This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ECB Relaxes Leverage Ratio for Banks; Spain’s Caixa & Bankia Get Board Approval for Merger; Turkish Lira Falls to Record Low

September 18, 2020

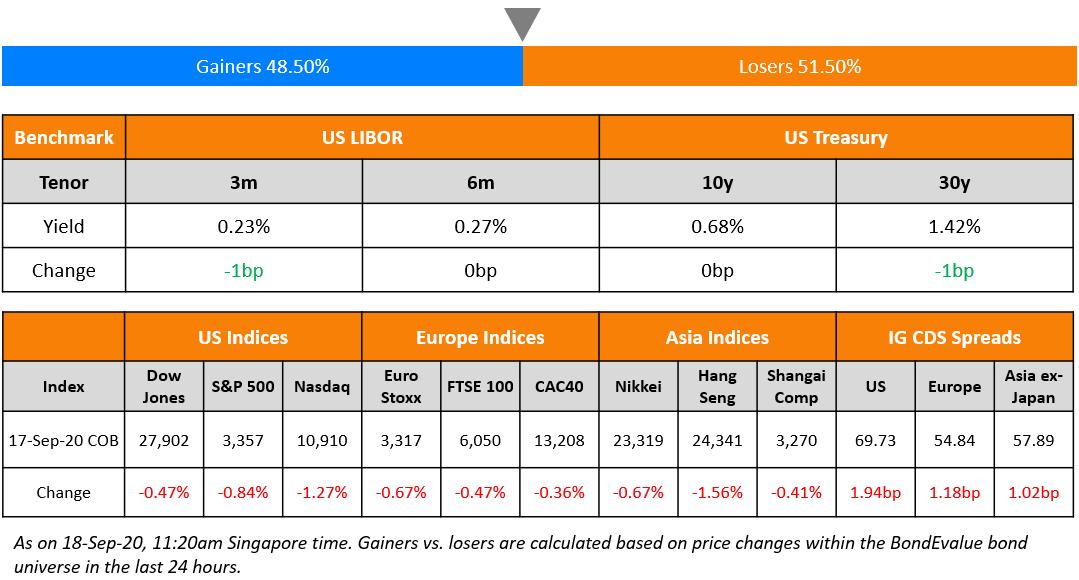

US stocks had another down session with S&P ending 0.84% lower while the 10Y Treasury yields were almost unchanged after moving 4bp lower mid-day. Laggards again included big tech like Apple, Amazon and Facebook with losses of 1.6%, 2.3% and 3.3% respectively. Initial Jobless Claims printed 860,000 for the week ended September 12, which was lower than the previous week, sending some positive signals although it was higher than expectations. Crude was up nearly 2% again with US HY CDS spreads flat while US IG CDS spreads roughly 2bp wider. Elsewhere, the Bank of England (BOE) kept rates unchanged whilst deliberating the efficacies of negative rates if implemented.

New Bond Issues

- Tangshan Financial Holding $ 3yr @ 7.25% area

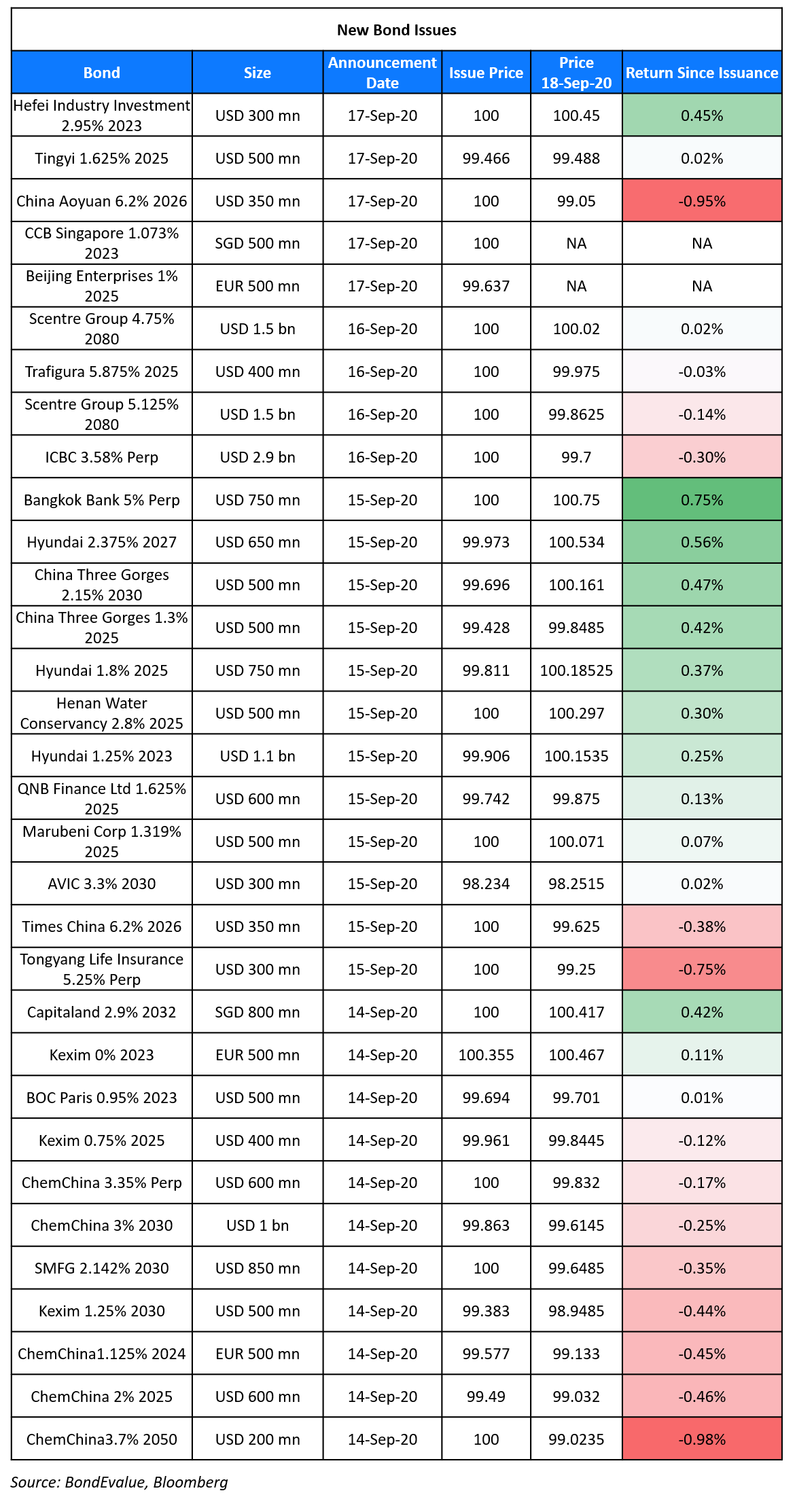

China Construction Bank Corp (CCB) Singapore branch raised S$500mn ($369mn) via 3Y bonds to yield 1.073%, 75bp over the Singapore swap offer rate (SOR) and 15bp inside initial guidance of T+90bp area. The bonds, with expected rating of A1, received orders exceeding S$850mn when final guidance was announced.

Property developer China Aoyuan Group raised $350mn via 5.5Y non-call 3Y (5.5NC3) to yield 6.2%, 30bp inside initial guidance of 6.5% area. The bonds, with expected ratings of B2/BB–, received final orders exceeding $1.7bn when final guidance was announced, 4.86x issue.

Beijing Enterprises raised €500mn ($592mn) via 5Y green bonds to yield 1.075%, 150bp over Mid-Swap and 40bp inside initial guidance of MS+190bp area. The bonds, with expected ratings of Baa1/BBB+, received orders exceeding €1.5bn ($1.7bn) during afternoon hours Asia time on the day of bookbuilding, 3x issue size. Talent Yield (Euro) is the issuer and Beijing Enterprises Holdings is the guarantor.

Tingyi (Cayman Islands) Holding raised $500mn via 5Y bonds to yield 1.737%, 147.5bp over Treasuries and 52.5bp inside initial guidance of T+200bp area. The bonds, with expected ratings of Baa1/BBB+, received final orders exceeding $3.3bn, 6.6x issue size.

Hefei Industry Investment Holding (Group) raised $300mn via 3Y bonds to yield 2.95%, 35bp inside initial guidance of 3.3% area. The bonds, with expected ratings of BBB, received final orders exceeding $1.4bn, 4.67x issue size. The bonds are issued by wholly owned subsidiary Xianjin Industry Investment and guaranteed by the state-owned parent company.

Rating Changes

Fitch Downgrades Sabadell to ‘BBB-‘; Outlook Stable

Moody’s downgrades eight Turkish corporates to B2 following sovereign downgrade, outlook negative

Fitch Affirms Malaysia’s PETRONAS at ‘A-‘; Outlook Negative

Fitch Affirms and Withdraws Marriott International’s Ratings; Outlook Negative

ECB Follows The Fed in Relaxing Banks’ Leverage Ratio Norms till June 27, 2021

The European Central Bank (ECB) continues to ease the implementation of monetary policy for banks under its supervision with an aim to combat the effects of the pandemic. Declaring the current circumstances as ‘exceptional’, the ECB allowed temporary relief to banks till June 27, 2021 by relaxing the requirements for leverage ratio, which is seen as a key yardstick by investors. Currently, the leverage ratio rule requires banks to maintain capital of at least 3% of its total assets. Under the relaxed norms, banks will be allowed to exclude central bank exposures from their leverage ratios. Based on data at the end of March 2020, this exclusion will raise the aggregate leverage ratio of 5.36% by ~0.3%. According to the FT, the lenders could now exclude €2tn of cash and deposits out of the €24.5tn of total assets held with the central bank, freeing up capital worth ~€73bn (~$86.5bn). The Federal Reserve had taken similar measures in April when it allowed US banks to exclude Treasuries from leverage ratio calculations till March 2021.

The ECB said in a report, “While financial markets have stabilised since April 2020, financing conditions in the euro area are tighter than at the beginning of the year, on account of higher bond yields and lower equity prices. The situation brought about by the coronavirus (COVID-19) pandemic, as well as the resulting and continued need for a high degree of monetary policy accommodation, and the fragility and vulnerabilities of the euro area economies and of the bank-based transmission channel of monetary policy, all justify the view of the Governing Council of the European Central Bank (ECB) that exceptional circumstances exist…”

For the full story, click here

Spain’s Caixabank and Bankia Merger to Result in Spain’s Largest Bank

The boards of Spain’s CaixaBank and Bankia met on Thursday and have given a go-ahead to a merger of the two banks. The new entity would result in Spain’s largest bank by market share in domestic loans and deposits and would have combined assets worth ~€650bn (~$770bn). Although consolidation has been on the cards since 2018, the impact of the ongoing pandemic and its effects on the Spanish economy has expedited the merger process. Details of the deal, which was first announced earlier this month still requires shareholders’ nod, are likely to be put on the table through a press conference later today. La Caixa Foundation holds ~40% of Caixa while the Spanish state holds a 61.8% stake in Bankia. The government obtained a majority stake in Bankia when it rescued it in 2012. As per Bloomberg, the market value of Caixa and Bankia based on Thursday’s share price was €12.4bn ($14.7bn) and €4.4bn (~$5.2bn) respectively, resulting in a combined market value of ~€16.8bn ($19.9bn) for the new entity. More banks in Europe are also likely to consolidate through mergers and acquisitions. Italy’s Intesa Sanpaolo is likely to acquire Unione di Banche Italiane while Spain’s Banco de Sabadell is also looking for strategic options.

The bonds of both the banks were largely stable. Caixa’s 6.75% euro perpetuals traded at 106 while Bankia’s 6% euro perpetuals traded at 100.6.

For the full story, click here

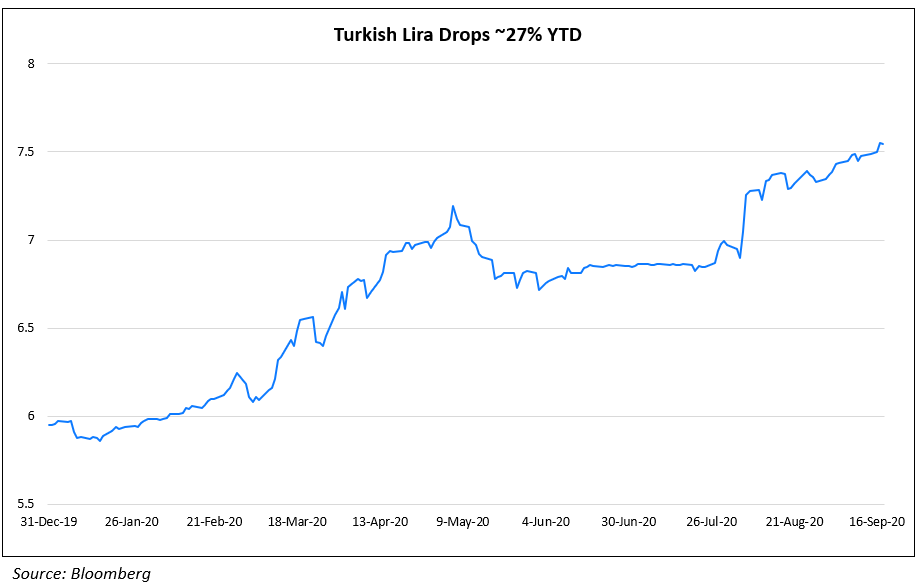

Turkish Lira Slumps to Record Low; Long-Dated Sovereign Bonds Trend Lower

The Turkish lira fell to a record low of 7.55 against the US dollar, taking the year-to-date depreciation in the transcontinental country’s currency to ~27%. This follows Moody’s downgrade of Turkey last weekend from B1 to B2, pushing it deeper into junk territory. The rating agency cited a potential balance of payments crisis for Turkey as its foreign exchange reserves have shrunk 40% this year. The currency fell by ~1% this week post the downgrade. State-owned banks sold at least $500mn worth of US dollars on Thursday to stem the fall in the currency, according to people with knowledge of the matter as per Bloomberg. This increases pressure on the central bank to raise rates, which currently stand at 8.25%, at its next policy meeting on September 24. The fall in the currency weighed on long-dated dollar sovereign bonds with its 6.75% and 6.625% bonds due 2040 and 2045 falling 1.3 and 1.5 points since Monday to 92.9 and 89.9 cents on the dollar currently. Dollar bonds of Turkish corporates were largely stable.

For the full story, click here

Lippo Launches Consent Solicitation on Two Dollar Bonds to Sell Jakarta Mall to LMIRT

Indonesian real estate company Lippo Karawaci has launched a consent solicitation on its $420mn 8.125% bonds due 2025 and its $417mn 6.75% bonds due 2026, both issued by Theta Capital. The Riady family backed company is seeking to sell Lippo Mall Puri in west Jakarta to Singapore-listed Lippo Malls Indonesia Retail Trust (LMIRT) for IDR 3.5tn ($238mn). This is part of the company’s restructuring plan announced in 2019 along with a rights issue and debt reduction. Regulatory delays kept the divestment from going through and led to a reduction in sale price from IDR 3.7tn initially. LMIRT will fund the asset purchase via a S$280mn ($206mn) rights issue, underwritten by Lippo. As per IFR, the company is seeking waivers on its debt and restricted payments in case it ends up with a majority stake in the REIT after the rights issue making it a subsidiary. Lippo is offering cash of $3 per $1,000 in principal to holders of its 2025s if they give their consent by September 30. Holders of its 2026s will also receive $3 per $1,000 of principal if they give their consent by September 30 or nothing if they give consent after September 30 but by the final deadline of October 9. Theta’s 8.125% and 6.75% bonds due 2025 and 2026 traded largely stable at 93.3 and 85 cents on the dollar.

Sri Lanka’s Dollar Bonds Fall As Minister Comments on IMF Funding Needs

Yields on Sri Lanka’s 6.25% 2021s and 6.85% 2024s widened 308bp and 152bp respectively as Ajith Nivard Cabraal, Minister of Money & Capital Market and State Enterprise Reforms commented that the “initial urgency“ for IMF funding is not there as per a report by Citigroup. However, he did mention that the $1bn 6.25% dollar bonds due in October will be repaid. He stated that the government has adequate resources to make good on debt repayments due to its enhanced reserve position, up $1bn since May, standing at $7.44bn as of end-August. This was primarily owing to controls on imports, better exports and other external funding sources. He also mentioned they were not planning to issue global bonds until the second half of 2021. Sri Lanka earlier in April requested the IMF for $800mn in emergency funding. In the context of its next 12-month obligations of roughly $7bn, reserves may not seem significant. USD/LKR is currently at 185, down over 2% YTD. The fall in the dollar bonds underscores global investors’ concerns over the island nation’s ability to sustain without support from the IMF.

For the full story, click here

Term of the Day

Greenium

Greenium is a relatively new term that refers to the premium that investors pay when buying green bonds vs. conventional bonds. Green bonds that trade with a greenium indicate strong investor demand for those bonds, which pushes prices higher and yields lower compared to conventional bonds. A recent example of this would be the recent green bond issuance by German carmaker Daimler. Daimler’s new 0.75% green bonds due 2030 are currently trading at a yield of 0.816%, 4.7bp tighter than its older conventional 2.675% bonds due 2030, which are currently yielding 0.863%. Thus the greenium on the new green bonds is 4.7bp. However, not all green bonds trade at a greenium to conventional bonds and this is subject to other factors such as rating and country/region of the issuer and investors.

Talking Heads

“Negative rates are the nuclear option,” said Marinov. “It could ultimately push the pound into uncharted territory of losing whatever is left of its rate advantage.”

“What can happen is that when the bank opens their books in six months, or in 12 months, they will realise that their non-performing loans ratio is not 2% but 20%,” he said.

“This is why I am very concerned about the sequencing of this crisis. We started with a health care crisis, that’s clear. We went into an economic crisis, and we might end up in a financial crisis. We will have probably many zombie firms around that will not be able to liquidate,” he said. “There are other cases where we will need to liquidate firms that should not be liquidated.”

On bond investors regaining appetite for emerging markets

Yacov Arnopolin, an emerging-markets debt portfolio manager for Pacific Investment Management Co.

“Emerging markets continue to look attractive and cheap versus developed markets,” said Arnopolin. “We are back to yield starvation, the same yield starvation we experienced before Covid.”

Eric Ollom, a strategist at Citigroup.

“When you have a crisis, investors say ‘enough emerging-markets spice, I want home cooking,’” Mr. Ollom said. “Now that home cooking is tasting boring and they are saying, ‘I want more emerging-markets spice.’”

Pramod Shenoi, head of APAC research at Creditsights.

“Achieving a tighter coupon may have been more important for the issuer,” Shenoi said. “We’ve seen that investors have had less cash to put to use more recently — they have allocated their cash and cash levels are low — so overall supply would have used up their cash.”

Thu Ha Chow, a portfolio manager at Loomis Sayles Investments Asia Pte

“There are also concerns that this may not be the best time to be in longer maturity assets if the treasury curve continues to steepen,” said Chow. “Chinese banks are supporting the real economy during this pandemic and are expected to take some credit losses, so capital buffers will need to be replenished.”

Harry Hu, a Hong Kong-based analyst at S&P Global

“The reason is because of high credit growth and there’s slowing profitability,” he said. “Credit growth is high this year, higher than what we originally expected. We were looking at about 13% loan growth or maybe slightly more.”

On Argentina’s policymakers split over dollar buying controls

Jimena Blanco, director of Latin America research at consulting firm Verisk Maplecroft in Buenos Aires

“There’s a high degree of unease in terms of investors looking at the country, and companies operating in the country,” said Blanco. “All of these policies are actually discouraging investment.”

Marcos Buscaglia, co-founder of Argentine consulting firm Alberdi Partners

“This is likely to make negotiations with the IMF more difficult, as they are effectively killing the private sector debt market and hence Argentina’s repayment capacity,” says Buscaglia.

“Based on the statistics we see, the overall market is down 20-25% if you look at it on an overall basis year to date … Effectively what we have seen is a major uptick in GRE activity,” Riad said. “These are event-driven transactions, for example acquisition-driven,” he said, adding, “infrastructure financing is an important consideration here in the market.”

“We will see further activity in the corporate space coming back to the market over the next few months as the economy improves and as the health situation, obviously, gets under control,” he said.

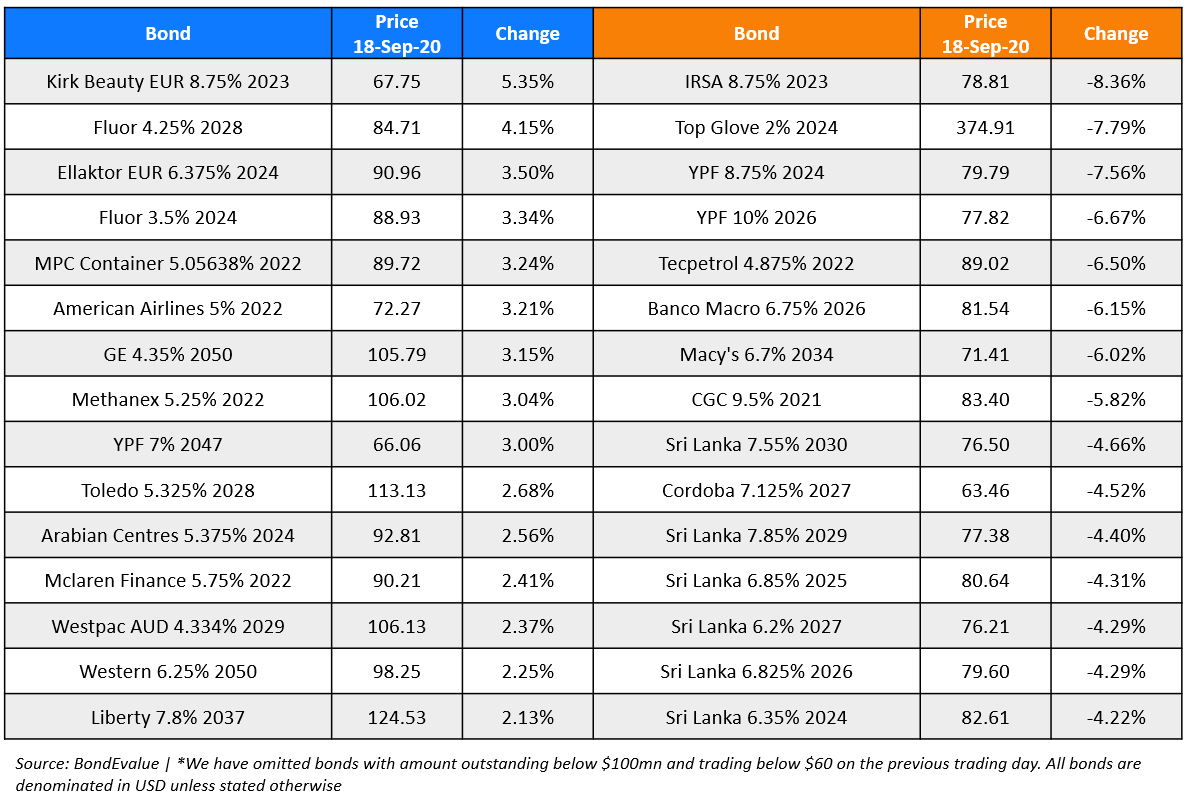

Top Gainers & Losers – 18-Sep-20*

Go back to Latest bond Market News

Related Posts: