This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Pakistan Hires Banks for Dollar Bond Sale Under New Government

May 11, 2022

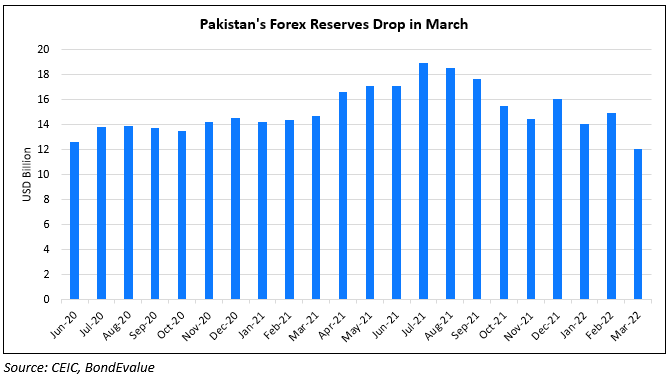

Pakistan has hired banks for its first dollar bond sale under the new government led by Prime Minister Shehbaz Sharif. As per reports, JPMorgan Chase, Citigroup, Standard Chartered and Credit Suisse are the banks that have gotten the nod to manage the sale of Pakistan’s planned dollar bonds. Pakistan is facing one of the highest inflation rates in Asia at 13.37% in April. Also, forex reserves have fallen to to $16.5bn as of end-April. Recently, Pakistan sought to increase the size of its $6bn IMF loan program alongside the extension of the program by a year. IMF agreed for a $6bn loan program in 2019 but the transfer of funds by the IMF slowed down due to concerns over monetary policy and fiscal tightening measures. Saudi Arabia is also expected to extend an oil loan facility. In January 2022, Pakistan had raised $1bn via a 7Y sukuk having at a yield of 7.95%.

Pakistan’s dollar bonds were trading lower, its 8.25% 2024s were down over 0.48 points to 88.88 yielding 15.11%.

Go back to Latest bond Market News

Related Posts: