This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Qatar, Bombardier Price $ Bonds; FOMC Minutes Reiterate Need for More Data

May 23, 2024

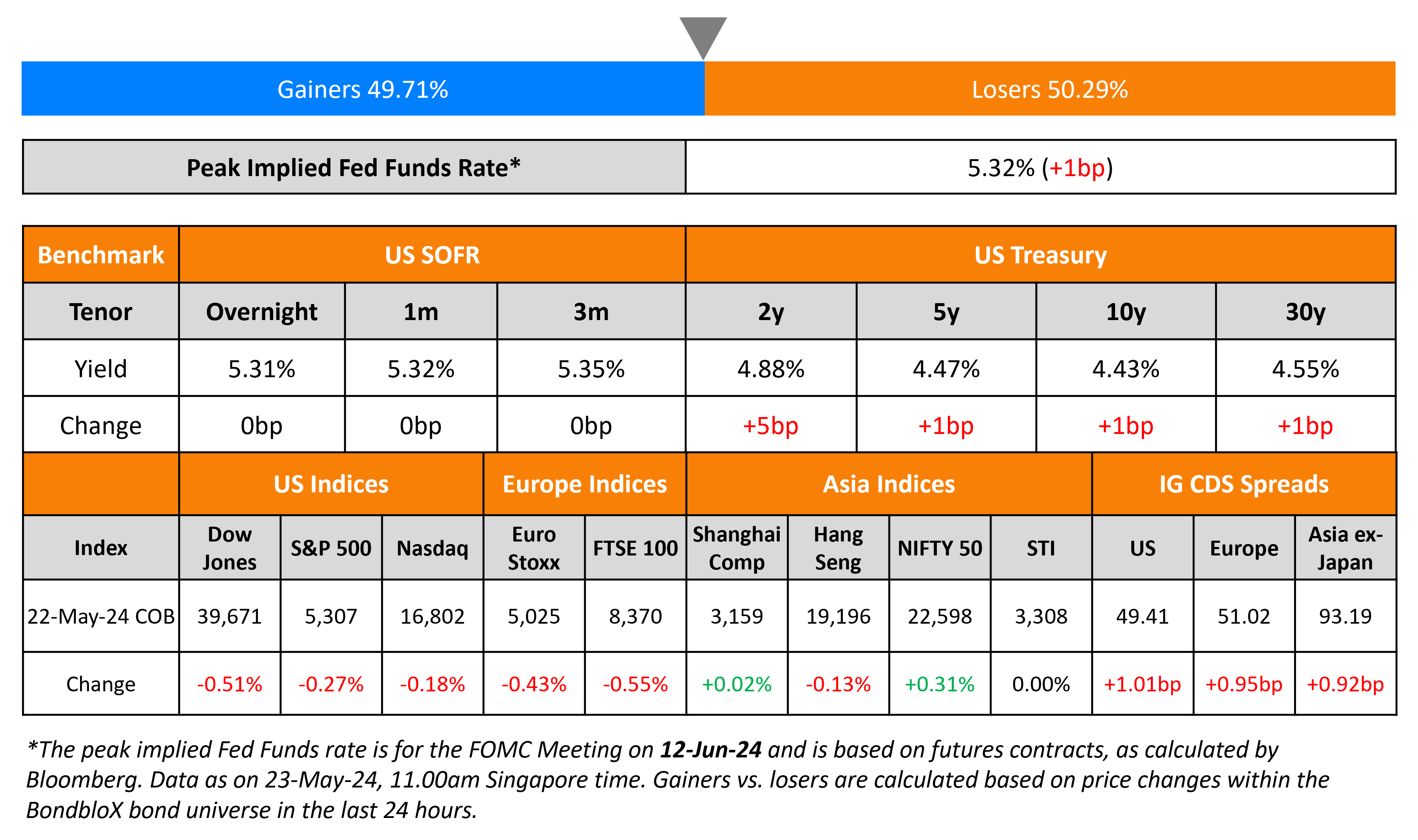

US Treasury yields were broadly steady across the curve. The Fed’s May meeting minutes were released yesterday – the FOMC “noted disappointing readings on inflation over the first quarter and indicators pointing to strong economic momentum”. They assessed that it “would take longer than previously anticipated” to gain “greater confidence that inflation was moving sustainably toward 2%”.

Several Fed speakers also came out with their assessment on monetary policy. Cleveland Fed President Loretta Mester said that she would like to see “a few more months of inflation data that looks like its coming down” before cutting interest rates. Similarly, Boston Fed President Susan Collins said that she wants to see more evidence that price pressures are moving towards the 2% target, adding that it would take longer than previously expected. Fed Governor Christopher Waller on the other hand, said there could be rate cuts at the end of this year if data continues to soften over the next 3-5 months. S&P and Nasdaq closed 0.2-0.3% lower. US IG CDS spreads widened 1bp and HY spreads were 2.9bp wider.

European equity markets ended lower too. Europe’s iTraxx main CDS spreads were 1bp wider while crossover spreads were wider by 1.3bp. ECB President Christine Lagarde said that an interest-rate cut is probable next month, given that they “have inflation under control”. Asian equity indices have opened in the red this morning. Asia ex-Japan CDS spreads tightened 0.9bp tighter.

New Bond Issues

- Shandong Hi-Speed $ PerpNC3 at 6.95% area

- TFI Overseas Investment $ 2Y at 6.9% area

- CSC Financial $ 3Y FRN at SOFR+115bp area

Qatar raised $2.5bn via a two-tranche green issuance. It raised $1bn via a 5Y bond at a yield of 4.739%, 40bp inside initial guidance of T+70bp area. It also raised $1.5bn via a 10Y bond at a yield of 4.818%, 40bp inside initial guidance of T+80bp area. The bonds are rated Aa2/AA/AA. Net proceeds will be used to finance new, or refinance, in part or in full, certain eligible green projects as set out in the Issuer’s Green Financing Framework. This was the nation’s first issuance of dollar bonds in four years. The new 5Y bond was priced roughly in-line with its existing 4% bonds due March 2029.

Bombardier raised $750mn via an 8NC3 green bond at a yield of 7%, 12.5bp inside initial guidance of 7.125% area. The senior unsecured notes are rated B1/B. Proceeds, together with cash on hand will be used to fund the repayment and/or retirement of outstanding debt, including $240mn of its outstanding 7.125% 2026s and $300mn of its outstanding 7.875% 2027s.

Singapore raised S$2.5bn via a 30Y green bond at a yield of 3.3%, 16bp inside initial guidance of 3.46% area. The bonds are rated Aaa/AAA/AAA. Proceeds will be used in accordance with SINGA and the Singapore green bond framework.

Emirates Islamic Bank raised $750mn via a 5Y sukuk at a profit rate of 5.431%, 30bp inside initial guidance of T+130bp area. The senior unsecured notes are rated A+. Proceeds will be used in whole or in part, towards new or existing Shariah-compliant financing or investments in accordance with Emirates NBD Group’s sustainable finance framework and in compliance with Shariah rules and principles as determined by the Emirates Islamic Internal Shariah Supervision Committee.

Citigroup raised $1.75bn via a PerpNC5 preference share at a yield of 7.125%, 25bp inside initial guidance of 7.375% area. The SEC-registered notes are rated Ba1/BB+/BBB-. Proceeds will be used for general corporate purposes. The depositary shares, each represent a 1/25th interest in a share of perpetual fixed rate reset non-cumulative preferred stock, Series CC.

New Bonds Pipeline

-

Coca-Cola hires for $ bond

- Uzbekistan hires for $ 7Y bond

- Amcor hires for $ 5Y bond

Rating Changes

- SoftBank Group Upgraded To ‘BB+’ And Subordinated Debt To ‘B+’ On Improvement In Asset Quality; Outlook Stable

- Koc Holding Upgraded To ‘BB’ Following Positive Action On Turkiye; Outlook Positive

- Air Baltic Upgraded To ‘B+’ And Off CreditWatch Positive On Debt Refinancing And Improved Credit Metrics; Outlook Stable

- Moody’s Ratings downgrades Ecopetrol to Ba1 and changes outlook to stable

- Fitch Downgrades Petroperu to ‘CCC+

Term of the Day

Fallen Angel

A fallen angel is a company or sovereign whose credit rating has been cut from investment grade to junk due to deteriorating financial conditions of the company. The downgrade to junk may have a negative impact on its bond prices as asset managers that are mandated to hold only investment grade debt may be forced to sell off their holdings in the fallen angels.

Talking Heads

On Fed unlikely to cut rates this year – Goldman Sachs CEO, David Solomon

“I’m still at zero cuts. I think we’re set up for stickier inflation… Inflation is not just nominal, it’s cumulative… starting to see the average American slowing down and changing his habits”

On India Needing ‘Balancing Act’ to Manage Bond Index Flows – S&P

Indian policymakers will face a “balancing act” in managing anticipated foreign capital inflows from its bonds’ inclusion in key global indexes. Tapping the $644bn reserves to tame volatility is an option, but that can be “fairly costly”.

Top Gainers & Losers- 23-May-24*

Go back to Latest bond Market News

Related Posts: