This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

SocGen Raises $5bn via Five-Trancher; US CPI at 3.4%, Core CPI at 3.9%

January 14, 2024

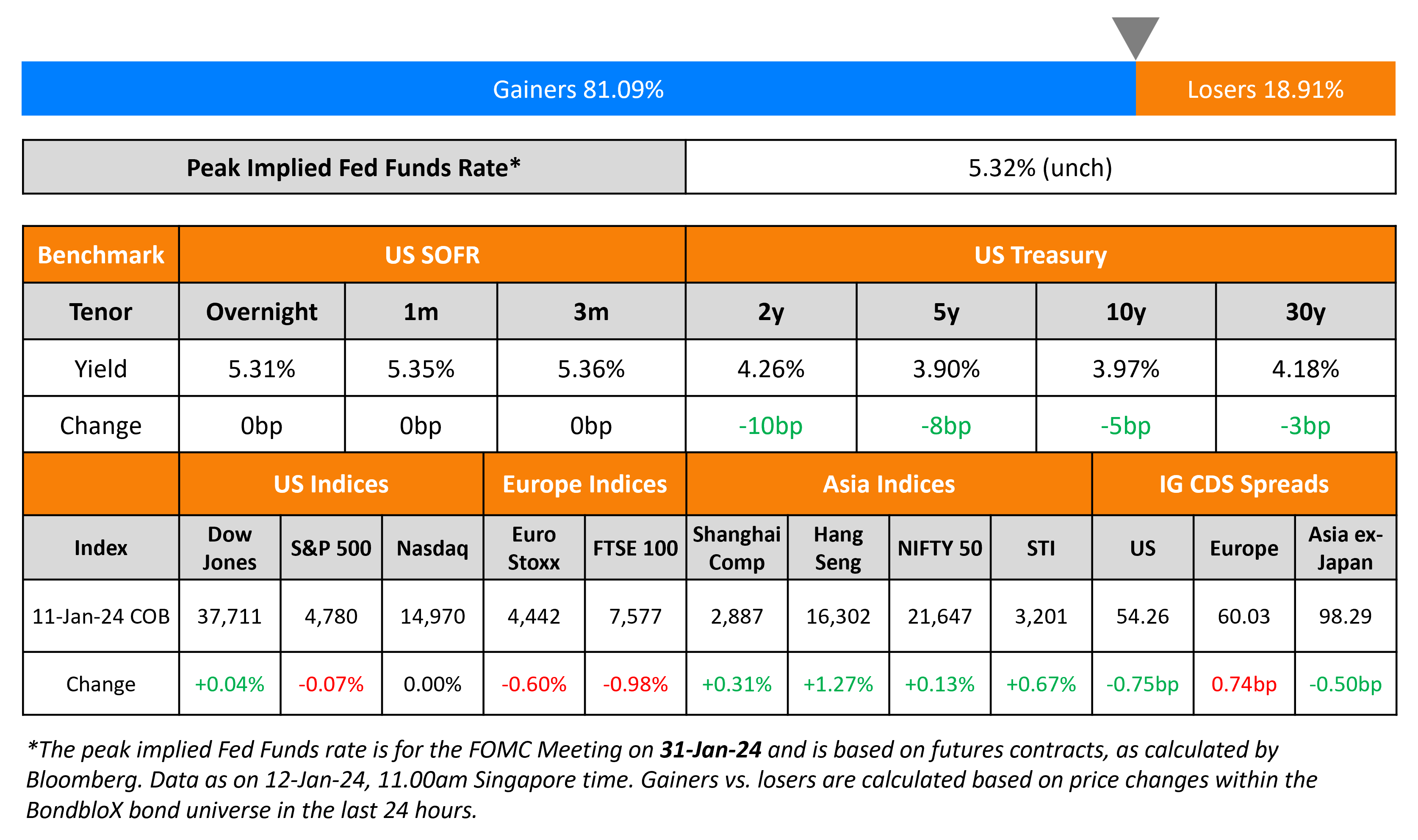

US Treasury yields moved lower across the curve on Thursday with 2Y and 10Y yields falling by 10bp and 5bp respectively to 4.26% and 3.97%. US inflation accelerated at the end of 2023 with the December CPI YoY up 3.4%, the most in three months. This was above estimates of 3.2% and the prior month’s data of 3.1%. While Core CPI YoY rose 3.9%, higher than the estimated 3.8%, it was lower than the prior month’s 4.0%. This was the first decrease in core inflation over the prior three months. A few Fed speakers came out with their assessment following the inflation report:

- Cleveland Fed President Loretta Mester said it was premature to consider cutting rates as soon as March, noting that the latest inflation data suggests policymakers have more work to do.

- Richmond Fed President, Thomas Barkin reiterated that he was still looking for more evidence that inflation was headed to their 2% goal following the latest report on prices.

- Chicago Fed President Austan Goolsbee signaled that he was not sure if the latest inflation data was enough progress for the Fed to start cutting rates. Separately, initial jobless claims for the prior week came at 202k, below estimates of 210k.

Looking at credit credit markets, US IG CDS spreads tightened by 0.8bp and HY spreads tightened 1.7bp. US equity markets traded stable, with the S&P and Nasdaq ending almost unchanged yesterday.

European equity markets ended slightly lower. Credit markets in the region saw the European main CDS spreads widen by 0.7bp and crossover spreads widen by 6bp. Asian equity markets have broadly opened in the green today. Asia ex-Japan IG CDS spreads tightened by 0.5bp.

New Bond Issues

SocGen raised $5bn via a five-tranche deal. Details are given in the table below:

The 31NC30 Tier 2 bond is a subordinated note while the other bonds are senior non-preferred (SNP) bonds. The SNP bonds are rated Baa2/BBB/A- and the 31NC30 Tier 2 note is rated Baa3/BBB-/BBB.

New Bond Pipeline

- YPF plans 7Y benchmark bond

- Greenko Plans for up to $450mn bonds

- SK Battery America 3Y Green bond

Rating Changes

- Boston Properties Inc. Rating Lowered To ‘BBB’ From ‘BBB+’ On Weaker Credit Metrics, Office Headwinds; Outlook Negative

- Ecuador Outlook Revised To Negative On Increasing Liquidity Strains; ‘B-‘ Long-Term Ratings Affirmed

- Hewlett Packard Enterprise Outlook Revised To Negative On Announced Juniper Networks Acquisition; ‘BBB’ Rating Affirmed

- Southwestern Energy Co. ‘BB+’ Rating Placed On CreditWatch Positive On Announced Merger With Chesapeake Energy Corp.

- Chesapeake Energy Corp. Ratings Placed On Watch Positive On Southwest Acquisition, Likely Upgrade To Investment Grade

New Bond Pipeline

- YPF plans 7Y benchmark bond

- Greenko Plans for up to $450mn bonds

Rating Changes

- Boston Properties Inc. Rating Lowered To ‘BBB’ From ‘BBB+’ On Weaker Credit Metrics, Office Headwinds; Outlook Negative

- Ecuador Outlook Revised To Negative On Increasing Liquidity Strains; ‘B-‘ Long-Term Ratings Affirmed

- Hewlett Packard Enterprise Outlook Revised To Negative On Announced Juniper Networks Acquisition; ‘BBB’ Rating Affirmed

- Southwestern Energy Co. ‘BB+’ Rating Placed On CreditWatch Positive On Announced Merger With Chesapeake Energy Corp.

- Chesapeake Energy Corp. Ratings Placed On Watch Positive On Southwest Acquisition, Likely Upgrade To Investment Grade

Term of the Day

Sustainability Bonds

As per ICMA, an authority in capital markets, “Sustainability bonds are bonds where the proceeds will be exclusively applied to finance or re-finance a combination of both green and social projects.” These can be issued by financial/non-financial companies, governments or municipalities and should follow guidelines by the ICMA. The green and social aspects would be aligned to ICMA’s Green Bond Principles (GBP) and Social Bond Principles (SBP).

Talking Heads

On Bond Market Adds to Fed Rate-Cut Bets Despite Inflation Uptick

Sinead Colton Grant, CIO at BNY Mellon Wealth Management

“There is a broader recognition that rates are moving lower this year and, while there is still going to be volatility, getting exposure to Treasury yields at 4% is attractive”

Gregory Faranello, head of US rates trading and strategy for AmeriVet Securities

“The inflation pathway from here is going to be bumpy and the pathway to formerly lower rates may prove more complicated than the price action of the prior two months of 2023”

On Seeing Strong Dollar Even as Fed Cuts Rates – Deutsche Bank

“The US exhibits no such urgency. Fed is priced to be the most dovish central bank over the next two years given the higher starting point of rates, but there are reasons to doubt this will materialize as soon… The market is most likely to focus on Trump’s foreign policy and trade priorities which include a 10% across-the-board tariff on imports… likely to be materially positive for the dollar and with very little priced in”

On Private Credit Investors Fear Rate Cuts May Come Too Late

Stuart Brinkworth, partner and head of leveraged finance at Mayer Brown

“Debt service costs have doubled in some cases and it’s obviously causing some issues from a liquidity perspective”

Blair Jacobson, Ares Management co-head of European credit

“It takes a while for the full impact of higher rates to really be seen and be felt”

Top Gainers & Losers- 12-January-24*

Go back to Latest bond Market News

Related Posts: