This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

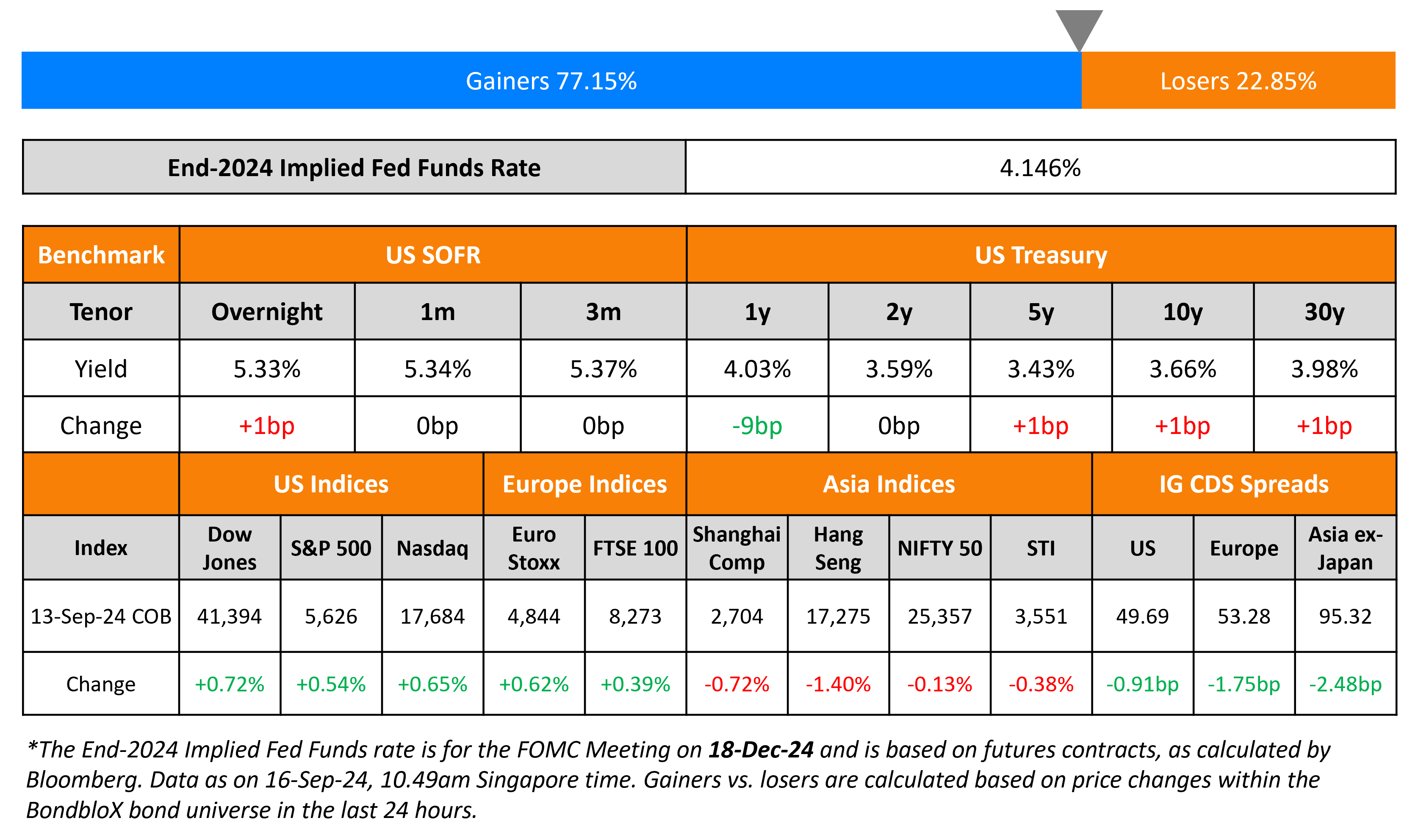

Markets Price-in Possibility of a 50bp Sep Rate Cut by the Fed

September 16, 2024

US Treasury yields held broadly steady across the board on Friday. However, the 12-month yield dropped by 9bp, largely due to investors weighing in the probability of a potential 50bp cut during the FOMC meeting on Wednesday. For instance, looking at the Implied Fed Funds Futures Rate, markets are now pricing-in ~40bp in Fed rate cuts in the September FOMC and ~118bp in rate cuts by end-2024. However, going by the commentary of Fed officials till date, many analysts note that the FOMC is largely expected to cut rates by 25bp. US IG CDS tightened by 1.0bp and HY CDS spreads tightened by 0.3bp. Looking at major US indices, the S&P and Nasdaq both posted gains of 0.5-0.7%.

European equity markets ended higher too. Looking at Europe’s CDS spreads, the iTraxx Main spreads were tighter by 2.8bp while Crossover spreads tighter by 8.5bp. Asian equity indices have opened with mixed moves. Asia ex-Japan IG CDS spreads saw a 2.5bp tightening.

New Bond Issues

Rating Changes

- Moody’s Ratings upgrades Vedanta Resources’ CFR to Caa1 and bonds to Caa2; changes outlook to stable from negative

- Croatia Upgraded To ‘A-‘ On Reform Progress; Outlook Positive

- Moody’s Ratings downgrades Berry’s CFR to B3; outlook remains negative

- Service Properties Trust Downgraded To ‘B’ On Pressured Credit Metrics And Tight Covenant Headroom, Outlook Negative

- Saudi Arabia Outlook Revised To Positive On Sustained Reform Momentum; ‘A/A-1’ Ratings Affirmed

- Braskem S.A. Outlook Revised To Negative On Slower Spreads Recovery; Ratings Affirmed

- Moody’s Ratings places Boeing’s ratings on review for downgrade

- Moody’s Ratings changes Greece’s outlook to positive from stable, affirms Ba1 ratings

Term of the Day

Yield-to-Call

Yield to Call (YTC) is a return metric applicable to callable bonds and refers to the total return that a bondholder would receive if the bond is held till the call date, provided that the issuer does not default. YTC is an important metric from an investor’s standpoint as it gives them an indication of the expected return, if the bond is called on the call date. It is important because the call option lies with the issuer, not the investor. And hence, investors must review both the yield to maturity (YTM) and the YTC when analyzing their bond investments.

YTC calculation is similar to the YTM calculation except that the maturity date is replaced by the call date and the redemption value (stated as a percentage) is replaced by the call price.

Talking Heads

On Goldman Sachs still seeing 25bp Fed cut in September

Continue to call for a quarter percentage point easing

Bill Dudley, Fmr. New York Fed President

There is a strong case for a 50-basis-point interest rate cut

On Brazil’s Investment Grade Is Further ‘Down the Road’ – Fitch

“We are still seeing fiscal uncertainties, we are still seeing debt in an upward path… We don’t think the rating is moving up in the near term, and the investment grade question is obviously further down the road”

On China Slowdown Spurring Calls for Stimulus Before It’s Too Late

Raymond Yeung, ANZ Banking Group

“The August data basically rules out the chance to attain the official target of 5% growth in 2024, unless the top leadership is willing to launch a bazooka stimulus package”

Lynn Song, ING Bank NV

“As we are already toward the tail-end of the third quarter, time is running low for policymakers to introduce measures to buoy the economy”

Top Gainers & Losers-16-September-24*

Go back to Latest bond Market News

Related Posts: