This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

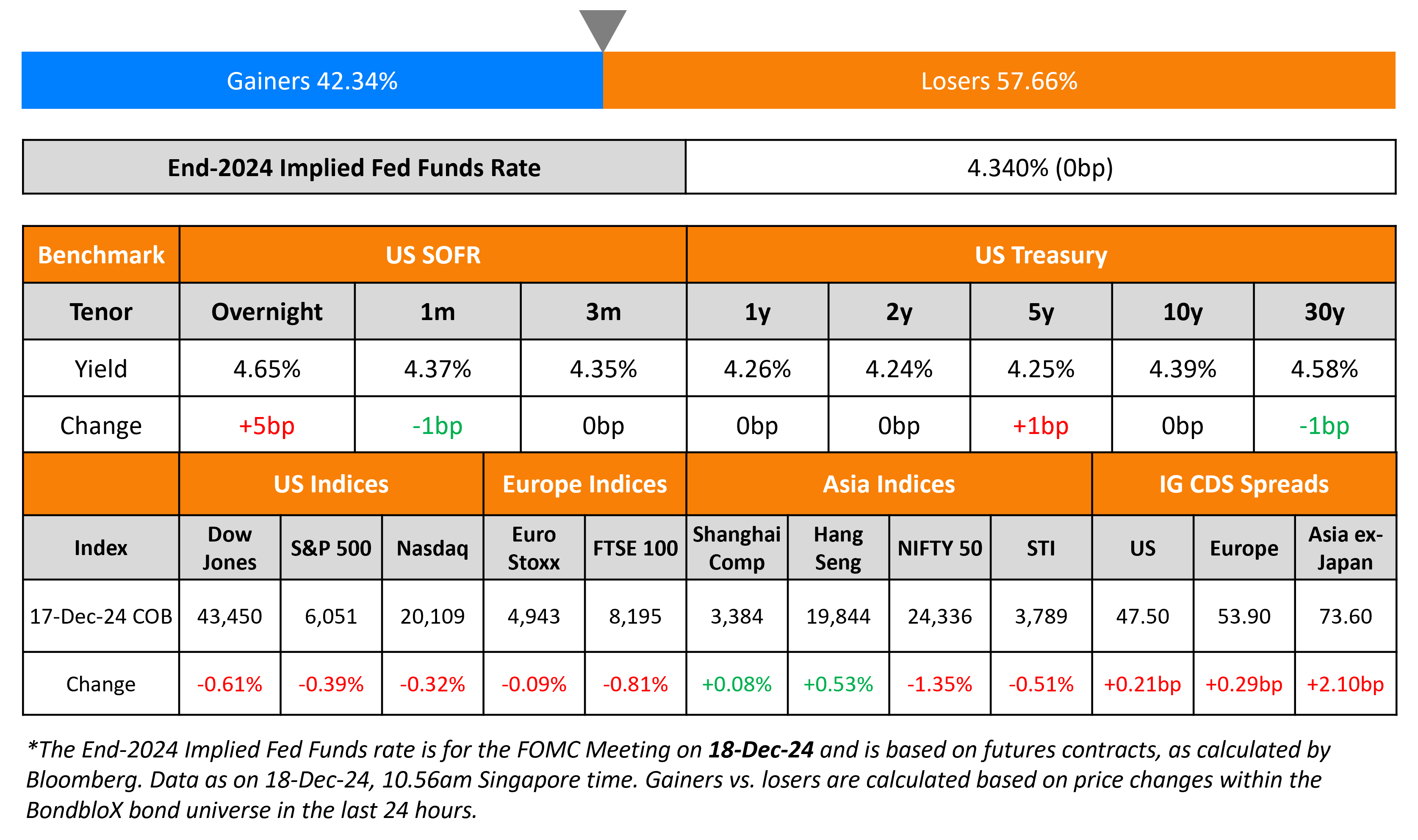

Retail Sales Improves; Markets Await FOMC

December 18, 2024

US Treasury yields were nearly unchanged on Tuesday. US Retail Sales for November came-in at 0.7% MoM above estimates of 0.6% and the prior month’s revised 0.5%. This was boosted by a jump in car purchases and online shopping during Black Friday. Core Retail Sales decelerated to 0.2% MoM vs. expectations of 0.4% and the prior month’s 0.2%.

US IG and HY CDS spreads widened by 0.2bp and 1.5bp respectively. Looking at US equity markets, the S&P ended flat while the Nasdaq ended 0.3% lower. European equities also ended lower. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.3bp and 1.4bp respectively. Asian equities have opened broadly mixed this morning. Asia ex-Japan CDS spreads were 2.1bp wider.

New Bond Issues

Rating Changes

-

Mallinckrodt PLC Upgraded to ‘BB-‘ On Material Deleveraging; Ratings Removed From CreditWatch; Outlook Stable

-

Moody’s Ratings downgrades the long-term deposit, senior unsecured debt and issuer ratings of seven French banks; outlook changed to stable

-

Fitch Revises Romania’s Outlook to Negative; Affirms at ‘BBB-‘

-

BRF S.A. Outlook Revised To Positive On Expected Low Leverage; ‘BB’ And ‘brAAA’ Ratings Affirmed

-

Moody’s Ratings affirms IHS’ B3 rating; changes outlook to positive

-

Moody’s Ratings changes Panasonic’s outlook to positive from stable; affirms Baa1 ratings

-

Moody’s Ratings places the issuer ratings of China Construction Bank (Europe) S.A. on review for downgrade

Term of the Day: Samurai Bonds

Samurai bonds are yen-denominated bonds issued by foreign entities in Japan. These bonds, which are subject to bond market regulations in Japan, are issued by foreign countries and corporations to attract Japanese investors. Another reason to issue Samurai bonds is to capitalize on lower interest rates in Japan compared to the issuer’s local market.

BPCE has launched a Samurai bond offering.

Talking Heads

On T. Rowe Raising Prospect of 6% Treasury Yields on Fiscal Risk

“Is a 6% 10‑year Treasury yield possible? Why not? But we can consider that when we move through 5%. The transition period in US politics is an opportunity to position for increasing longer‑term Treasury yields and a steeper yield curve.”

On Australia Is New Bond Market Favorite for JPMorgan Asset

“A lot of the Europe story has played out. Australian government bonds are the ones that probably are most attractive to us right now. That’s a more interesting near-term divergence story for us… Near-term, I think Europe is a little bit harder to see significant outperformance”

On Brazil Traders Selling First, Asking Later as Panic Sweeps Markets

Sergey Goncharov, Vontobel Asset

“Brazil has become ‘sell first, ask later’ in the current market. The fiscal concerns coupled with the central bank’s reaction to the FX move triggered some panic selling.”

Jack McIntyre, Brandywine Global

“It’s reached a crisis stage from a bond standpoint. Lula’s got to say something constructive.”

Olga Yangol, Credit Agricole

“Investors clearly have thrown in the towel”

Top Gainers and Losers- 18-December-24*

Go back to Latest bond Market News

Related Posts: