This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

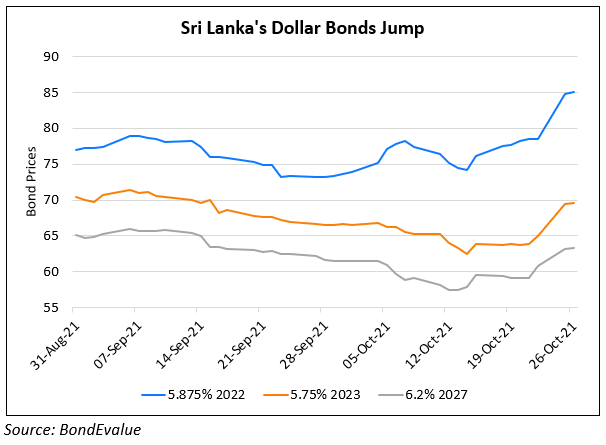

Sri Lanka Confident of Not Defaulting and Having a Lower Budget Deficit in 2022

November 15, 2021

Sri Lanka finance minister Basil Rajapaksa said on Saturday, November 13 that Sri Lanka is confident of not defaulting on its debt and will work on gradually improving the quality of its foreign exchange reserves. In his budget speech on Friday, Rajapaksa stated that the government will reduce the budget deficit to around 8.8% of GDP in 2022. The new projected 11.1% budget deficit for 2021 is higher than the 9.5% target set in June which was itself revised up from 8.9%. In a briefing, a day after presenting the annual budget, Rajapaksa said “Sri Lanka has never defaulted in its history and that record will be maintained… Even part of our reserves are borrowed but we will improve the quality of reserves gradually from next year till 2024. By 2024, we are confident we will be able increase reserves and put debt on a sustainable footing”. While the government did not provide an estimate for 2022 growth, central bank governor Ajith Cabraal said growth is likely to improve in 2022 adding “This year we are looking at 5% growth and if we have a good year in 2022 with tourism reaching a quarter of pre-2019 levels then we are well on course for 6% growth”.

Sri Lanka’s forex reserves dropped to $2.27bn as of end-October with Rajapaksa stating that its main sources of dollar inflows, remittances and tourism were affected by the pandemic and that it is becoming tougher to attract investors. Treasury Secretary S. R. Attygalle said the budget is likely to bring in structural reforms, improve its fiscal position and that the government has a revenue target of 15% of GDP by 2025 whilst strictly managing expenditure. However, analysts are uncertain whether the budget announcements are sufficient to instill confidence among investors, ratings agencies and market participants. Trisha Peries, head of economic research at Frontier Research said, “Overall, the budget is unlikely to help the economic situation significantly and does not give a strong indication of how it expects to meet its debt obligations going forward or how it expects to address the plummeting reserves”.

For the full story, click here

Go back to Latest bond Market News

Related Posts: