This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Saudi, Santander, Morgan Stanley Prices $ Bonds

May 29, 2024

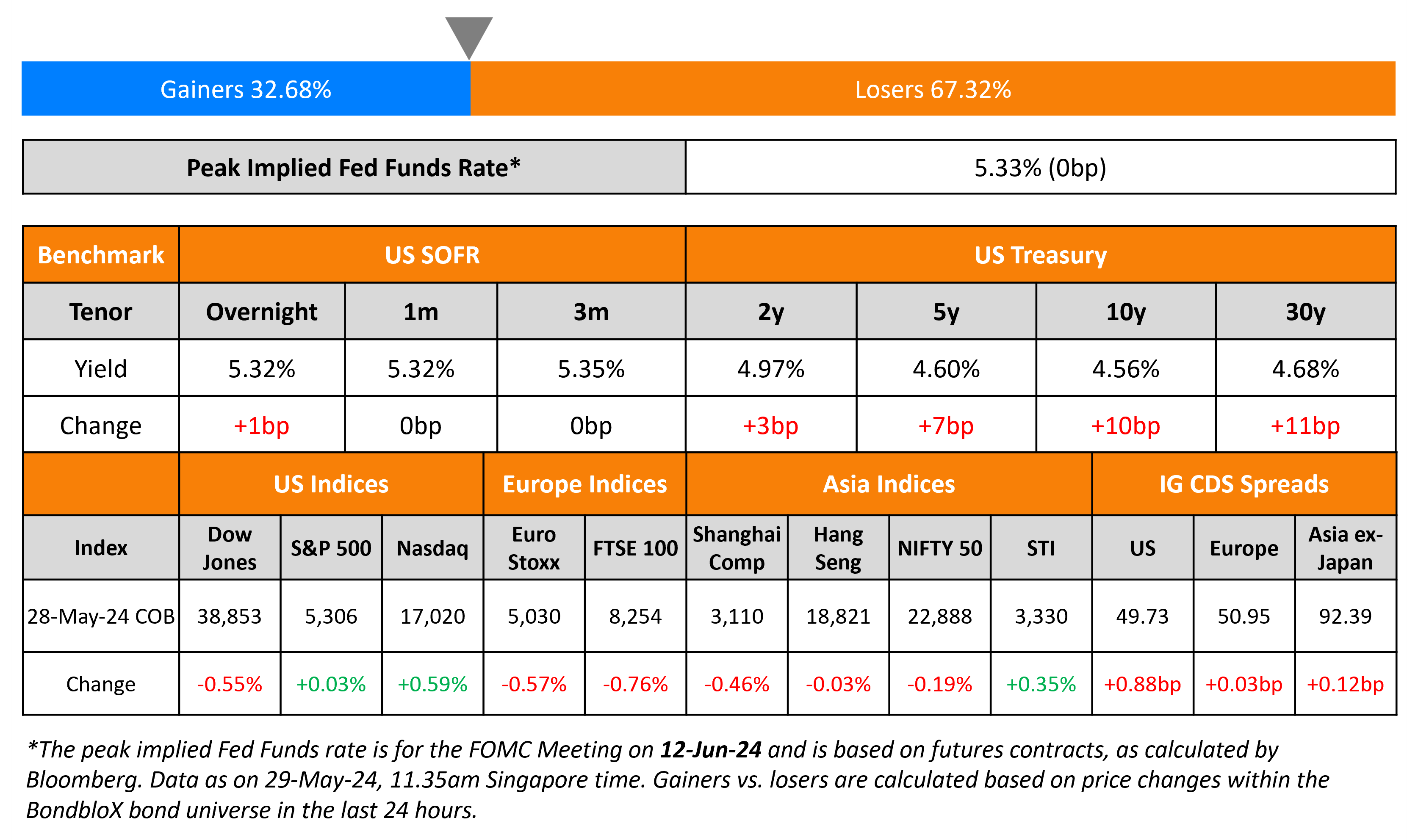

US Treasury yields moved higher across the curve on Tuesday as markets resumed after the extended weekend. The US Consumer Confidence Index rose to 102 in May vs. expectations of 96 and the prior 97.5 reading. This was the first increase after three consecutive months of decline. Also, the average 1Y inflation expectations ticked higher to 5.4% from 5.3%. Separately, Minneapolis Fed President Neel Kashkari said that he and other members have not ruled out the possibility of additional rate increases, albeit with the odds of that being “quite low”. He added that he has not gained confidence about the disinflation process since the March FOMC meeting. Equity markets saw the S&P close almost unchanged while the Nasdaq was up 0.6%. US IG CDS spreads widened 0.9bp and HY spreads were 3.3bp wider.

European equity markets ended in the red. Europe’s iTraxx main CDS spreads were flat while crossover spreads were tighter by 0.5bp. Asian equity indices have opened lower this morning. Asia ex-Japan CDS spreads widened 0.1bp.

New Bond Issues

- Fujian Jinjiang 364-Day at 6.8% area

Saudi Arabia raised $5bn via a three-tranche sukuk issuance. It raised:

- $1.25bn via a 3Y bond at a yield of 5.364%, 25bp inside initial guidance of T+85bp area. The new bonds were priced at a new issue premium of 17.4bp over its existing 2.5% 2027s that currently yield 5.19%.

- $1.5bn via a 6Y bond at a yield of 5.349%, 25bp inside initial guidance of T+100bp area. The new bonds were priced at a new issue premium of 13.9bp over its existing 2.25% 2030s that currently yield 5.21%.

- $2.25bn via a 10Y bond at a yield of 5.402%, 25bp inside initial guidance of T+110bp area.

The sukuk notes are rated A1/A+ (Moody’s/Fitch) and received orders of over $19.2bn, 3.84x issue size. Proceeds will be used for general domestic budgetary purposes.

Santander Holdings raised $1.25bn via a two-trancher. It raised $500mn via a 3NC2 bond at a yield of 6.124%, 30bp inside initial guidance of T+145bp area. It also raised $750mn via a 11NC10 bond at a yield of 6.342%, 25bp inside initial guidance of T+180bp area. The senior unsecured notes are rated Baa2/BBB+/BBB+. Proceeds will be used for general corporate purposes or debt repayment. The new 3NC2s were priced at a new issue premium of 40bp over its existing 6.527% 2027s (callable in November 2026) that currently yield 5.71%.

Morgan Stanley Bank NA raised $2.75bn via a two-part offering. It raised $2.1bn via a 4NC3 bond at a yield of 5.504%, 15bp inside initial guidance of T+90bp area. It also raised $650mn via a 4NC FRN at a yield of SOFR+86.5bp vs. initial guidance of SOFR equivalent area. The senior notes are rated Aa3/A+/AA-. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Continuum Green Energy India hires for $ green bond

- Amcor hires for $ 5Y bond

Rating Changes

- Moody’s Ratings upgrades Adler Pelzer’s ratings to B2; outlook stable

- Petroleos del Peru Petroperu S.A. Downgraded To ‘B’, Placed On CreditWatch Negative On Heightened Vulnerabilities

- Nitrogenmuvek Ratings Lowered To ‘CCC’ On Increasing Refinancing Risk; Outlook Negative

- LG Chem, LG Energy Solution Outlook Revised To Negative On Aggressive Expansion Investments; ‘BBB+’ Ratings Affirmed

- Fitch Affirms The Toronto-Dominion Bank at ‘AA-‘; Outlook Revised to Negative

Term of the Day

Debtor-in-Possession Financing

Debtor-in-possession (DIP) Financing is a funding option available to distressed companies that have filed for Chapter 11 bankruptcy protection, where lenders believe that the company has a realistic chance of turning itself around. DIP financing is not an option available to distressed companies that simply want to liquidate the company. DIP financing can be a lifeline for distressed companies as it may find it hard to borrow from typical channels after filing for Chapter 11.

From a lender’s perspective, DIP financing can be attractive given the special treatment of such financing under US bankruptcy laws, which dictate that DIP lenders are to be paid before other creditors. DIP financing is subject to court approval wherein the distressed borrower must prove to the courts that the existing or older creditors will not be made worse by the new financing.

Talking Heads

On Pipeline for Acquisition Financing Shrinking, Boon for Credit

Scott Kimball, CIO Loop Capital Asset Management

“Funding costs remain high relative to the past decade so issuance will necessarily slow… tailwind for secondary markets because the opportunity to buy high quality corporate paper over 5% does not last indefinitely”

Winifred Cisar, global head of strategy at CreditSights

“Robust issuance hasn’t done anything to shake rock solid technicals. Deals have gotten done at tight spreads”

Central banks must assess bond-buying risks – ECB’s Isabel Schnabel

“These losses need to be viewed against the profits central banks made before the rise in interest rates, but they may still be weighing on central banks’ reputation and credibility”

On India May Cut Borrowing on Less Spending Time

Kruti Chheta, a fixed-income fund manager at Mirae Asset

“We have nine months of spending this fiscal year because of elections… These borrowings could be added to the next fiscal year… In case there is a change in the regime, there will be a selloff”

Top Gainers & Losers- 29-May-24*

Go back to Latest bond Market News

Related Posts: