This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Scor Prices EUR Perp; Markets on Hold Ahead of FOMC

December 17, 2024

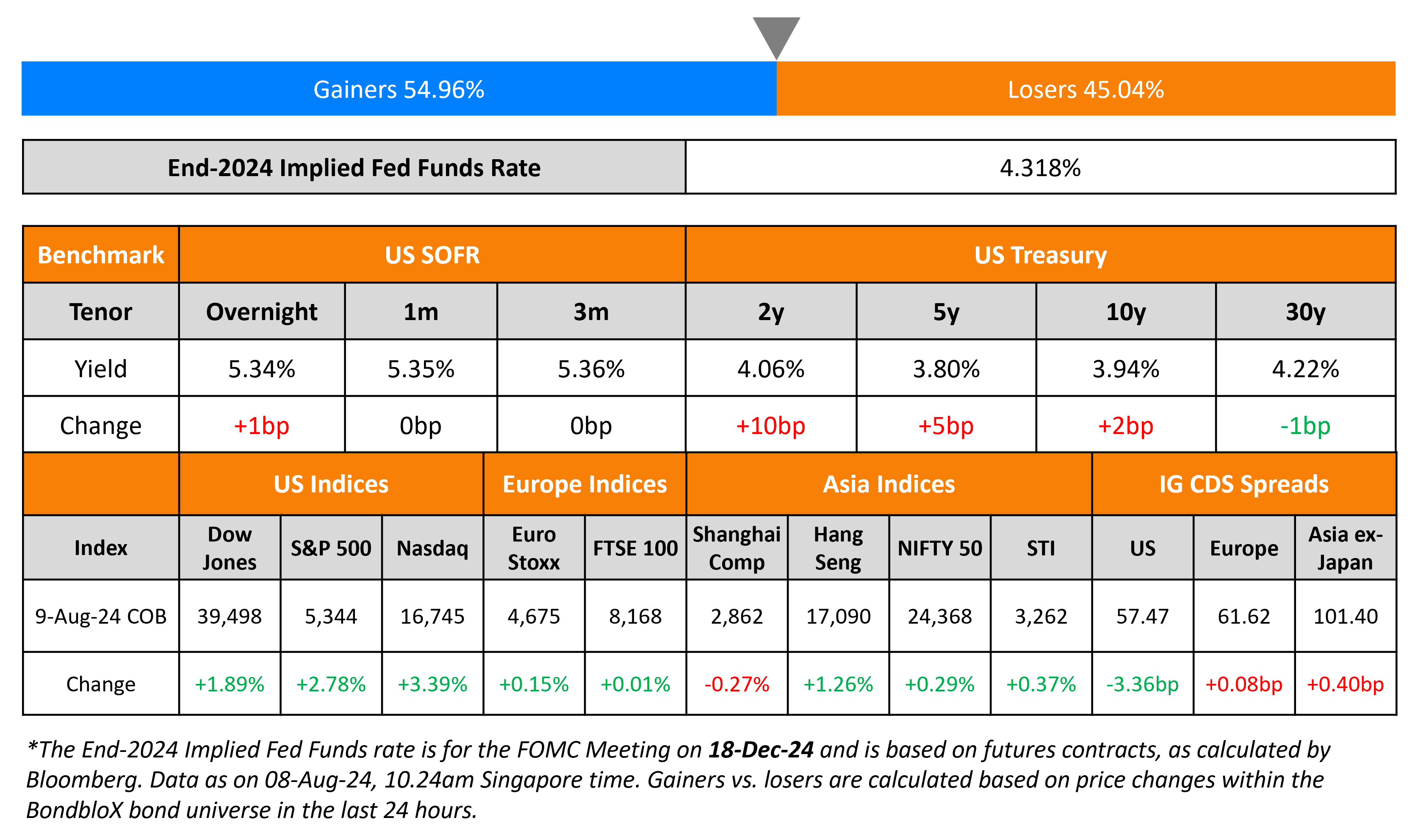

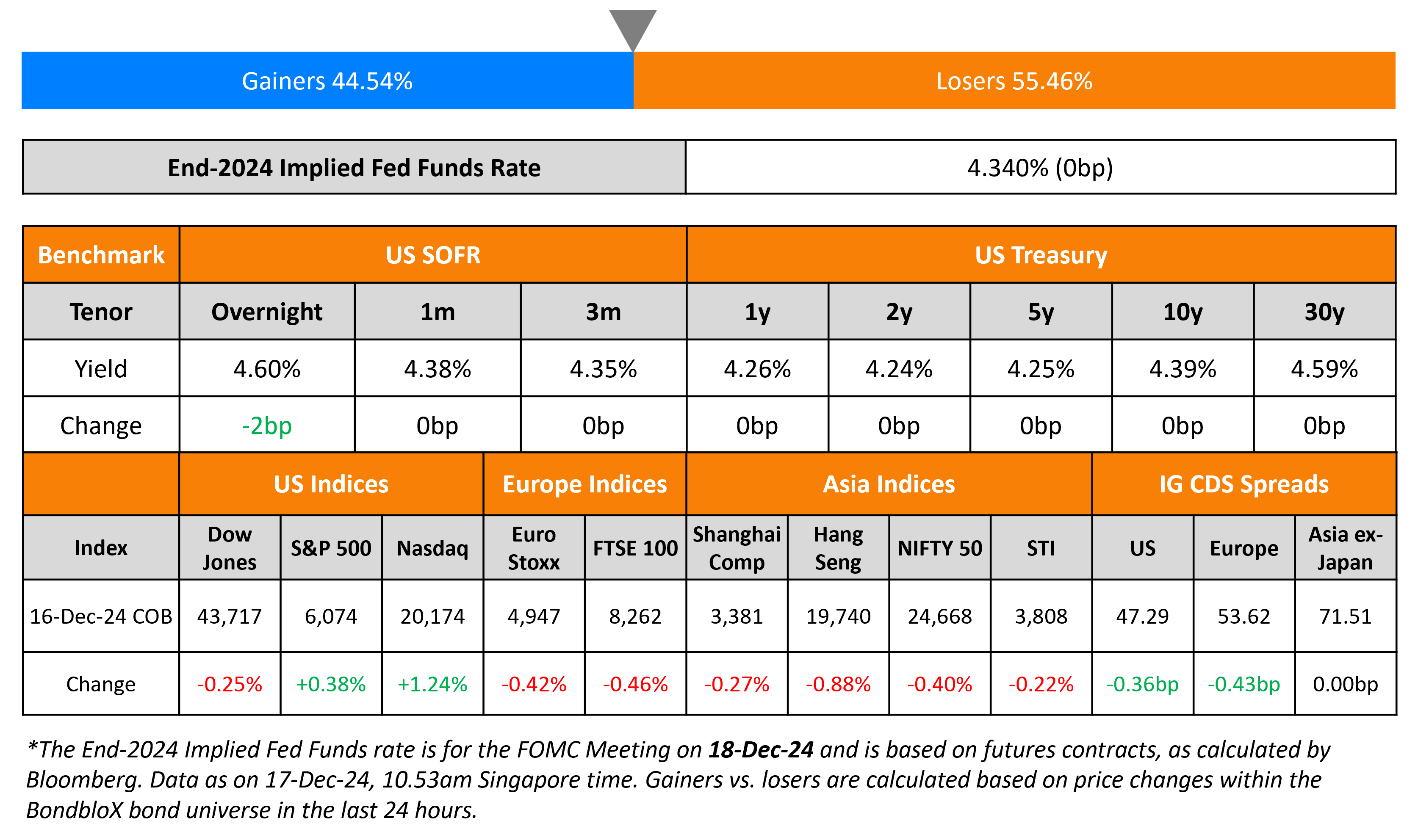

US Treasury yields held steady across the curve. The Empire Manufacturing Index for December came-in softer at 0.2 vs. expectations of 10.0 and the prior month’s 31.2. US IG and HY CDS spreads tightened by 0.4bp and 2bp respectively. Looking at US equity markets, the S&P and Nasdaq ended higher by 0.4% and 1.2% respectively. European equities ended lower. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.4bp and 2.3bp respectively. Asian equities have opened mixed this morning. Asia ex-Japan CDS spreads were flat.

New Bond Issues

Scor raised €500m via a PerpNC10 RT1 bond at a yield of 6.09%, 28.5bp inside initial guidance of 6.375% area. The Restricted Tier 1 notes are rated BBB+ (S&P). If not called by 20 December 2034, the coupon will reset to the Euribor 5Y ICE Swap rate plus 385.7bp. Proceeds will be used for general corporate purposes, including the repurchase of all or part of its outstanding €250mn Perp.

Rating Changes

-

Moody’s Ratings upgrades Imperial Brands to Baa2 from Baa3; outlook stable

-

Moody’s Ratings upgrades National Bank of Canada’s long-term ratings (deposits Aa2 from Aa3), concluding review; outlook stable

-

Moody’s Ratings downgrades KIPCO’s ratings to B1 from Ba3, maintains negative outlook

-

Moody’s Ratings downgrades CVS Health to Baa3; outlook stable

-

Moody’s Ratings downgrades Tatra banka, a.s.’s deposit ratings to A3 and its senior unsecured and issuer ratings to Baa1; outlook changed to positive from negative

-

Fitch Downgrades OCI N.V. to ‘BB’; Maintains RWN

-

Moody’s Ratings affirms T-Mobile’s Baa2 ratings; changes outlook to positive

-

Kroger Co. Outlook Revised To Stable From Negative On Terminated Albertsons Deal; ‘BBB’ Ratings Affirmed

Term of the Day: Technical Recession

A technical recession for economic purposes is defined as one where a country witnessed two consecutive quarters of negative GDP growth/decline in GDP. However in reality, it might not necessarily indicate an actual recession and could be influenced by temporary factors. A actual recession may sustain for a considerable period of time and covers a wide range of declines in economic activity.

Talking Heads

On US bond investors bracing for ‘hawkish cut,’ spurn long-term bonds

George Bory, Allspring Global

“A hawkish cut is consistent with both what the data will look like, but also potential policy changes from the new administration”

Greg Wilensky, Janus Henderson

“The Fed will be less dovish in the summary of economic projections than they were during September, which is appropriate… I believe they will raise the 2025 dots by about 25bp from where it was”

Jay Barry, J.P. Morgan

“No one’s really looking to aggressively extend duration right now”

On Seeing Fed Skipping a Rate Cut in January – Goldman Sachs Economists

“The key question for the statement and press conference is the relative emphasis put on slowing the pace versus on decisions remaining meeting-by-meeting and data-dependent… expect to hear both messages, including an addition to the statement that nods toward a slower pace”

On ECB to Cut Further With Inflation Close to Goal – ECB President Christine Lagarde

“Even though we are not there yet, we are close to achieving our target. If the incoming data continue to confirm our baseline, the direction of travel is clear and we expect to lower interest rates further… data suggest that there is scope for a downward adjustment in services inflation”

Top Gainers and Losers- 17-December-24*

Go back to Latest bond Market News

Related Posts: