This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

OCBC US, China Merchants Bank, BOSC Launch $ Bonds; Chinese Government Bonds Likely To Be Included In WGBI Later This Month, Triggering Huge Inflows

September 2, 2020

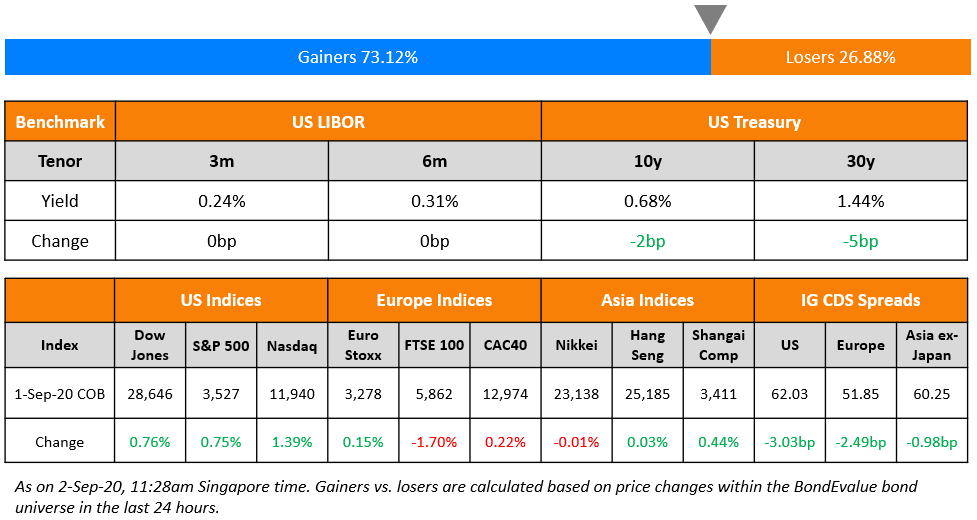

WallStreet continues the rally with encouraging economic data and progress in the US fiscal stimulus talks making major indices hit new records. The US ISM manufacturing index for August rose to 56 from 54.2 which was larger than expected. Nasdaq continues to outperform and Apple had a 4% rally after it reportedly asked suppliers to make 75 million 5G iPhone units for later this year, along with the launch of a new iPad air and new watches. European shares were weaker in comparison as travel related stocks were lower due to coronavirus spikes in tourist destinations. The US treasuries were initially lower but recovered and went higher after Fed Board Governor Lael Brainard indicated support for more aggressive bond purchases to support the Fed’s new inflation target of 2% over time. Long end of the treasury curve was down 4-6 bps. European and US IG CDS spreads tightened 2.5 bps and 3 bps respectively. Asian dollar bond market issuances are picking up this week and Asian markets are opening higher this morning.

New Bond Issues

- OCBC US $ 10NC5 tier 2 @ T+200bp area

- China Merchants Bank HK $ 5yr green @ T+150bp area

- BOSC International $ 3yr @ T+145bp area

- Beijing Infrastructure Inv. $ 3yr @ T+150bp area

- China South City $ 2yr7m @ 12.75% area

- Kaisa Group $ tap 11.25% 2025 @ 11.125% area

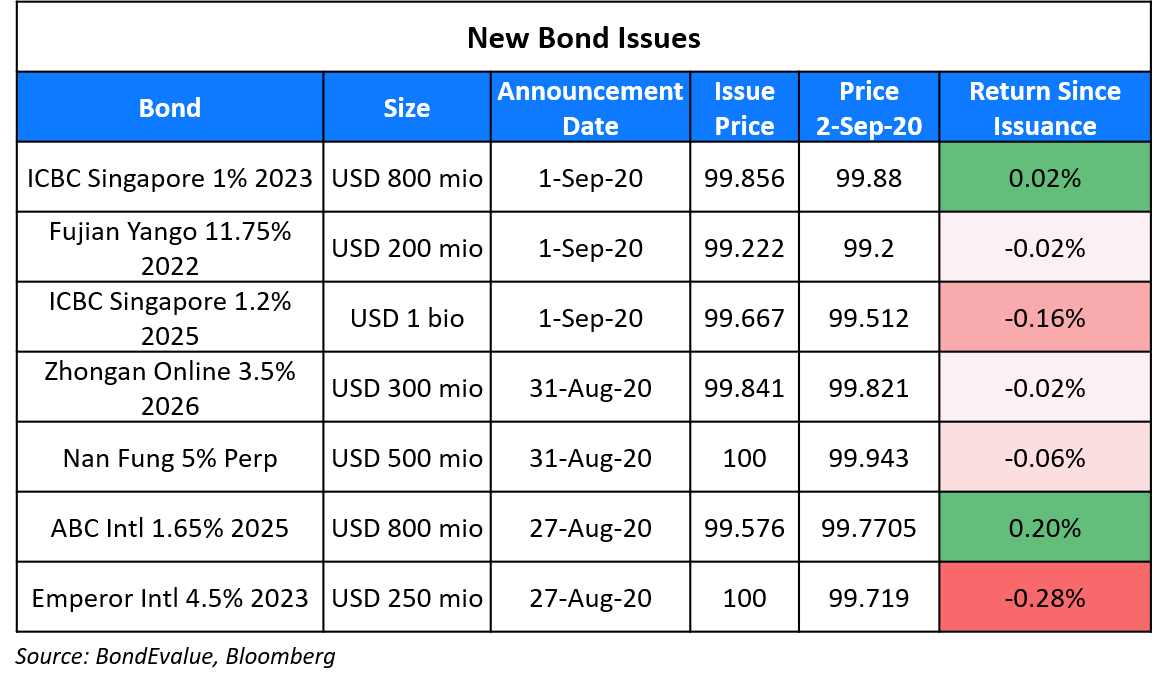

Industrial and Commercial Bank of China raised a total of $1.8bn via a dual-tranche bond offering yesterday. It raised $800m via 3Y bonds to yield 1.049%, 90bp over Treasuries and 40bp inside initial guidance of T+130 area. It also raised $1bn via 5Y bonds to yield 1.269%, 100bp over Treasuries and also 40bp inside initial guidance of T+140 area. The two tranches, with expected rating of A1, received total final orders exceeding $3.5bn, 1.94x issue size.

Fujian Yango Group raised $200mn via 2Y bonds to yield 12.2%, 30bp inside initial guidance of 12.5% area. The bonds, with expected rating of B–, received final orders exceeding $990mn, 4.95x issue size. Yango (Cayman) Investment is the issuer and Fujian Yango Group is the parent guarantor.

Rating Changes

Ecuador Long-Term Ratings Raised To ‘B-‘ From ‘SD’ On Completed Debt Exchange; Outlook Stable

Moody’s changes SQM’s outlook to negative; affirms Baa1 rating

Fitch Upgrades Vale’s Ratings to ‘BBB’

Fitch Downgrades Bahrain’s Ahli United Bank to ‘BB+’; Outlook Stable

Fitch Revises Turkish Banks’ Outlooks to Negative on Sovereign Outlook Change

Fujian Yango Group Co. Ltd. ‘s Proposed Guaranteed U.S. Dollar Notes Assigned ‘B-‘ Rating

Tenet Healthcare Corp. Senior Unsecured Note Issuance Rated ‘CCC+’ ; Recovery Rating ‘6’

Fitch Rates Tenet’s Senior Unsecured Notes ‘B’/’RR4’

Moody’s assigns Ba1 rating to ENEL S.p.A.’s hybrid notes; positive outlook

Fitch Rates ENEL’s Proposed Subordinated Notes ‘BBB(EXP)’

Chinese Government Bonds Likely To Be Included In WGBI Later This Month, Triggering Huge Inflows

According to Standard Chartered, Chinese Government Bonds (CGBs) have a strong likelihood to be included in the World Government Bond Index (WGBI) (ToD covered below) when the index provider FTSE Russell conducts its annual review later this month. This could lead to inflows of $250bn to $300bn into the market. China is currently on the WGBI’s watch list for potential index inclusion, according to FTSE Russell’s March 2020 interim review. The inclusion would trigger passive inflows of $150-$180 billion, boosting foreign ownership of CGBs by 6-7% and foreign ownership of the overall China bond market by 1%. It expects foreign ownership of CGBs to rise to 20% by end-2022 from 8.5% currently. The expected inclusion in the WGBI follows China’s inclusion in the Bloomberg Barclays Global Aggregate Bond Index and the JP Morgan Government Bond Index. “These three benchmarks, even at their planned low inclusion weights, could draw potential additional inflows of between US$250 billion and $300 billion into China’s onshore bond market,” JP Morgan’s Ian Hui and Chaoping Zhu said.

For the full story, click here

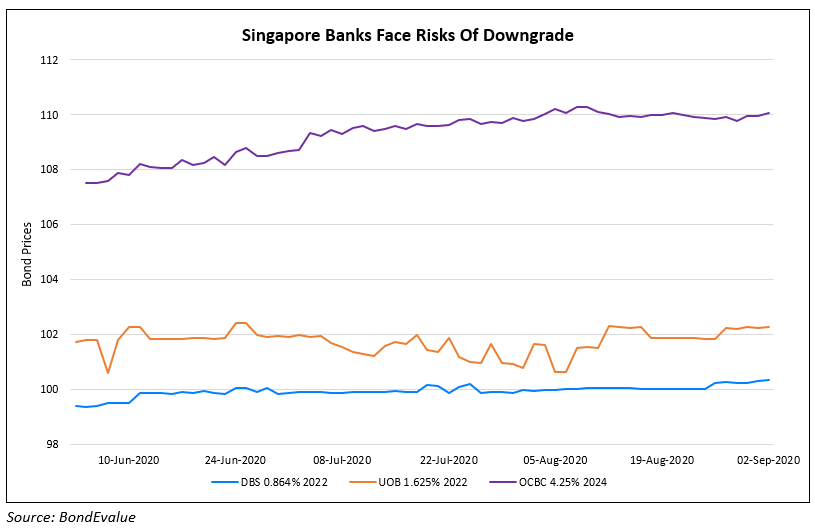

Fitch Places the Ratings of DBS, OCBC and UOB at Risk on Weaker Financial Metrics

According to a Fitch report the economic fallout from the coronavirus will weaken the key financial metrics of the Singapore banks. DBS, OCBC and UOB are all rated AA- and were placed on Rating Watch Negative (RWN) in April. The rating agency expects lower profitability, higher credit costs and lower credit growth for the banks and said that “We have factored our assessment of this into the ratings: we expect impaired-loan ratios to more than double from end-2019 levels, and earnings to fall by around one third. However, were these metrics to deteriorate by more than our base case, either collectively or individually, this may be sufficient to result in rating downgrades.” The local banks need to maintain capital ratios ~14% over the next few years to avoid a rating downgrade. The banks have targeted common equity Tier 1 (CET1) ratios between 12.5% and 13.5%. DBS Bank’s CET1 ratio stood at 13.7% as of the Q2, OCBC Bank at 14.2% and UOB at 14%. As per the rating report “The capital score is likely to be lowered should the banks sustain CET1 ratios well below 14 per cent without a credible plan to rebuild them to around 14 per cent within the next couple of years.” and added “We expect continued margin compression due to the lag effect of Sibor reduction, which will pressure revenues for 2020.” The bonds of all the banks have been largely stable and if at all have trended marginally higher over the last one week.

For the full story, click here

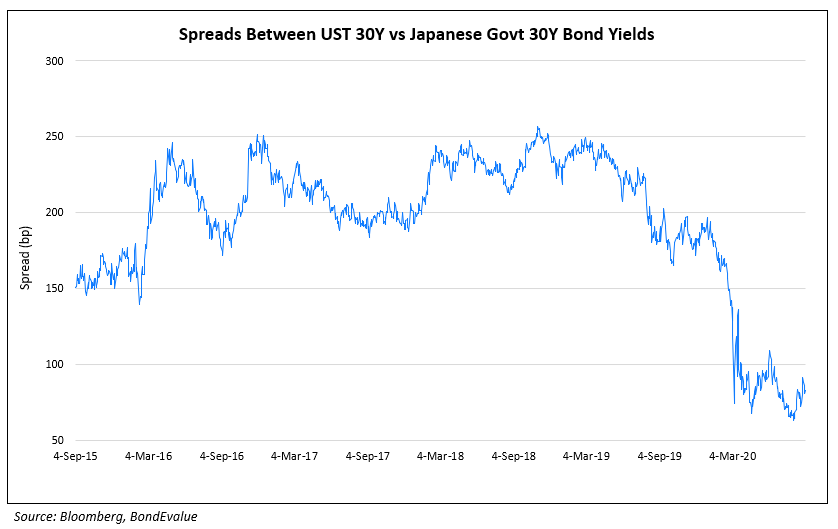

JGB Decline In Prices Could Trigger Rise in Global Rates

Ever since the Bank of Japan started Yield Curve Control and pegged the long end of the curve (10 year anchored around zero percent), betting on the Japanese Government Bond (JGB) prices declining was a loss-making endeavor. Called the “widow-maker” trade, this trade could now be back in play after Japan’s long dated yields are hovering near 16-month highs after a massive boost in debt supply to fund the stimulus spending. Resignation of Prime Minister Shinzo Abe will add to the uncertainty and with more supply coming, traders are expecting yields to shoot higher. This matters to the rest of the world as currently, the spread between US treasury and JGB is close to the lowest level in the last 30 years and a spike in JGB yields along with the extra supply in the US from their fiscal programs could add pressure to global rates. Another reason is that the BoJ has refrained from boosting bond purchases at its regular operations with Governor Haruhiko Kuroda saying in June that super long end yields were not that high compared to other nations.

For the full story, click here

Ecuador Gets a Multiple Level Upgrade from S&P; Upgraded to B- from SD

The Republic of Ecuador has finalized the delivery of $15.5bn of bonds to its creditors as a part of a debt re-structure plan which allowed the country to slash the total debt by ~$1.5bn along with a lower interest rate. The credit rating agencies seem to have acknowledged the sovereigns efforts. S&P has awarded the South American nation by giving it a multiple level upgrade and raising its Long Term ratings to B- from SD while predicting a stable outlook on the completed debt exchange. Ecuador is also in advanced stage of talks with IMF for a new $6.5bn, 27-month Extended Fund Facility (ETF). The rating agency also assigned B- rating to the $16.5bn new debt issued by the government. The Moreno government issued three sets of bonds maturing in 2030, 2035 and 2040 in exchange for the notes maturing between 2022 and 2030. According to the rating agency “The upgrade to ‘B-‘ reflects Ecuador’s more manageable debt service as well as our expectation of broad policy continuity in the government’s implementation of reforms that support fiscal, financial, and economic stability.” while adding that “The ‘B-‘ rating indicates our expectation that the next administration will capitalize on this space and advance polices that support continuity on the broad policy agenda.”

Ecuador’s bonds were largely stable and the 7.875% and 9.525% bonds maturing in 2028 and 2027 respectively traded at ~52 cents on the dollar.

For the full story click here

Term of the Day

World Government Bond Index (WGBI)

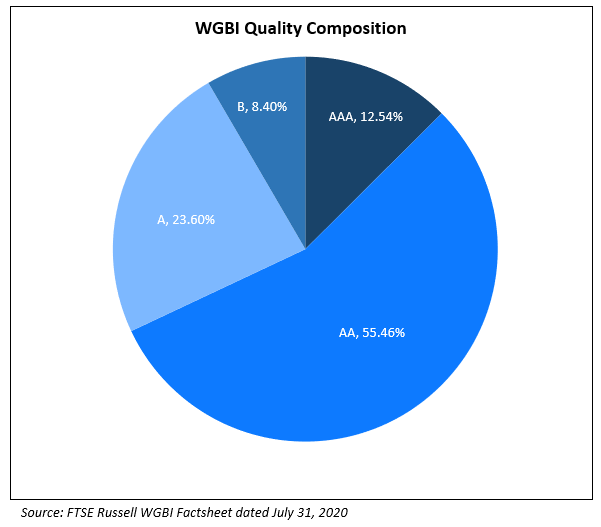

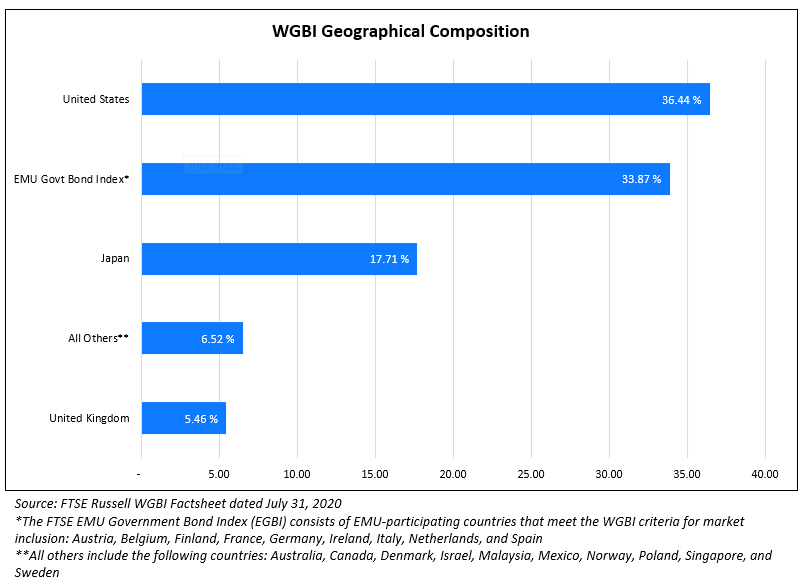

WGBI stands for World Government Bond Index. This is an index maintained by FTSE Russell and measures the performance of fixed-rate, local currency, investment-grade sovereign bonds. The WGBI is a widely used benchmark that currently includes sovereign debt from over 20 countries, denominated in a variety of currencies, and has more than 30 years of history available. The WGBI provides a broad benchmark for the global sovereign fixed income market. Sub-indexes are available in any combination of currency, maturity, or rating. The WGBI quality composition and geographical composition as of July 31 are given below.

Talking Heads

On more Fed stimulus needed to boost the US economy – Lael Brainard, Fed Governor

“With the recovery likely to face COVID-19-related headwinds for some time, in coming months, it will be important for monetary policy to pivot from stabilization to accommodation,” Brainard said, and do what’s appropriate to hit the new goals of “maximum employment and average inflation of 2% over time.”

On the Eurozone sliding into deflation for the first time in four years

Florian Hense, economist at Berenberg

“Given the recent volatility in the data, the ECB may choose to look through the considerable short-term variations. If inflation remains very low, the ECB may decide in December to extend its crisis-response asset purchase programme.”

Daniela Ordonez, economist at Oxford Economics

“If core inflation continues to fall, pressure on the ECB to amplify its monetary support to the economy will increase,” said Ordonez.

Isabel Schnabel, ECB executive director

“As long as the baseline scenario remains intact, there is no reason to adjust the monetary policy stance.”

On the ratings of Singapore banks at risk over capital ratios – in a statement by Fitch

“We expect continued margin compression due to the lag effect of Sibor reduction, which will pressure revenues for 2020. We believe margins are likely to be flat in 2021,” said Fitch Ratings.

On Australia’s central bank considering other steps to boost economy

Philip Lowe, Reserve Bank of Australia (RBA) chief

“The board will maintain highly accommodative settings as long as is required.”

Gareth Aird, senior economist at Commonwealth Bank of Australia

“This is the closest that we have been since the emergency mid-March board meeting to the governor, signalling that more monetary easing could in the offing in his post-meeting statements,” he said. “We do not know what form additional easing may take, and we don’t think that more easing is imminent. But it does suggest a slight shift in the governor’s thinking.”

On the expectation of interest rates to remain anchored around zero for five years or longer

Quincy Krosby, chief market strategist at Prudential Financial

“It’s lower for considerably longer, if you believe as the Fed does that the recovery in the economy and the labor market is going to take years.”

Michael Wilson, Morgan Stanley equity strategist

“The bottom line is that back end rates are mispriced and everyone knows it. The only thing holding them down has been a belief that the Fed won’t allow it,” Wilson wrote.

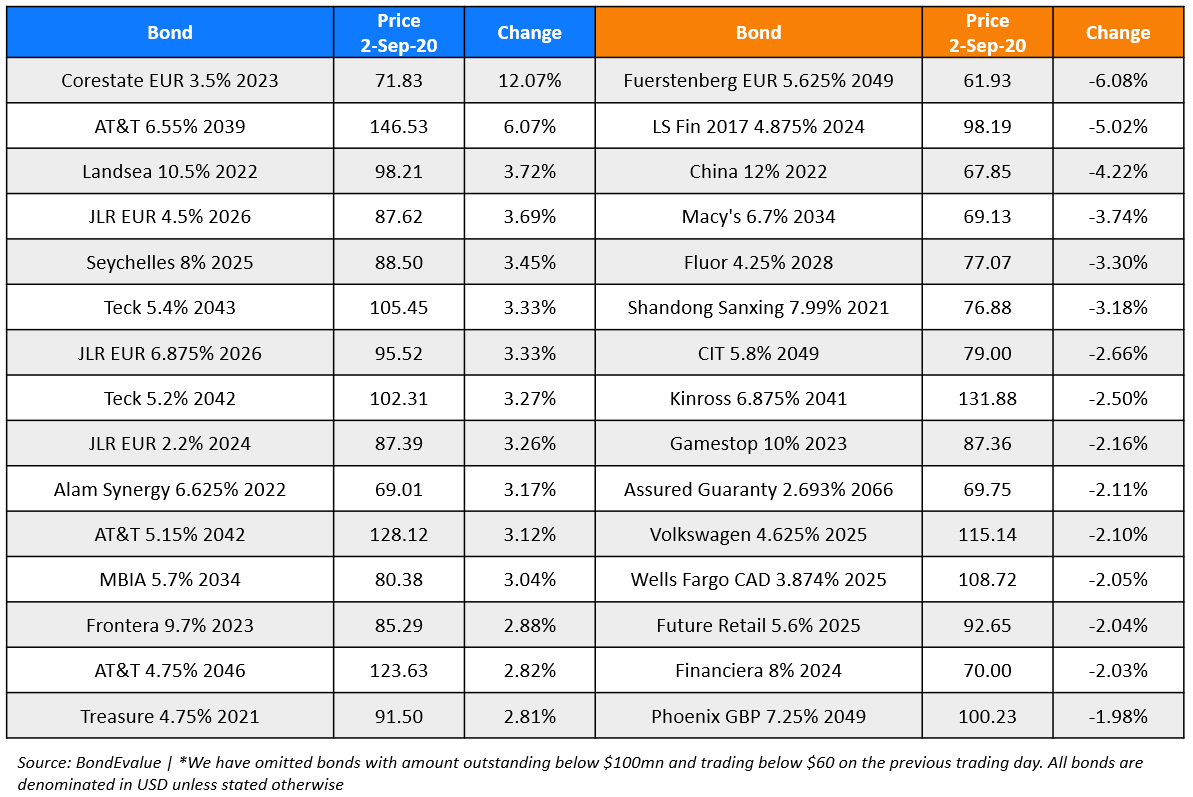

Top Gainers & Losers – 2-Sep-20*

Go back to Latest bond Market News

Related Posts: