This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Rakuten Prices $ Bond at 12.125%; Markets Await FOMC

January 31, 2024

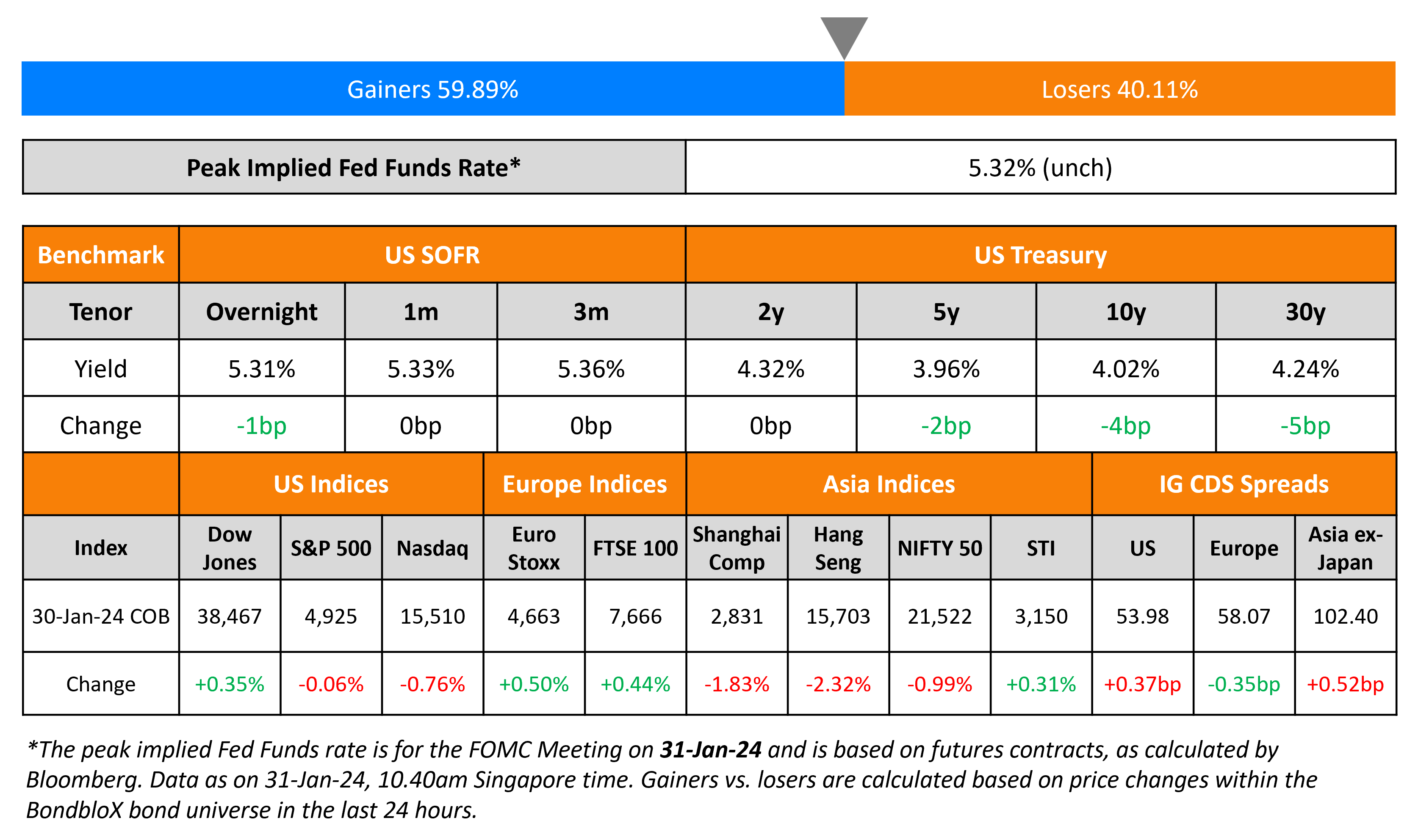

US Treasury yields were broadly steady across the curve on Tuesday with markets awaiting the FOMC meeting later today. While the policy Fed Funds Rate is expected to be unchanged, insights on the path of interest rates are said to be keenly watched out for. US consumer confidence rose in January to the highest level since the end-2021, from a revised 108 to 114.8. Looking at credit markets, US IG CDS spreads widened 0.4bp and HY spreads were 4bp wider. Equity markets saw the S&P and Nasdaq fell 0.1% and 0.8% respectively.

European equity markets ended flat. Credit markets in the region saw the European main CDS spreads tighten by 0.4bp while crossover spreads tightened by 1bp. Eurozone’s economy stagnated last year, following weakness in Germany. Germany’s GDP shrank by 0.3% in 4Q 2023, while the bloc saw growth remain flat vs. 0.1% in Q3, helped by expansions in Spain and Italy. Reuters notes that it is the sixth consecutive quarter of no or little growth. Asian equity markets have opened in the red today. Asia ex-Japan IG CDS spreads widened by 0.5bp.

.png)

New Bond Issues

- Science City Guangzhou Investment $ 1.5Y Green at 7.2% area

- Qingdao Huatong $ 3Y at 7.3% area

Rakuten Group raised $1.8bn via a 3Y bond at a yield of 12.125%, 12.5bp inside initial guidance of 12.25% area. The senior unsecured bonds are unrated. The deal was upsized from $1bn.The company had launched a tender offer earlier this week, to buy back up to $1bn of its dollar bonds due 2024, exclusive of accrued and unpaid interest.

Ji’an Chengtou Holding raised $173.7mn via a 3Y green bond at a yield of 7.5%, 30bp inside initial guidance of 7.8% area. The senior unsecured bonds are unrated. The notes have a change of control put at 101 and proceeds will be used to finance/refinance existing debt in accordance with is green finance framework.

New Bond Pipeline

- Greenko Plans for up to $450mn bond

Rating Changes

- Moody’s upgrades Noble’s senior notes to B1

- Lumen Technologies Inc. Downgraded To ‘CC’ From ‘CCC+’ On Amended Transaction Support Agreement, Outlook Negative

- Fitch Downgrades Televisa’s Ratings to ‘BBB’; Outlook Negative

Term of the Day

Schuldschein

Schuldschein (pronounced schuld-shine) is a debt instrument popular with German issuers that is similar to a bond albeit with lower expenses for the issuer. These instruments do not need to be registered at an exchange, thereby reducing documentation and time taken. They are more flexible than a bond, as they can be adjusted to the customer’s needs regarding repayment terms, drawdown periods, etc. and thus have some features of loans. Commerzbank notes that Schuldschein transactions can be arranged very quickly, with a tenor of 2 and 5 years, in order to improve asset-liability management (ALM). Lending can be done by one bank, which might look for participants afterwards.

Volkswagen earlier this week planned to raise financing from the Schuldschein market.

Talking Heads

On US Facing a ‘Death Spiral’ of Swelling Debt – Nassim Taleb

“Eventually you’re going to have a debt spiral…. we need something to come in from the outside, or maybe some kind of miracle…. This makes me kind of gloomy about the entire political system in the Western world”

On global ‘soft landing’ in sight, lifting 2024 growth outlook – IMF

“The global economy continues to display remarkable resilience, with inflation declining steadily and growth holding up. The chance of a ‘soft landing’ has increased… very far from a global recession scenario”

On cooling inflation could lead to Fed rate cuts this summer – Citadel’s Ken Griffin

Cooling inflation in USA gives the Fed room to potentially start cutting rates this summer… “We are still engaged in a reckless level of federal spending. That is creating a very different backdrop for the economy than any point in prior history”

On the path of yields looking at history – Sebastian Hillenbrand, economist teaching at HBS

“If you take the patterns seriously, yields have to come down”… most recently it likely registers bursts of confidence that the Fed’s benchmark rate will come back down… lot of things that the Fed doesn’t have control over… These forces could have increased yield volatility dramatically over the last two, three years… might not be that relevant for the long run”

Top Gainers & Losers- 31-January-24*

Other News

Gol airline receives court approval to borrow $350mn in bankruptcy

Go back to Latest bond Market News

Related Posts: