This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Retail Sales Soften; MGM China, Continuum Price $ Bonds

June 19, 2024

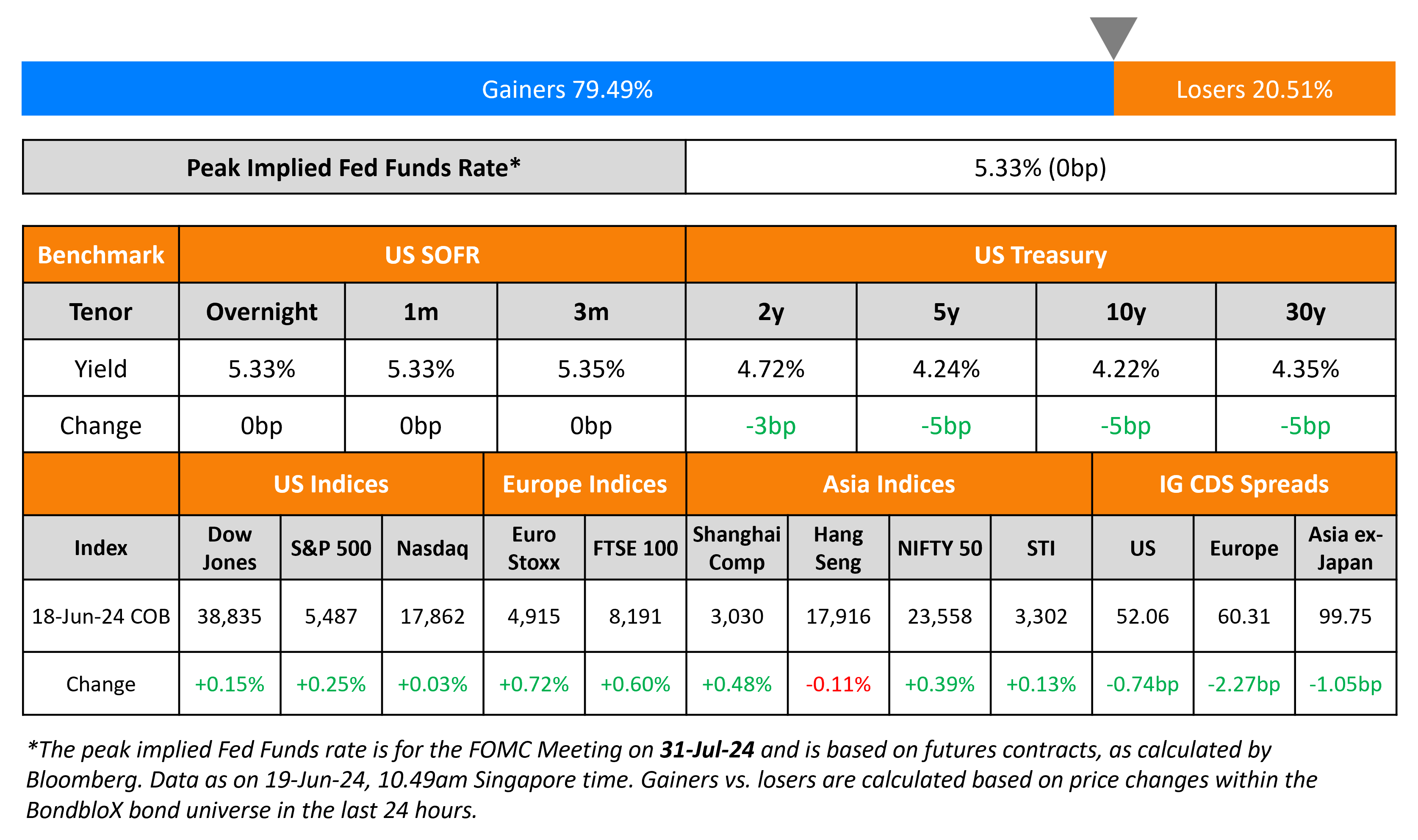

US Treasuries continued to rally, by 5bp across the board following softer-than-expected economic data. US Retail Sales rose by 0.1% in May, weaker than expectations of 0.3%, whilst April’s print was revised downward from 0% to -0.2%. Core retail sales rose 0.4% in May, lower than expectations of 0.5%, whilst the previous month’s print was revised lower to -0.5%. New York Fed’s John Williams said that he sees a “disinflationary process continuing” and he expects “inflation to keep coming down the second half of this year and next year”. While he added that the economy was moving in the “right direction”, he stopped short of saying when he would favor a rate cut. Separately, Boston Fed’s Susan Collins said that it was “too soon to determine whether inflation is durably” towards 2%, and that policy patience was warranted. US equity markets inched higher. US IG and HY CDS spreads tightened by 0.7bp and 4bp respectively.

European equity markets closed higher. Europe’s CDS spreads tightened further – the iTraxx Main and Crossover spreads tightened by 2.3bp and 9.3bp respectively. Asian equity indices have opened in the green this morning. Asia ex-Japan CDS spreads were tighter by over 1bp.

New Bond Issues

- BoC Johannesburg $ 3Y at SOFR+105bp area

- CapitaLand Group S$ 7Y at 4% area

Continuum Green Energy raised $700mn via a 9NC3 green bond at a yield of 7.50%, 12.5bp inside initial guidance of 7.625% area. The senior unsecured notes are rated Ba2/BB+ (Moody’s/Fitch). The bonds have a change of control put at 101. Proceeds will be used to prepay/repay existing debt in full or part, at Kutch Windfarm Development Pvt (KWDPL) and Continuum Trinethra Renewables Pvt (CTRPL). The covenants include cash sweeps at end of each period from 0.5Y onward, a graded debt service coverage ratio (DSCR) construct, a 6-month Debt Service Reserve Account (DSRA). The notes have a Weighted Average Life (WAL) of 7.11Y, and a make-whole call schedule at par+75% of coupon, 66%, 50%, 20% for every one-year period beginning 26 June 2027. At or after 26 June 2032, the call would be done at par. Bondholders will be secured by certain project assets/accounts and share pledges over 100% equity shares of co-issuers.

MGM China raised $500mn via a 7NC3 bond at a yield of 7.125%, ~25bp inside initial guidance of 7.25-7.50%. The senior unsecured notes are rated B1/B+/BB-. Proceeds will be used to repay a portion of the amounts outstanding under its revolving credit facility (RCF) and for general corporate purposes. The bonds have a put option at par upon the occurrence of certain events regarding termination, rescission, revocation or modification of gaming licenses. The bonds also have a change of control put.

Hyundai Capital America raised $3.75bn via a five-tranche issuance. Details are given in the table below:

The senior unsecured bonds are rated A3/BBB+/A-. Proceeds will be used for general corporate purposes.

Rating Changes

- Fitch Upgrades ENN Natural Gas to ‘BBB’; Revises Outlook on ENN Energy to Stable, Affirms ‘BBB+’

- Bank of Cyprus Upgraded To ‘BB+’ On Reduced Economic Imbalances And Stronger Capitalization; Outlook Positive

- Fitch Downgrades Intrum to ‘CCC’

- Moody’s Ratings changes Anglo American’s outlook to stable from positive; affirms Baa2

- Moody’s Ratings places Hellenic Bank’s ratings on review for upgrade

- Enbridge Inc. Outlook Revised To Stable From Negative On Close Of Acquisitions, Financing; Ratings Affirmed

Term of the Day

Significant Risk Transfer (SRT)

A Significant Risk Transfer (SRT) is a transaction where banks can deleverage their balance sheet by buying protection on diversified loan portfolios, so that they can release regulatory capital or manage risk. This is typically achieved by selling notes linked to a pool of loans that also include a credit derivative. Selling SRTs may help avoid using less investor friendly measures like dividend cuts, stopping share repurchases or raising new equity to boost regulatory capital levels. In 2023, as per Pemberton Asset Management, banks globally sold $25bn of SRTs, partially offloading the risk of $300bn of loans.

Talking Heads

On China Should Break QE Taboo, Widen Deficit – Ex-PBOC Adviser, Yu Yongding

“China doesn’t have to embark on massive QE just yet. But it’s necessary we shake off the thinking that QE is a taboo first so that we can launch it immediately when needed”

On French Bond Premium Risks Hitting Danger Zone – Candriam CIO

“The real question today is whether there’s a second wave and we are going to break 80 basis points, because if we break 80, we’ll be set for 100. If we break 80 it’s gonna hurt.”

On Suggesting Forecast Meetings Are Key for Rate Moves – ECB’s Guindos

“Forecasts are updated every three months — the next one is in September. It’s one of the most significant moments and the most interesting because the forecasts are an important indicator… The direction is clear in the mid-term, but in the short term it will depend on the data”

Top Gainers and Losers- 19-June-24*

Go back to Latest bond Market News

Related Posts: