This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Primary Markets See HSBC, BNP, Fosun and Others Price $ Bonds

November 13, 2024

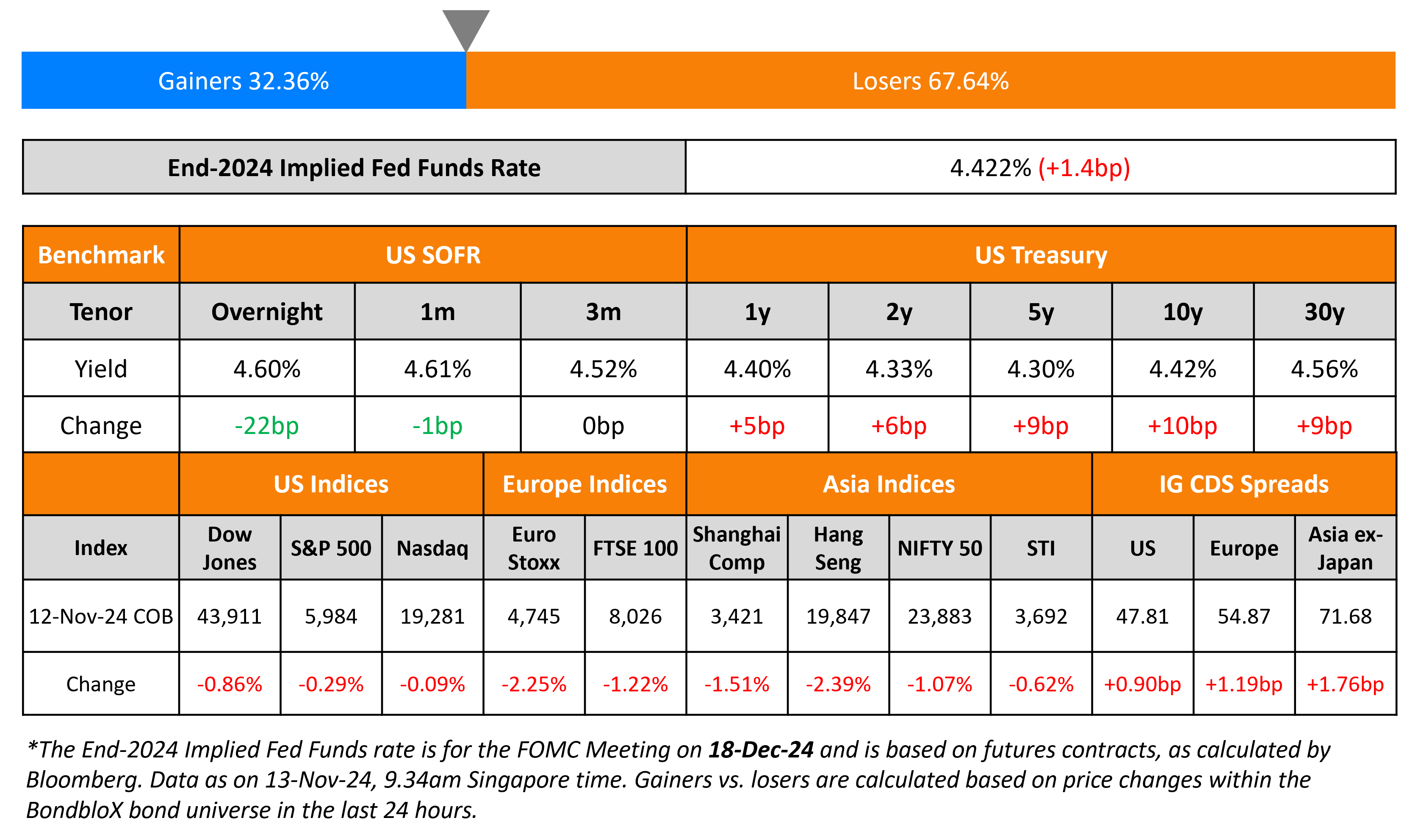

US Treasuries slumped yesterday, with the 2Y yield up by 6bp and the 10Y up by 10bp. Citi Strategist David Bieber commented that while the market was correctly positioned for the election result, it was broadly underinvested in terms of treasury hedges. In addition to this, CPI data for the month of October is scheduled to be released later in the evening, with a higher headline reading than prior months. US IG and HY CDS spreads widened by 0.9bp and 4.8bp respectively. Looking at US equity markets, the S&P and Nasdaq both closed lower by 0.3% and 0.1% respectively.

European equities closed much lower across the board. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 1.2bp and 6.5bp respectively. Asian equities opened broadly lower this morning. Asia ex-Japan CDS spreads widened by 1.8bp.

New Bond Issues

- China $ 3Y/5Y at T+25bp/30bp areas

![]()

HSBC raised $1.75bn via a 11NC10 Tier 2 bond at a yield of 5.874%, 25bp inside initial guidance of T+170bp area. The subordinated notes are rated Baa1/BBB/A-. Also, BNP Paribas raised $1.75bn via a 11NC10 Tier 2 bond at a yield of 5.906%, 32bp inside initial guidance of T+180bp area. The subordinated notes are rated Baa2/BBB+/A-.

HSBC raised $4.75bn via a four-trancher. Details are given in the table below:

The senior unsecured notes are rated A3/A-/A+. Proceeds will be used for general corporate purposes.

BNP Paribas raised $1.75bn via a 6NC5 bond at a yield of 5.283%, 32bp inside initial guidance of T+130bp area. The senior non-preferred notes are rated Baa1/A-/A+. Proceeds will be used for general corporate purposes.

Citibank NA raised $3bn via a two-part deal. It raised $2.2bn via a 3NC2 bond at a yield of 4.88%, 17bp inside initial guidance of T+70bp area. It also raised $800mn via a 3NC2 FRN at SOFR+71.2bp vs initial guidance of SOFR equivalent area. The senior bank notes are rated Aa3/A+/A+. Proceeds will be used to finance or refinance in whole or in part, “Social Finance Assets”, in accordance with its social bond framework. Separately, Citigroup Inc raised $1.25bn via a 10NC5 bond at a yield of 5.59%, 22bp inside initial guidance of T+150bp area. The subordinated notes are rated Baa2/BBB/BBB+. Proceeds will be used for general corporate purposes.

South Africa raised $3.5bn via a two-part deal. It raised $2bn via a 12Y bond at a yield 7.1%, 30bp inside initial guidance of 7.4% area. It also raised $1.5bn via a 30Y transition bond at a yield of 7.95%, 30bp inside initial guidance of 8.25% area. The senior unsecured notes are rated Ba2/BB-/BB-. Proceeds will be used to pay its foreign currency commitments, subject to Section 71 of the South African Public Finance Management Act dated 1999.

ANZ Bank raised S$600mn via a 10NC5 bond at a yield of 3.75%, 35bp inside initial guidance of 4.10% area. The subordinated notes are rated A3/A-/A-, as compared to the issuer’s ratings of Aa2/AA-/AA-. The issuer has the right to call the notes in whole, but not in part, at par on 15 November 2029 subject to prior written approval of Australian Prudential Regulation Authority (APRA). The notes are subject to mandatory conversion into ordinary shares of ANZ if a non-viability trigger event occurs. If conversion has not taken place within five business days on the trigger event, then a write-off will occur.

SocGen raised $1.5bn via a two-part deal. It raised $1.1bn via a 2.25Y bond at a yield of 5.256%, 23bp inside initial guidance of T+115bp area. It also raised $400mn via a 2.25Y FRN at SOFR+110bp vs. initial guidance of SOFR equivalent area. The senior non-preferred notes are rated Baa2/BBB/A-. The new bonds are priced tighter to its existing 6.447% senior non-preferred 2027s that yield 5.38%.

Goldman Sachs raised $3bn via a 21NC20 bond at a yield of 5.561%, 25bp inside initial guidance of T+110bp area. The senior unsecured notes are rated A2/BBB+/A. Proceeds will be used for general corporate purposes.

Fosun raised $300mn via a 3.5NC2 bond at a yield of 8.5%, 37.5bp inside initial guidance of 8.875% area. The senior unsecured notes are rated BB- by S&P. The notes are callable at 104.25%, at any time from 19 November 2026 to 18 November 2027. Also, they are callable at 102.125%, any time on or after 19 November 2027. Proceeds will be used to refinance some of its offshore debt, including any payment in connection with the concurrent buyback offer, and for working capital and general corporate purposes.

Westpac raised $3bn via a three-part deal. It raised:

- $750mn via a 2Y bond at a yield of 4.62%, 22bp inside initial guidance of T+50bp area. The senior unsecured bonds are rated Aa2/AA-. The new bonds are priced at a new issue premium of 10bp over its existing 1.15% 2026s that yield 4.52%.

- $750mn via a 2Y FRN at a yield of SOFR+46bp. The senior unsecured bonds are rated Aa2/AA-.

- $1.5bn via a 11NC10 bond at a yield of 5.62%, 30bp inside initial guidance of T+150bp area. The Tier 2 notes are rated A3/A-/A-.

Proceeds will be used for general corporate purposes.

Term of the Day

Transition Bonds

Transition bonds are bonds aimed at industries with high greenhouse gas (GHG) emissions a.k.a. “brown industries” to raise capital with the objective of becoming less brown and thereby shift to greener business activities. Industries issuing transition bonds could range from mining, utilities, transport, chemicals etc. These bonds are different from ‘Green Bonds’ in that the use of proceeds is less clear; also the latter are generally issued by industries/companies already on the path of reducing emissions.

Talking Heads

On Trump’s Policies May See Return of ‘Bond Vigilantes’ – Nouriel Roubini

“The market discipline is going to be quite quick” if Trump pushes to make his 2017 tax cuts permanent… could curb against more “radical” economic policies… Trump “cares about market discipline”

On US stocks are ‘good thing’ to hold now – Bridgewater co-CIO, Karen Karniol-Tambour

“We probably still have room to run on growth, even under a scenario of tariffs with a lot of the unknowns”… US stocks are a “good thing” to hold, expecting robust economic growth under President-elect Donald Trump.

On US Companies Storming Debt Markets After Risk Premiums Plunge – Ken Monaghan, Amundi Asset

“Nearly all the market’s immediate needs in terms of refinancing for 2025 have already been handled… question therefore is going to be refinancing for maturities in 2026 and beyond, and what kind of new issuance we’ll see as it relates to M&A.”

Top Gainers & Losers – 13 Nov 2024*

Go back to Latest bond Market News

Related Posts:

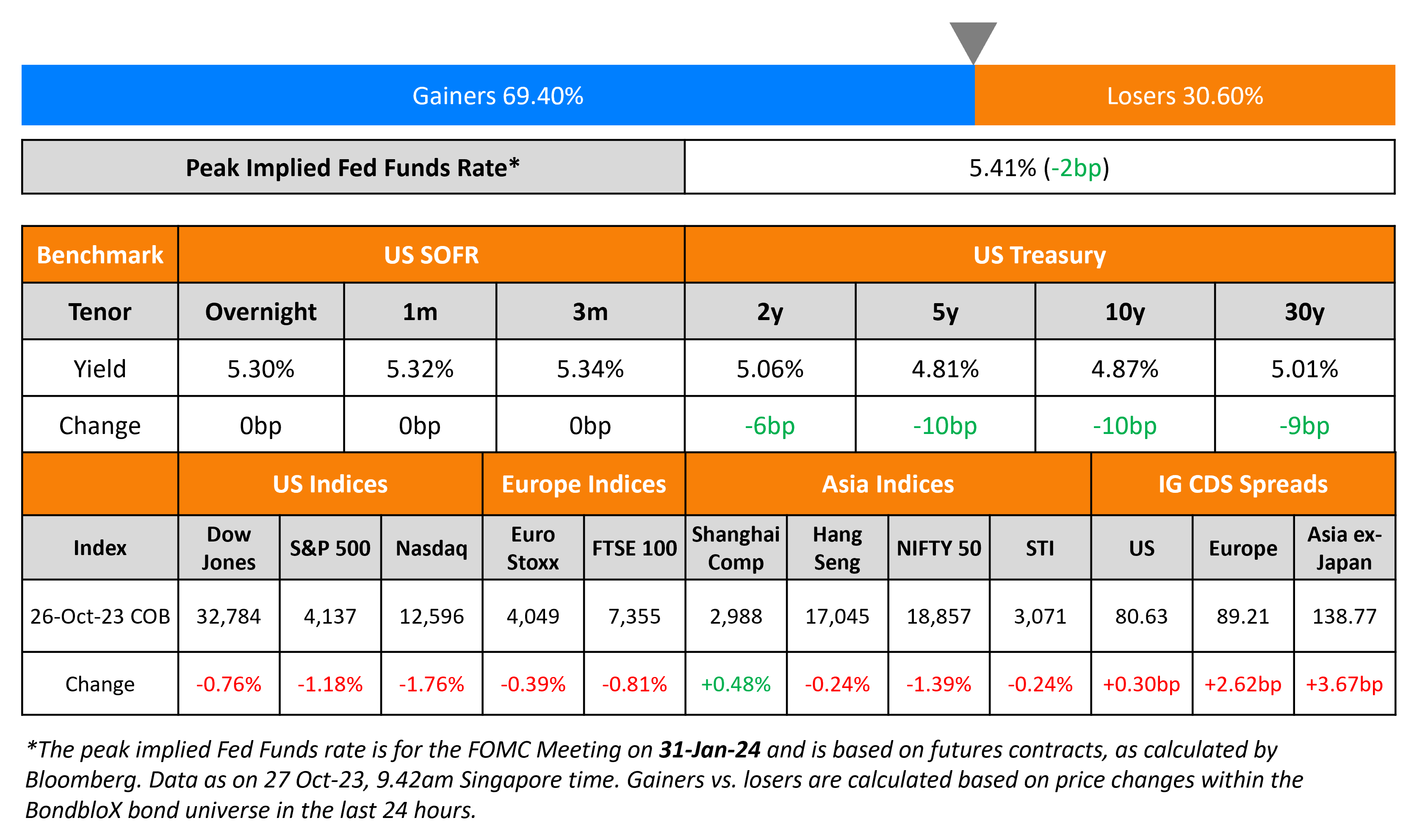

US Economy Grew at 4.9% in Q3; Treasury Yields Move Lower

October 27, 2023

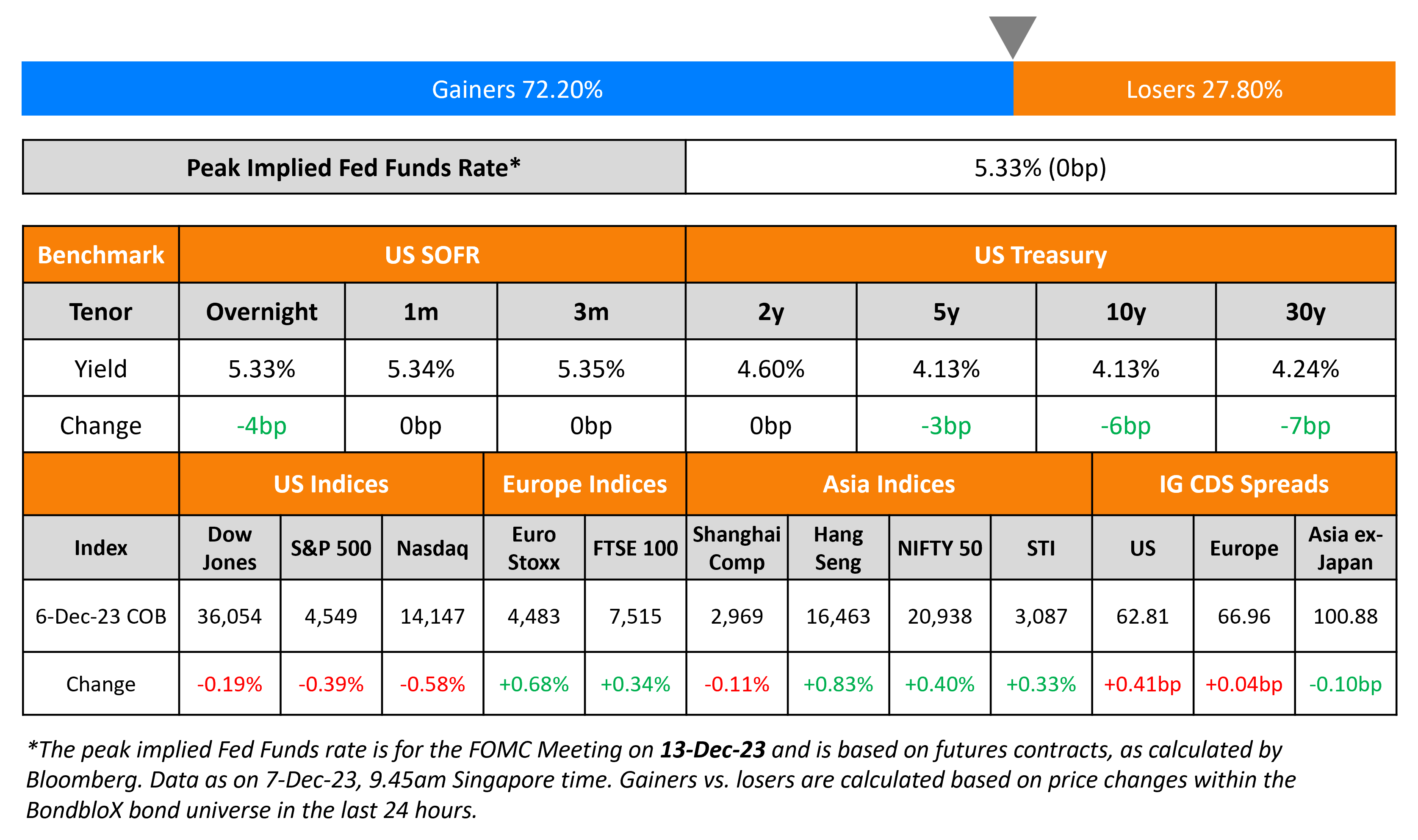

ADP Payrolls Softer Than Expected

December 7, 2023