This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

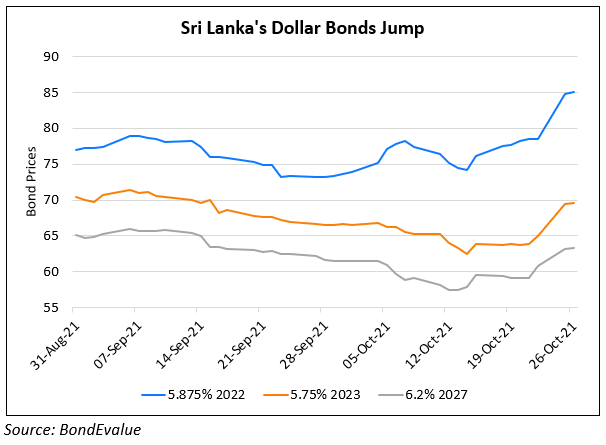

Sri Lankan Bonds Rise Ahead of Talks to Decide on IMF Bail-out Financing

January 4, 2022

Sri Lanka’s dollar bonds inched higher by ~1 point as the federal cabinet was to meet on Monday to decide whether or not to seek bailout financing from the IMF. The cabinet meeting included Governor Ajith Cabraal and Treasury Secretary Sajith Attygalle. As per Bloomberg, President Gotabaya Rajapaksa’s ruling coalition is split on whether benefits of an IMF loan outweigh the costs. Presently, the government is running short of forex to pay for imports of some key food items and thereby is turning to China and India for emergency support. Damien Buchet, London-based chief investment officer at Finisterre Capital said, “We’re convinced Sri Lanka will have to bite the bullet and turn to the IMF at some point, or restructure their debt”. In the next 12 months, Sri Lanka has ~$7.3bn in domestic and foreign loans across the government and private sector. This includes a $500m international sovereign bond repayment on January 18. As of November 2021, its forex reserves were at only $1.6bn.

Sri Lanka’s dollar bonds continue to trade slightly higher with its 5.75% 2022s up 0.85 points to 95.09 cents on the dollar and its 7.85% 2029s up 0.81 points to 52.47 cents on the dollar.

Go back to Latest bond Market News

Related Posts: