This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Performance of APAC and Middle East Bank AT1s and Tier 2s

December 21, 2023

In the table below, we have compiled a list of AT1s and Tier 2 bonds from popular APAC and Middle East banks, sorted by change in credit spreads through the year. Make sure to switch between AT1s and Tier 2 via the tabs below the title. While page 1 lists bonds that saw the most tightening in spreads, pages 2 and 3 includes bonds that witnessed a widening in spreads.

Looking at dollar AT1s and Tier 2s from Asian banks, z-spreads broadly tightened across the spectrum. Major tightening was idiosyncratic and seen for issuers' notes that are approaching their call dates in the first half of 2024. This included Kuwaiti lender Burgan Bank's 5.749% Perp that saw a ~900bp tightening in its yield-to-call. Burgan was helped by a 52% stake sale in its Turkish unit that improved its financial position. Meanwhile Chong Hing's Perps tightened with the continued impact of its HK$ 5.3bn ($680mn) capital injection from Yuexiu in 2022. Rizal's Perps benefitted from a 15% stake sale to Japan’s SMBC. Broadly, the larger moves in tightening of these perps were idiosyncratic.

Amongst AT1s that widened, Bank East Asia's Perps saw the largest expansion. This was likely on account of the bank's exposures to the real estate sector and increasing impaired loans that later led Moody's to change its outlook to negative. At the end of last year, AT1s from the Middle East region traded tighter vs. European Bank AT1s, a phenomenon which has moderated over the course of 2023. Based on data from our bond universe, the average spread for European AT1s at end-2022 was 438bp while that of Middle East AT1s was 273bp. Currently, the average spread for European AT1s is at 348bp while that for Middle East AT1s is at 321bp.

Similar to European Tier 2s, credit spreads of Tier 2 dollar bonds from APAC and Middle East tightened as well. Among them, Turkey's Tier 2 bonds tightened the most, in-line with the sovereign performance, followed by those from Australia and New Zealand.

Disclaimer

The materials and information contained herein are solely for general information reference and educational purposes only, and not intended to constitute nor as a substitute for legal, commercial and/or financial advice from an independent licensed or qualified professional. The information, opinions and views expressed herein are not, and shall not constitute an offer or a recommendation to sell, a solicitation of an offer to buy or an offer to purchase any securities, nor should it be deemed to be an offer, or a solicitation of an offer, or a recommendation, to purchase or sell any investment product or service or engage in any investment strategy. Nothing herein has been tailored to the investment objectives or financial situation of any specific individual, are current only as of the date hereof and may be subject to change at any time without prior notice. No representation, warranty or claim whatsoever is made nor implied as to the accuracy or completeness of any material or information contained herein, nor we have no liability whatsoever for any error, inaccuracies or omissions. No reliance should be made on the materials or information herein for any investment decision, and we accept no liability whatsoever for any direct or indirect loss whatsoever which may arise from the use or reliance of any such material or information. The business of investing is a complicated matter that requires serious financial due diligence for each investment. No representation whatsoever on the suitability or otherwise of any securities, products, or services for any particular investor. Each investor is solely responsible for its own independent investment decision based on its personal investment objectives, financial circumstances and risk tolerance, and should seek its own independent legal, tax and other professional advice prior to any such decision.

The inclusion of any hyperlinks or external links should not be seen as an endorsement or recommendation of that website or the views expressed therein. We do not have any control over the content or actions of the websites we link to and will not be liable for anything that occurs in connection with the use of such websites.

All intellectual property rights, title and interest (including but not limited to copyrights, trademarks, patents and other proprietary rights) in and to these materials and the contents therein, shall remain the sole and exclusive ownership of and are fully reserved by Bondevalue Pte. Ltd.. No licence or rights whatsoever in or to these materials or their contents or any part thereof is granted or deemed to be granted to any recipient. No form of reproduction, dissemination, copying, disclosure, modification, distribution and/or publication of these materials or any part of its contents, shall be permitted.

Go back to Latest bond Market News

Related Posts:

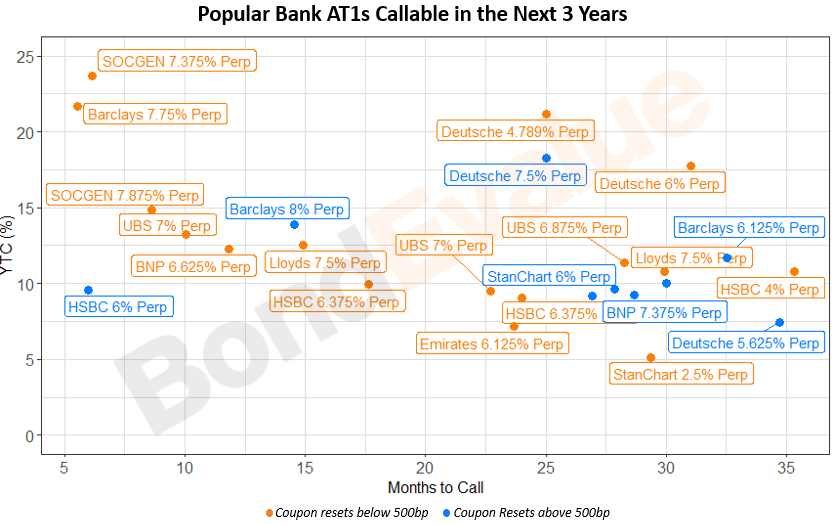

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023

Non-Call Risk in Focus as Bank AT1s Approach Call Date

April 19, 2023

Performance of European Bank AT1s and Tier 2s

December 21, 2023