This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Solidify Sep Rate Cut on Softer Inflation Reading

August 15, 2024

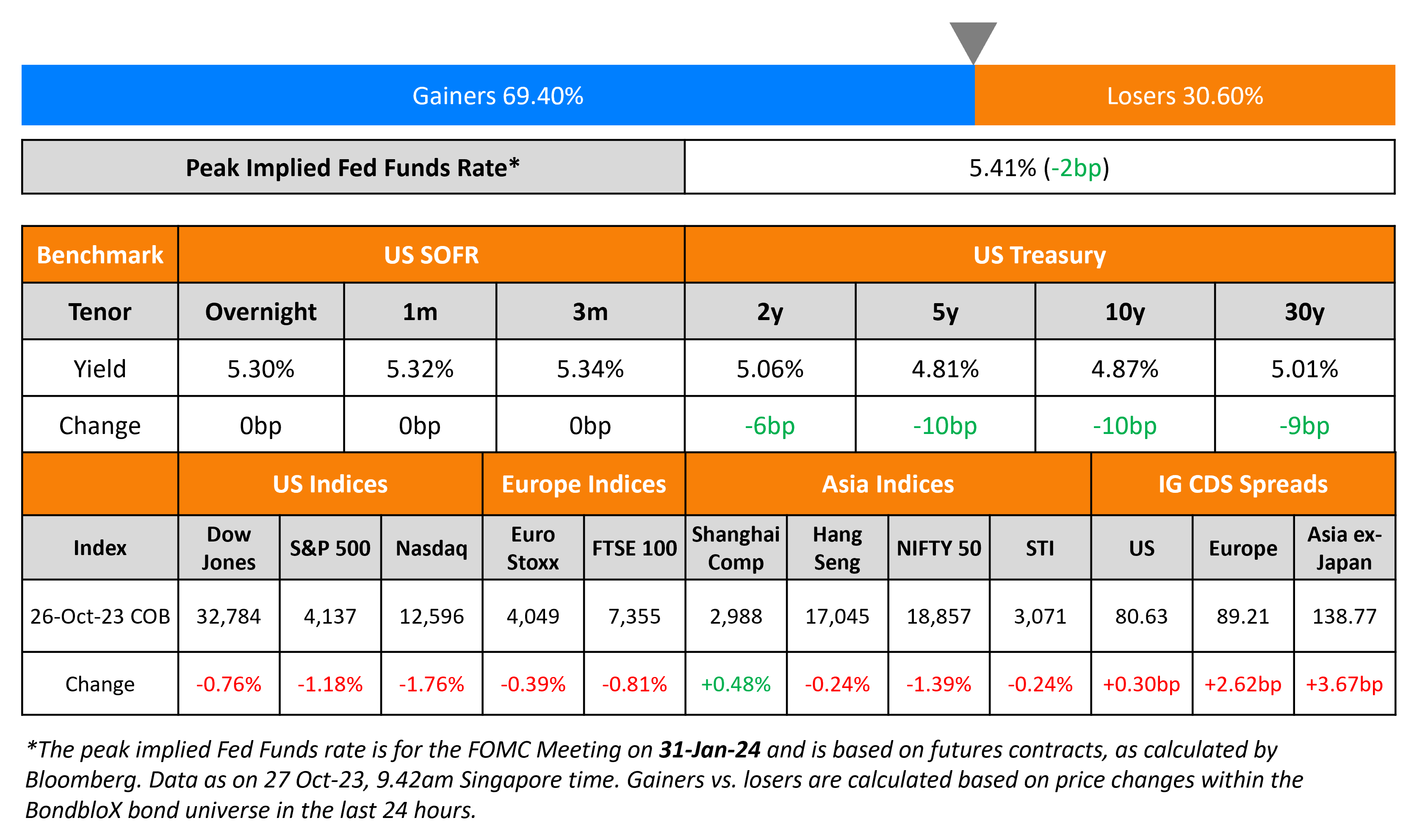

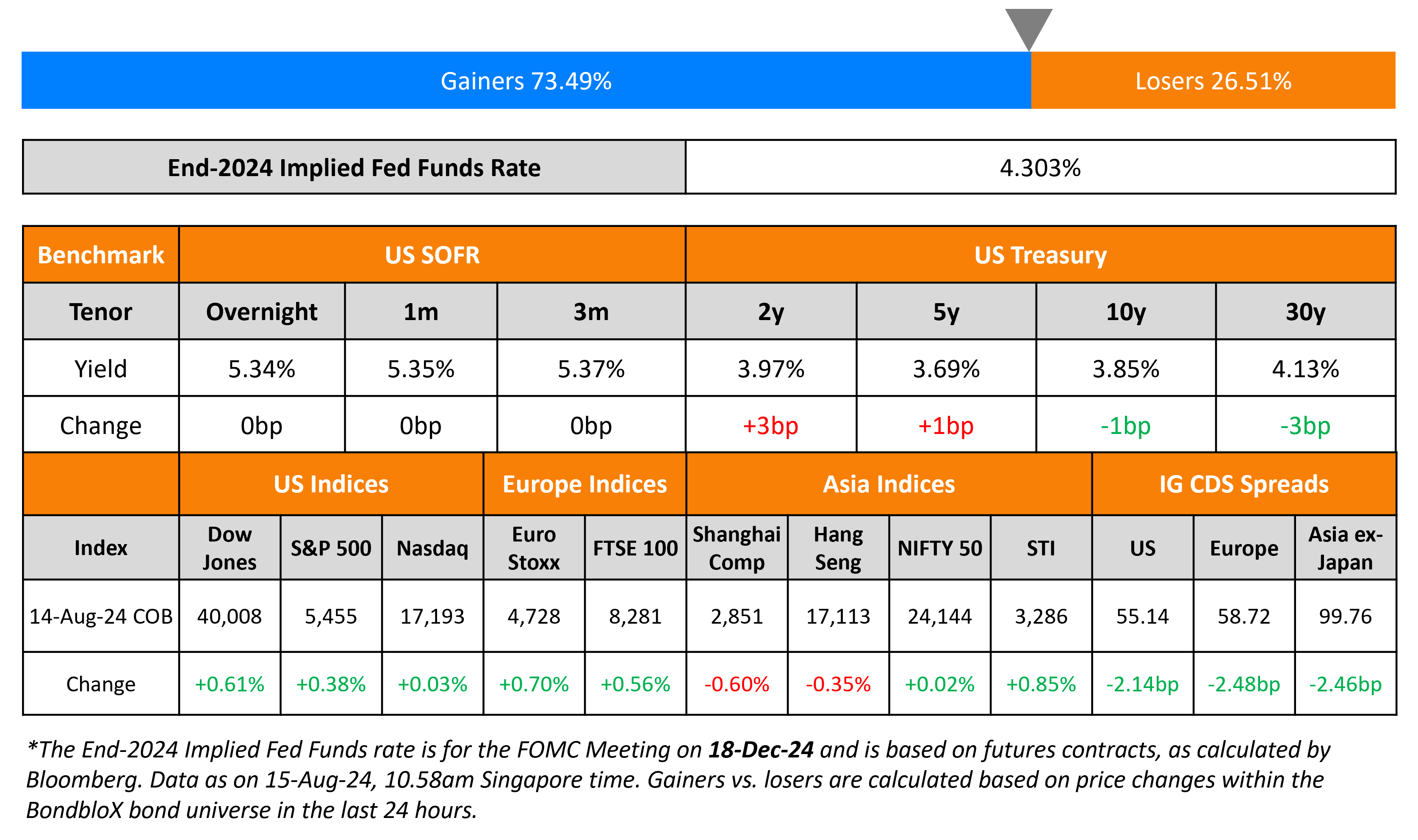

US Treasury yields held steady across the curve, with markets already pricing-in a 25bp rate cut in the Fed’s September meeting. US CPI in July rose by 2.9% YoY, lower than the expectations and the prior month’s 3.0% reading. This was the headline number’s first reading below 3.0% since March 2021. Core CPI rose by 3.2% in-line with expectations, and lower than the prior month’s 3.3% reading. This was the fourth consecutive month of easing in the core inflation print. Looking at US equities, S&P closed 0.4% higher while Nasdaq ended almost unchanged. US IG CDS spreads tightened by 2.1bp while HY CDS spreads tightened by 9.4bp.

New Bond Issues

-

CapitaLand Investment S$ 10.5Y at 3.75% area

- Mapletree Logistics S$ PerpNC5 at 4.55% area

-

NWS Holdings $ 4Y at T+310bp area

.png)

Rating Changes

- Moody’s upgrades Rolls-Royce to Baa3 from Ba1 on continued strong financial performance; maintains positive outlook

- Carvana Co. Upgraded To ‘B-‘ On Sustainable Improvements In Operating Performance; Outlook Stable

- Fitch Downgrade Avon to ‘D’; Ratings Withdrawn

Term of the Day

Bridge Financing

Bridge financing is a temporary form of financing used to cover the borrower’s short-term costs until the moment when regular long-term financing is secured. This form of financing ‘bridges’ the gap between when the borrower’s funds are set to dry up and its next long-term funding option.

Mars secured the largest bridge loan of the year to help finance its $36bn purchase of Kellanova.

Talking Heads

On Junk Bonds in Asia Can Build on Rally

Julio Callegari, JPMorgan

“Our view is that economic growth in Asia should be more resilient than in the US, where concerns about a recession are mounting… should underpin the outperformance of Asia high yield”

Omar Slim, Pinebridge

“Asia high yield ex China property has historically maintained a lower default rate than US high yield. We expect this trend to continue over the next two years”

Union Bancaire Privee

We are asking clients to look at some short-dated high yield” in Asia to lock in bigger yields

On July CPI supporting disinflation scenario for September ease

Tom Graff, CIO, Facet

“CPI came in largely in-line with expectations. The monthly Core figure was 0.2%, exactly as expected… Fed’s favored inflation measure will come in a bit below the CPI… seals the argument for a September rate cut… does not necessarily add to the argument for a 50 bps cut”

David Doyle, Macquarie

“The report isn’t quite as favorable for disinflation as what occurred in June, but that report set a very high standard.”

On Euro Nearing 2024 Highs on Bets that Fed Will Cut Faster Than ECB

Franceso Pesole, ING

This is “the start of a longer-lasting upward trend… We target a move to $1.12 in the near term”

Sonja Marten, DZ Bank

“Investors are very quick to jump on the bandwagon of one or two better or worse than expected data releases… has led markets down the wrong path on numerous occasions this year.”

Top Gainers & Losers-15-August-24*

Go back to Latest bond Market News

Related Posts: