This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

OAT-Bund Spread Widens on France’s Political Risk

June 11, 2024

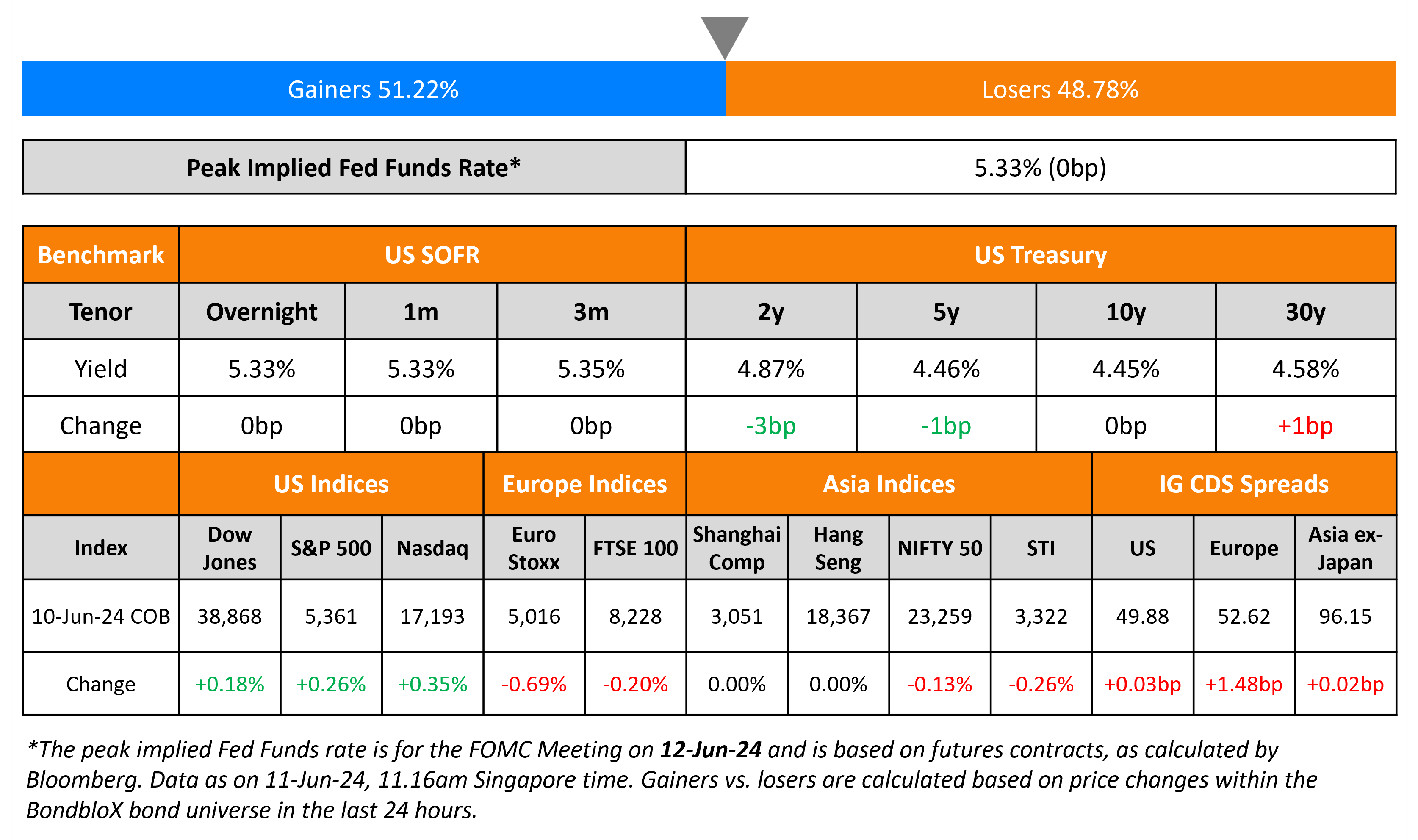

US Treasury yields were muted to begin the week, with markets awaiting the inflation report and the Federal Reserve’s meeting on Wednesday. Primary markets were also muted, ahead of the key data and policy meeting. US equity markets ended higher by 0.3-0.4%. US IG and HY CDS spreads remained flat.

European equity markets ended lower. Europe’s iTraxx main CDS spreads were 1.5bp wider and crossover spreads were wider by 5.1bp. The broad widening in spreads comes following the recent political risks emerging from France wherein, the President Emmanuel Macron has called for a snap election later this month. France’s OAT 10Y bond yield rose by 13bp and the OAT-Bund 10Y sovereign spread widened by 7bp to 55bp, both of which are at their highest levels this year. Asian equity indices have opened in the red this morning. Asia ex-Japan CDS spreads remained flat.

New Bond Issues

- Manulife Financial S$ 10NC5 Sub at 4.6% area

New Bonds Pipeline

- REC Limited hires for $ Long 5Y Green bond

Rating Changes

- Fitch Affirms Bahrain’s Ahli United Bank at ‘BB+’/Stable; Downgrades VR to ‘bb-‘

- Moody’s Ratings affirms Handelsbanken’s Aa2 long-term deposit and senior unsecured debt ratings, changes outlook to stable from negative

- Moody’s Ratings revises Toyota Industries’ outlook to positive, affirms A2 ratings

Term of the Day

Catastrophe bonds

Catastrophe bonds also referred as Cat bonds are risk-linked securities that are designed in favor of the issuer as these allow the transfer of risks related to a major catastrophe or a natural disaster to the investors. These are generally high yield debt instruments that payout to issuers in case of specific triggers. These bonds essentially act as insurance policies for the issuer against natural disasters, where they pay regular coupons (premium) in exchange for protection. In the event of a natural disaster trigger, issuers will receive a payout from the proceeds of the bond and the principal repayment and interest payments are either deferred or cancelled. If a trigger event doesn’t occur, the issuer continues to pay the coupons as scheduled, similar to a regular bonds and proceeds are returned to the investors at maturity. Cat bonds are generally purchased by governments, insurance and reinsurance companies. These bonds have gained traction as the frequency of natural disasters is on the rise.

Talking Heads

On Low-Default Era of Past 20 Years Is Over – Deutsche Bank

“For 40 years, virtually all fixed-rate borrowers across the economy could refi at a lower rate than they’d previously achieved. This changed after 2022, but the full impact could still be slow to be felt… So there is perhaps a ‘boiling frog’ analogy here where the market doesn’t notice it, until it does.”

On Warning of a Shock to Stock Market’s Calm From CPI, Fed – JPMorgan

“With CPI and Fed on the same day there is a possibility of a CPI outcome being reversed by Powell’s press conference”… Some traders would even bet on July for “surprise, insurance”

On ECB Cut Doesn’t Put Rate on ‘Linear Declining Path’ – ECB President Christine Lagarde

“We’ve made the appropriate decision, but it doesn’t mean interest rates are on a linear declining path… There might be periods where we hold rates again… At every step of the way, not only when we have new projections, we will reassess”

Top Gainers & Losers- 11-June-24*

Go back to Latest bond Market News

Related Posts: