This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Singapore Government Launches S$ 30Y; Cinda, CapitaLand Ascendas REIT Price $ Bonds

May 21, 2024

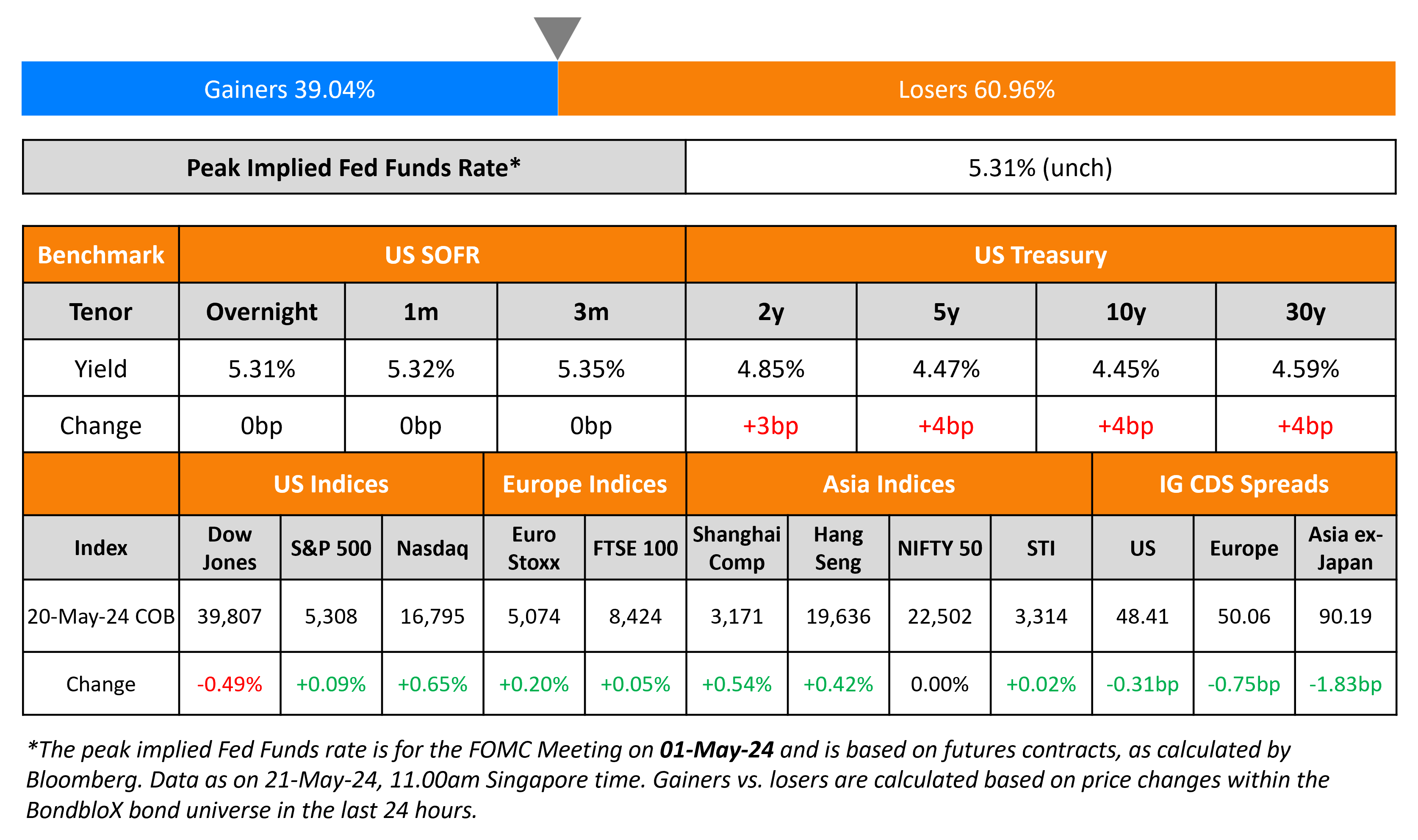

US Treasury yields ticked higher by 3-4bp on Monday. Fed Vice-Chair Philip Jefferson said that while April’s data was “encouraging”, it was “too early to tell whether the recent slowdown in the disinflationary process will be long lasting”. Echoing a similar view was the Fed Vice Chair of Supervision Michael Barr, noting that the “disappointing” first-quarter inflation readings did not provide him increased confidence to support easing policy. S&P ended 0.1% higher while Nasdaq was 0.7% higher to start the new week. US IG CDS spreads tightened 0.3bp and HY spreads were 1bp tighter.

