This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sri Lanka Downgraded to CCC by S&P; CBSL Gov Says it Will Meet All Debt Repayments

January 13, 2022

Sri Lanka was downgraded to CCC from CCC+ by S&P reflecting continued deterioration in the nation’s ability to maintain sufficient forex resources to meet external obligations. S&P said, “The Sri Lankan government faces increasingly likely default scenarios without unforeseen significant positive developments”. While it announced a $1.2bn relief package providing support to the economy, it has weakened the government’s fiscal position and debt burden risks. While forex reserves are said to have risen from $1.6bn in November 2021 to $3.1bn in December, this still remains slightly less than two months’ worth of import cover. Particularly S&P said, “Additional inflows may be insufficient to offset pre-determined short-term drains on foreign reserves estimated at US$6.6 billion over the next 12 months”. S&P estimates a 11.1% fiscal deficit in 2021, and a deficit of 9.8% in 2022. Sri Lanka has $500mn due on a dollar bond in January and another $1bn in July 2022, besides bilateral and official obligations and SLDBs. Total SLDB maturities in 2022 amount to ~$1.45bn.

Separately, Sri Lanka’s central bank governor Ajith Nivard Cabraal said that its government will meet all 2022 debt repayments and work on a more comprehensive plan to address its forex reserves. Cabrall said that they are is seeking a $1bn credit line and a $400mn swap arrangement from India, plus a $500mn credit line for fuel involving Indian Oil Corp that has operations on the island. It is also in discussions with Qatar for a $1bn credit line.

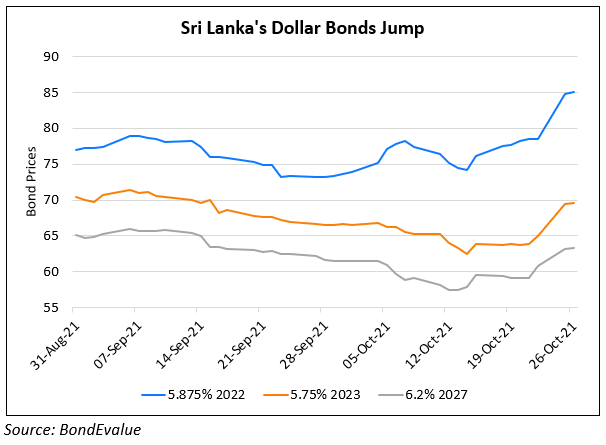

Sri Lanka’s dollar bonds were stable, with its bonds beyond 2022 trading at about 50 cents on the dollar. Its 5.75% bonds due January 18 were at 98 while its 5.875% bonds due July 2022 were at 71.8.

Go back to Latest bond Market News

Related Posts: