This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Pakistan Upgraded to CCC by Fitch

July 11, 2023

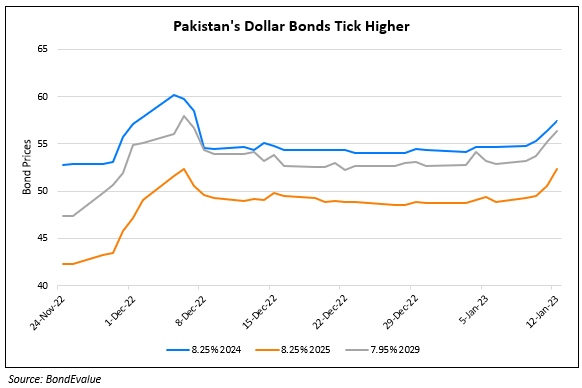

Pakistan’s dollar bonds have rallied by roughly 2-3% after its rating was upgraded to CCC from CCC- by Fitch. Lower external financing risks, IMF-driven reforms and narrowing external deficits were some of the primary reasons cited. This comes after Pakistan successfully reached a $3bn staff-level agreement with the IMF on a nine-month stand-by arrangement in end-June, which is likely to be approved by the IMF board this month. This will improve Pakistan’s external liquidity and funding conditions, hence easing external financing risks. Moreover, Pakistan amended its proposed 2023-24 budget to make it more in line with IMF requirements, by introducing new revenue collection measures and expenditure cuts. Finally, Pakistan’s current account deficit has also narrowed sharply following import restrictions and lower commodity prices. Their current account deficit is forecasted to be $3bn in FY 2023 and $4bn in FY 2024, much lower than the $17bn seen in FY 2022. However, the country’s fiscal deficits are expected to widen to 7.6% of GDP in FY 2024, from an estimated 7.0% in FY23, driven by higher interest costs on domestic debt, and it still suffers from low foreign currency reserves.

Pakistan’s 8.25% 2025s dollar bonds have rallied by 2 points and are currently trading at 58.5 cents on the dollar.

Go back to Latest bond Market News

Related Posts: