to tick up to about 2-3% with a lot of this risk priced in already.”

On 10yr Treasuries Being Overvalued

Bill Gross, former chief investment officer of Pacific Investment Management Co.

“The fair value of the 10-year Treasury yield is about 4.5%, compared with the current level of around 4.16% Inflation may prove sticky at around 3%. 10-year yields historically have traded about 135 basis points above the Federal Reserve’s policy rate. So even if the Fed lowers interest rates to about 3%, the current 10-year yield remains too low, given the historical relationship.”

On Correlation between EM and US Bond Yields

Arun Sai, Senior multi-asset Strategist at Pictet Asset Management

“The disinflation process in emerging markets is proceeding faster than we had previously expected — this should allow EM central banks to cut rates sooner and faster than developed-market ones. We remain overweight EM local-currency bonds.”

On Rising European Inflation Expectations

Benjamin Schroeder, senior rates strategist at ING

“Suddenly some inflation alarms are ringing again. Recent swings in the price for natural gas highlight the lingering risk of supply disruptions to the more benign inflation dynamics of late.”

Top Gainers & Losers- 14-August-23*

Go back to Latest bond Market News

Related Posts: