This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Resorts World Las Vegas; Macro; Rating Changes; New Issues; Talking Heads

July 19, 2023

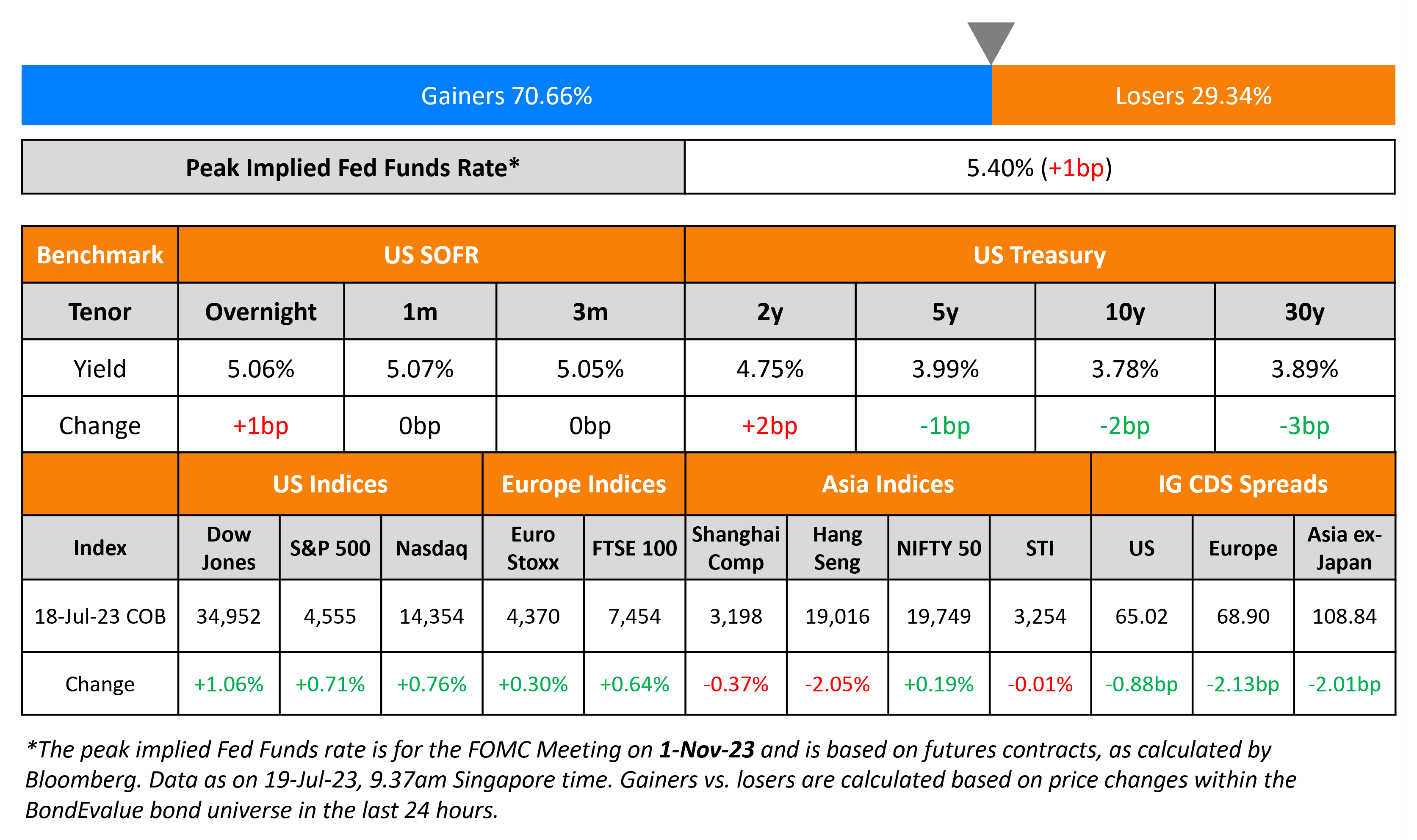

Treasury yields were mixed on Tuesday with the 2Y moving 2bp higher while the longer 10Y and 30Y moved 2-3bp lower. US retail sales rose by 0.2% in June, missing forecasts of a 0.5% increase and lower than May’s 0.5% rise. Core retail sales rose in-line with expectations at 0.6%. The peak Fed Funds rate was 1bp higher at 5.40%. US equity indices ended higher with the S&P and Nasdaq up 0.7-0.8% respectively. Credit spreads were tighter with US IG and HY CDS spreads tighter by 0.9bp and 5.2bp respectively.

European equity indices closed higher too with European main CDS spreads 2.1bp tighter and Crossover CDS were tighter by 6.7bp. Asia ex-Japan CDS spreads tightened by 2bp and Asian equity markets have opened mixed today. Primary markets had a busy day on Tuesday with prominent deals from Korean lenders and Gulf issuer.

New Bond Issues

- Resorts World Las Vegas $ 7Y at 8.9% area

- Mirae Asset $ 3Y at T+295bp area

Dar Al-Arkan raised $600mn via a long 5Y sukuk at a yield of 8.25%, 25bp inside initial guidance of 8.5% area. The senior unsecured bonds have expected ratings of B1 (Moody’s), and received orders over $1.55bn, 2.6x issue size.

Shinhan Financial raised $500mn via a 5Y social bond at a yield of 5.063%, 25bp inside initial guidance of T+135bp area. The senior unsecured bonds have expected ratings of A1/A (Moody’s/S&P). Proceeds will be used to finance/refinance projects in accordance with Shinhan Financial Group’s Sustainable Development Goals Financing Framework The new bonds offer a new issue premium of 19.3bp over its existing 4.5% social 2028s that yield 4.87%.

SMBC Aviation raised $1bn via a 10Y bond at a yield of 5.745%, 30bp inside initial guidance of T+225bp area. The senior unsecured bonds have expected ratings of A–/BBB+ (S&P/Fitch). The bonds come with a 3-month par call, a make-whole call and a change of control put at 101. Proceeds will be used for general corporate purposes, which may include the purchase of aircraft and the repayment of existing debt.

Wells Fargo raised $8.5bn via a two-part deal. It raised $4.25bn via a 6NC5 bond at a yield of 5.574%, 22bp inside initial guidance of T+180bp area. It also raised $4.25bn via a 11NC10 bond at a yield of 5.557%, 22bp inside initial guidance of T+200bp area. If the 6NC5s are not called after 5 years, the coupon will be reset at the overnight SOFR plus 174bp and be paid quarterly. If the 11NC10s are not called after 10 years, the coupon will be reset at the overnight SOFR plus 199bp and be paid quarterly. The new 11NC10s offer a new issue premium of 5.7bp over its existing 5.389% 2034s that yield 5.5%. The senior unsecured bonds have expected ratings of A1/BBB+/A+.

Saudi dairy company Almarai raised $750mn via a 10Y sukuk at a yield of 5.233%, 35bp inside initial guidance of T+180bp area. The senior unsecured bonds have expected ratings of Baa3/BBB-, and received orders over $4bn, 5.3x issue size.

UAE state-owned renewable energy company Masdar raised $750mn via a 10Y debut green bond at a yield of 4.939%, 35bp inside initial guidance of T+150bp area. The senior unsecured bonds have expected ratings of A2/A+ (Moody’s/Fitch), and received orders over $4.2bn, 5.6x issue size. Proceeds will be used to finance/refinance certain `Eligible Green Projects’ in accordance with the Issuer’s Green Finance Framework.

New Bond Pipeline

- KEPCO hires for $ 3Y and/or 5Y Sustainability bond

Rating Actions

- Fitch Downgrades Total Play’s Ratings to ‘B+’; Placed on Rating Watch Negative

- Fitch Downgrades Canopy’s IDR to ‘RD’ on Exchange and Upgrades to ‘CCC- ‘; Withdraws All Ratings

Term of the Day

Term Premium

The term premium is the yield premium that investors expect to receive in order to be compensated for lending for longer periods as compared to shorter periods. The term structure of interest rates in a normal scenario would imply that longer term yields are higher than short term yields. However, research by the BIS and other institutions note that the term premium can also be affected by other factors, thereby reducing the yield compensation – for example flight to quality towards long-end treasuries, liquidity considerations etc.

Goldman’s chief economist notes that the term premium is lower than its long-term average in the current yield curve inversion being seen in the US.

Talking Heads

On Fed Interest Rate Decisions Following Softening Inflation Data

Jan Nevruzi, US rates strategist at NatWest Markets

“For the Fed, despite the soft CPI print, we still anticipate a hike in July … (and) while we hope the softness in inflation persists, it is unwise from a policymaking standpoint to bank on that…We do not want to rush ahead and say the fight against inflation has been won, as we have seen head-fakes in the past.”

Doug Porter, chief economist at BMO Capital Markets

“While the latest figures are encouraging, the real battle begins now, as the easy base effects are now behind us…As the disinflationary force of lower energy prices fades, that will leave us dealing with the underlying 4% trend in core … (and) to truly crack core will likely require a more significant slowing in the economy.”

On Disinflationary Pressures in the US – US Treasury Secretary Janet Yellen

“The intensity of hiring demands on the part of firms has subsided…The labor market’s cooling without there being any real distress associated with it…Housing had a reduced contribution (to core inflation), and there’s every reason to believe that that will continue and come down further…That’s an important thing that influences core inflation.”

Vedanta is awaiting government approval for incentives under a modified semiconductor production plan to begin construction of a plant in the country’s western state of Gujarat, for which it has tapped technology and equity partners. (Vedanta) has engaged with more than 100 global suppliers and ancillary industries which will form a key part of the semiconductor and display ecosystem. The group already has a partnership with Taiwan’s Innolux for display fab manufacturing.

On ECB Interest Rate Decisions Beyond July

Klaas Knot, ECB Governing Council member

“For July I think it is a necessity, for anything beyond July it would at most be a possibility but by no means a certainty…From July onward I think we have to carefully watch what the data tells us on the distribution of risks surrounding the baseline.”

Theophile Legrand, strategist at Natixis

“The market has been too convinced of a terminal rate of 4% after the June meeting and is now starting to realise that there is considerable uncertainty for September…If the hawks also start to talk about uncertainty, the terminal rate at 3.75% is a real possibility.”

Top Gainers & Losers – 19-July-23*

Go back to Latest bond Market News

Related Posts: