This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

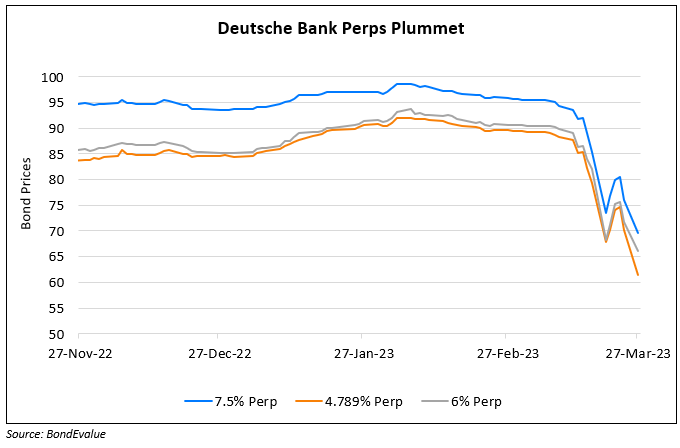

Deutsche Bank AT1s Tumble on Concerns after CDS Spike; Other European Bank AT1s Follow

March 27, 2023

Deutsche Bank’s AT1s tumbled by over 5-8 points after its credit default swaps (CDS) jumped by 60bp since Thursday to over 203bp. This comes in the wake of spillover risks following Credit Suisse’s downfall and subsequent rescue by UBS. Deutsche Bank had for a decade been considered among the weaker European big banks, ever since its capital and liquidity position were under question besides legal fines amounting to over €12bn. However, currently its CET1 ratio stands at 13.4% (as of end-2022), higher than its minimum threshold of 10.55% set by the ECB. Besides, Deutsche Bank has reported 10 straight quarters of profit after a large organizational restructuring that began in 2019. German Chancellor Olaf Scholz said on Friday that the bank has “thoroughly reorganized and modernized its business model and is a very profitable bank”. The broad spillover risks impacted AT1s of other European banks too, including the likes of Barclays, SocGen, Commerzbank that fell by over 5%.

Go back to Latest bond Market News

Related Posts:

Fed Looking Into Deutsche’s Compliance Failures

May 31, 2021

Chinese Banks to Call Back $12bn in Perpetual Bonds amid Surge in Rates

September 20, 2022

UniCredit Set To Redeem Its 6.625% Perps in June

March 27, 2023