European equity markets ended higher too. Europe’s iTraxx main CDS spreads were 0.8bp tighter while crossover spreads were 3bp tighter. Asian equity indices have opened in the red this morning. Asia ex-Japan CDS spreads were 1.8bp tighter.

New Bond Issues

- Singapore Government Bond S$30Y at 3.46% area

China Cinda HK raised $800mn via a 5Y bond at a yield of 5.763%, 35bp inside initial guidance of T+175bp area. The senior unsecured bonds are rated BBB+/A- (S&P/Fitch), and have a change of control put at 101. Proceeds will be used to pay existing debt. The new bonds are priced at a new issue premium of 9bp over its existing 4.75% 2029s that currently yield 4.67%.

CapitaLand Ascendas REIT raised $300mn via a 10Y green bond at a yield of 3.73%, 17bp inside initial guidance of 3.9% area. The senior unsecured notes have expected ratings of A3 by Moody’s. OCBC is the green finance adviser for the issuance. Redemption would be at par due to (a) tax reasons, (b) termination of CapitaLand Ascendas REIT, (c) cessation or suspension in trading of units in CapitaLand Ascendas REIT and (d) minimum outstanding amount, in accordance with the Programme. 100% of the net proceeds from the notes (after deducting issue expenses) will be used for financing or refinancing, in whole or in part, Eligible Projects under its framework.

Rating Changes

- Fitch Upgrades Hannon Armstrong and Subsidiaries to ‘BBB-‘/Stable; Rates New Debt Fitch Upgrades Ras Al Khaimah to ‘A+’ from ‘A’; Outlook Stable

- Calumet Specialty Products Partners L.P. Downgraded To ‘CCC+’ On Elevated Refinancing Risk; Outlook Negative

- Hecla Mining Co. Outlook Revised To Negative On Diminished Cushion In Credit Metrics; ‘B+’ Rating Affirmed

New Bonds Pipeline

-

Coca-Cola hires for $ bond

- Uzbekistan hires for $ 7Y bond

- Amcor hires for $ 5Y bond

Term of the Day

Basis Trade

The Treasury Basis Trade is a trade which involves buying/selling a treasury bond and simultaneously taking the opposite position in a corresponding treasury futures contract. When a trader buys the bond and sells the futures, it is considered to be a ‘long basis’ trade and when he/she sells the bond and buys the futures, it is a ‘short basis’ trade. Fed economists reported that the cash-futures basis positions could be exposed again to stress during broader market corrections.

Talking Heads

On ECB Flagging Basis Trade Risks in Europe’s Government Bond Market

ECB noted a group of offshore hedge funds has become increasingly present in Europe’s government bond repo market… the hedge funds in question… hold more than half of investment funds’ positions on euro-area government bond futures

On India’s Bond Index Entry Not Enough to Lift Rating – Moody’s

Christian de Guzman, SVP at Moody’s

“I don’t necessarily think that the bond market inclusion is going to be a material addition to the strengths that we already ascribed to the government’s ability to fund itself”

On UK Interest Rates May Drop This Summer – BOE’s Ben Broadbent

“If things continue to evolve with its forecasts – forecasts that suggest policy will have to become less restrictive at some point – then it’s possible Bank Rate could be cut some time over the summer”

On Bond Buyers Paid Least in Years for EM Corporate-Bond Risk

Arnaud Boué, senior fixed-income PM at Julius Baer

“Even with thin spreads, total valuations are comparatively attractive if investors are looking at a carry trade-strategy”

Luke Codrington, global fixed income at Pinebridge Investments

“The thin spreads have been driven by factors including limited supply, relatively strong fundamentals and muted election risks”

Top Gainers & Losers- 21-May-24*

Go back to Latest bond Market News

Related Posts: