This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Non-Call Risk in Focus as Bank AT1s Approach Call Date

April 19, 2023

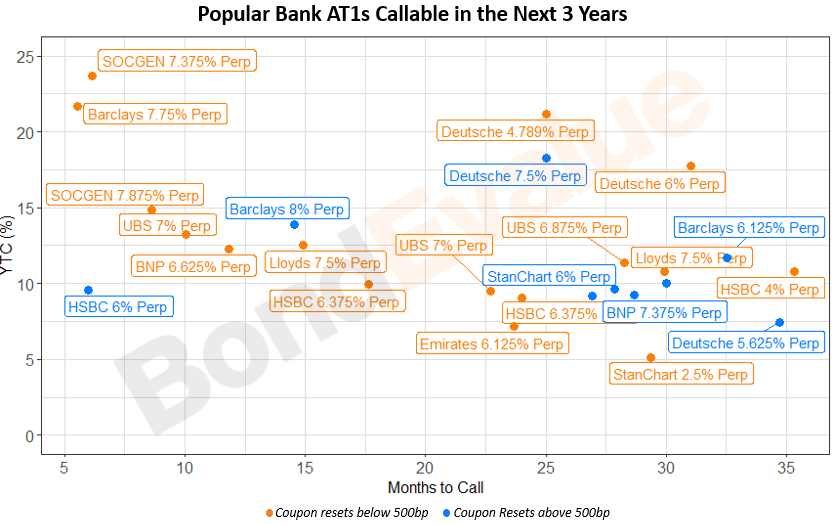

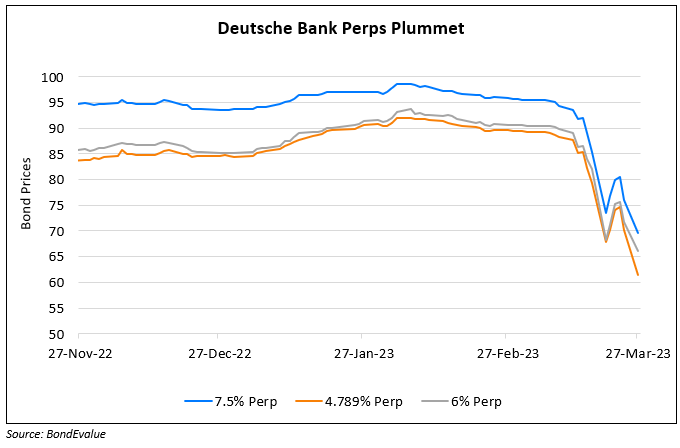

Following the historic write-off of Credit Suisse’s AT1 debt, non-call risk of the broader bank AT1 universe has been in focus. While market participants often assume that AT1s will be called on their first call date, that is not always the case. There have been prominent cases in the past such as that of Santander and Deutsche Bank, which shocked the markets in 2019 and 2020 respectively when they did not call their AT1s on the first call date.

UniCredit’s 6.625% Perp is now said to be in focus with its call date coming up on June 3. Its AT1 has a reset of 638.7bp over the EU 5Y Swap that is currently at 3.209%. Assuming the reset index stays unchanged until its call date and the bond is not called, the coupon would then reset to a much higher level of 9.596% (3.209%+6.387%). This higher reset would provide an economic incentive for UniCredit to call back its notes on its call date. At current level, if the bond is to be called back by UniCredit on June 3, it would offer a 13.5% yield-to-call.

Market participants note that a prudent approach should be taken regarding investing in AT1s broadly, in the current market. They say that a large reset spread helps increase call probability as the bond is more expensive to maintain as compared to calling it back. They also note that as the market is pricing-in some non-call risk in general, AT1s are trading at a relative discount. This would imply that investors may not be at much of a disadvantage. Here, they note that even if a bond is not called back, there is a strong likelihood of the bond being called back at the subsequent call date, giving investors the benefit of a higher coupon until its next call.

In the table below, we have provided a list of the 30 most popular banks in our bond universe whose AT1s have call dates this year, sorted by upcoming call dates. We have excluded American banks below.

Go back to Latest bond Market News

Related Posts: