This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Powell Hints At Rate Cuts Saying, “Time Has Come for Policy to Adjust”

August 26, 2024

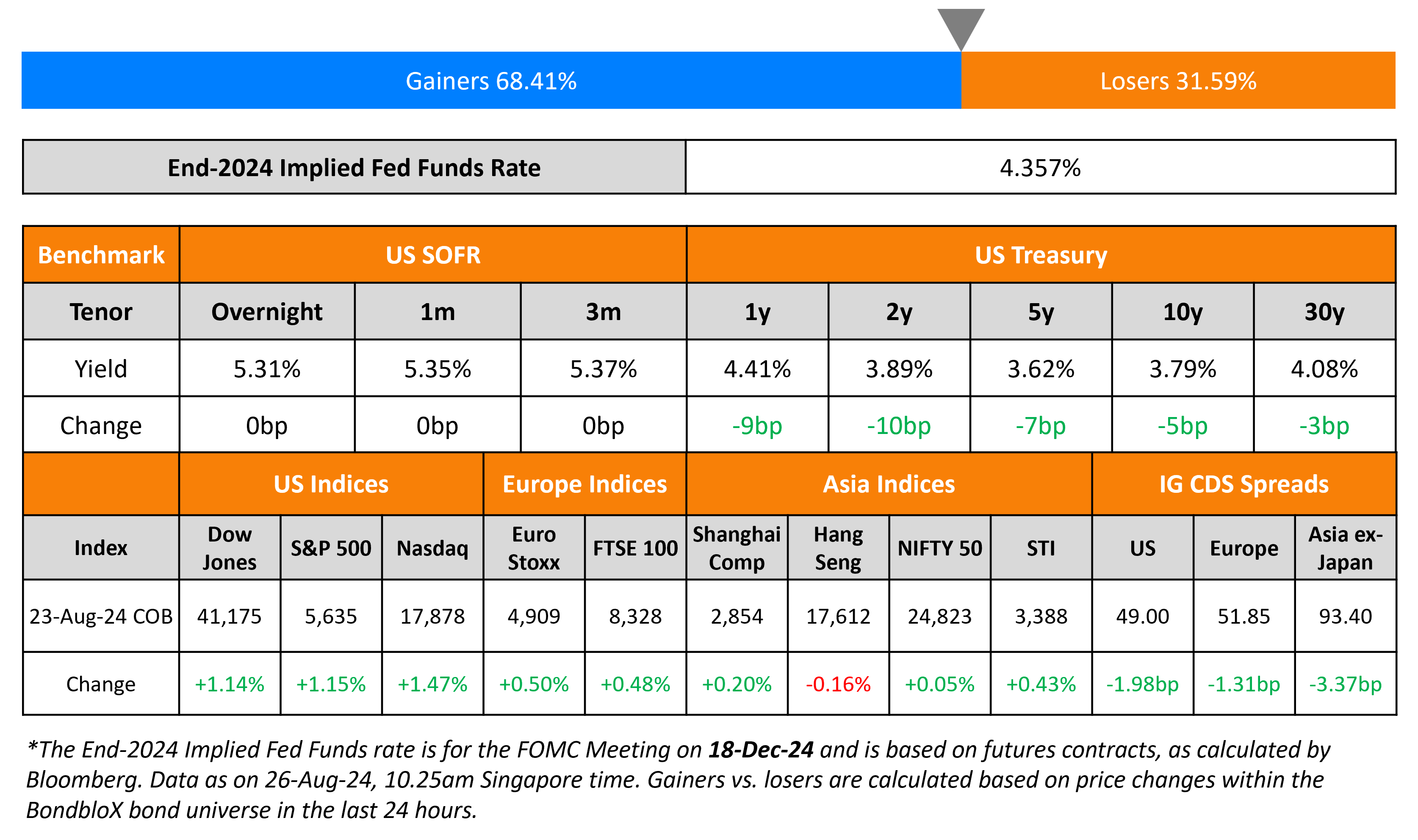

US Treasury yields dipped across the curve, led by the 2Y yield down by 10bp while the 10Y yield was down 5bp. At the Jackson Hole meeting, Fed Chairman Jerome Powell said that the “time has come for policy to adjust”, adding that the “direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks”. He further noted that current level of the fed funds rate gave them “ample room to respond to any risks”. US IG CDS spreads tightened by 2bp while HY CDS spreads tightened by 13bp. Looking at US equity indices, the S&P and Nasdaq were up by 1.2% and 1.5% respectively.

European equity markets ended higher too. Looking at Europe’s CDS spreads, the iTraxx Main spreads tightened 1.3bp while Crossover spreads were tighter by 6.6bp. Asian equity indices have opened mixed this morning. Asia ex-Japan CDS spreads were 3.4bp tighter.

New Bond Issues

- Jingzhou Municipal Urban $ 3Y Sust. at 7% area

- Jinan Financial Holding $ 3Y at 6.7% area

Rating Changes

- Moody’s Ratings downgrades Mercer’s CFR to B2; outlook negative

- Kenya Downgraded To ‘B-‘ On Weaker Fiscal And Debt Trajectory; Outlook Stable

- TMK Hawk Parent Corp. Downgraded To ‘CCC’ On Near-Term Refinancing Risks And Negative Cash Flow; Outlook Negative

Term of the Day: Jackson Hole

Jackson Hole, Wyoming is the location of The Federal Reserve Bank of Kansas City’s annual monetary policy symposium, one of the most important events attended by central bankers and economists across the globe. The conference is typically held in-person although it was run virtually for two years due to the pandemic. The symposium has an interesting history with the venue being shifted to Jackson Hole in 1982 to entice then Fed Chair Paul Volcker to attend. Volcker was an avid fly fisherman and Jackson Hole has world class trout fishing. In particular, the Jackson Hole meet is generally looked at as a key event that offers more depth into the insight of central bankers, especially the Federal Reserve Chairman’s policy stance and outlook.

Talking Heads

On Junk Bond Maturity Wall Erodes as Money Managers Seek Yield

George Curtis, TwentyFour Asset Management

“Is less of a wall now. Maybe a fence. The market has been in a pretty good place. Macro has been more stable, while the high yield market has seen decent inflows.”

Olof Svensson, EQT

“Over the past 12 months, we have executed more than 20 maturity extensions across the portfolio”

Marco Stoeckle, Commerzbank

“Given the improved rates momentum, the funding outlook is no longer as toxic as in large parts of 2022 and 2023”

On Fed’s actions spoke louder than words in inflation fight: Research

Michael Bauer, San Francisco Fed & Carolin Pflueger, University of Chicago

“Forecasters and markets were highly uncertain about the monetary policy rule prior to ‘liftoff’ and learned about it from the Fed’s rate hikes… Substantial rate hikes were apparently necessary for perceptions to shift”

On Fed Recovered From ‘Egregious’ Inflation Mistake – Former US Treasury Secy., Larry Summers

“I’ve got to give the Fed credit. While it wasn’t always obvious that this would be the case, they moved strongly enough and vigorously enough to keep expectations anchored… We all make lots of mistakes — and the important thing is, when you make a mistake, to recognize it and fix it”

Top Gainers & Losers-26-August-24*

Go back to Latest bond Market News

Related Posts: